USDJPY Downside Risks Growing As Trade War Heats Up

Yen Rallies on Safe-Haven Demand

USDJPY remains weak today with the pair reversing from initial highs on the session as safe-haven demand fuels a pick up in JPY again today. Risk appetite is on shaky ground today as the tech standoff between US and China saw tech stocks around the world plummeting yesterday. Markets are now bracing themselves ahead of the keenly awaited Nvidia earnings tomorrow which could cause further volatility if any undershooting of forecasts is seen.

Bullish JPY Scenario

JPY remains one of the strongest performers against USD this year with hawkish BOJ expectations and continued safe-haven demand keeping the currency well supported. News that Trump will push ahead with previously postponed tariffs on Canada and Mexico has also rocked risk markets this week. With aggressive rhetoric from Trump, promising a 25% levy on goods alongside an additional 10% levy on Canadian energy, JPY looks likely to remain supported near-term with room for a further rally if tariffs are implemented next week as threatened.

Bearish JPY Scenario

On other hand, if this proves to simply be a bartering tool by Trump and the US manages to strike a deal with Canada and Mexico to avoid tariffs (or see much smaller tariffs) then we could see JPY unwinding as risk sentiment rebounds. As such, incoming headlines over the remainder of the week look set to produce further volatility with the pair vulnerable to a downside break if Trump maintains his current hostile tone.

Technical Views

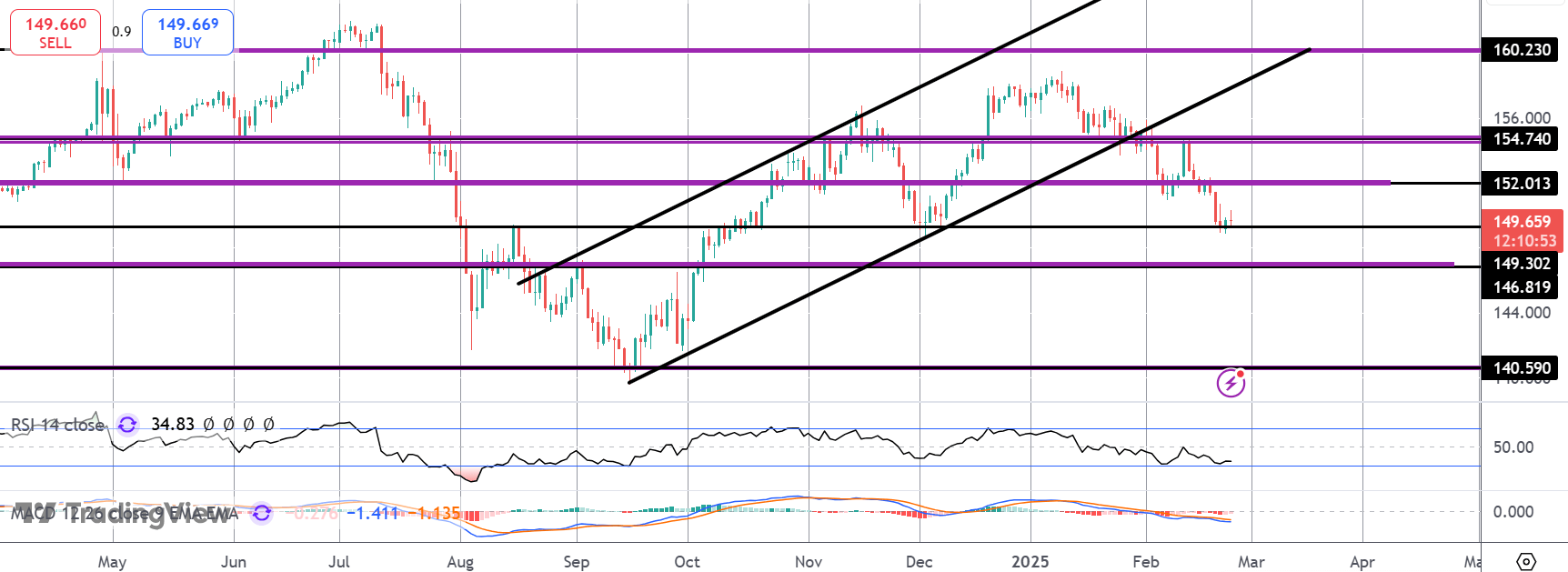

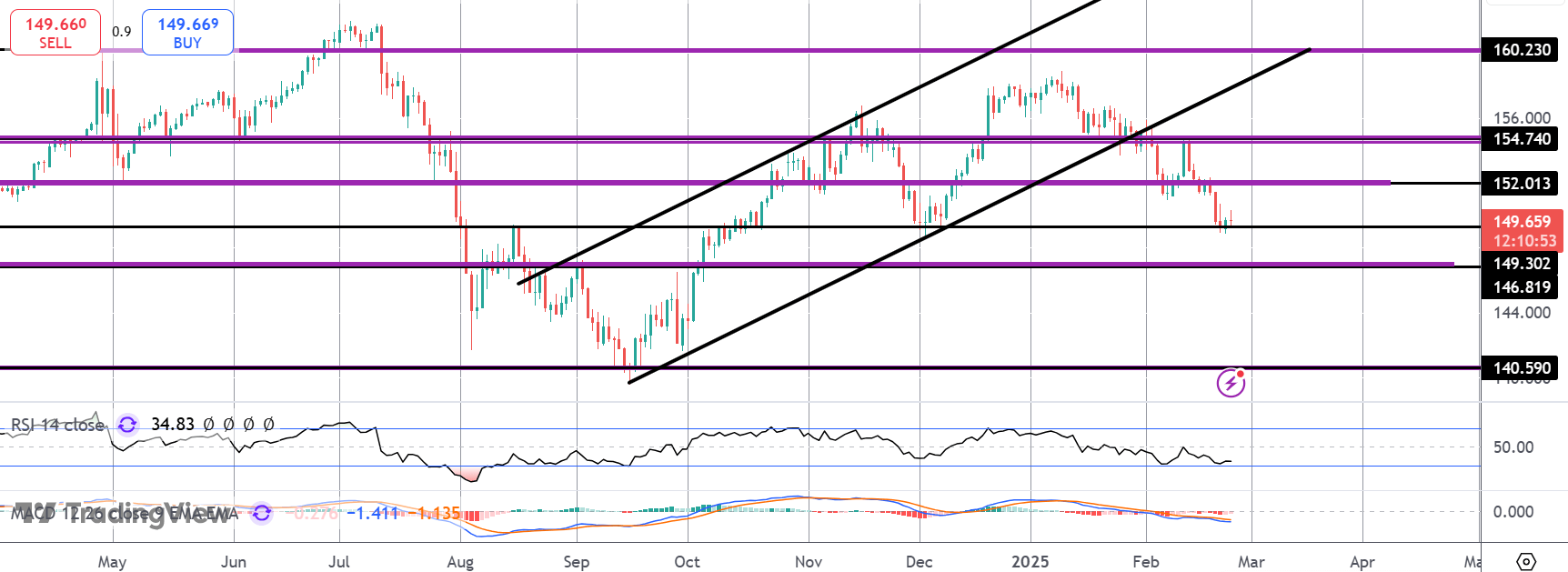

USDJPY

The sell off in USDJPY has seen the market breaking down to the 149.30 level where price is currently stalled. With momentum studies bearish, downside risks remain and a fresh break here will put 146.82 in view as the next downside target. Bulls need to see price quickly back above 152 to alleviate this risk.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.