USD Steadies Amid Global Central Bank Divergencea

After Thursday's sharp decline, the Greenback is trading broadly steady on Friday, grappling with the implications of the Fed’s aggressive rate cut and contrasting monetary policies from other global central banks.

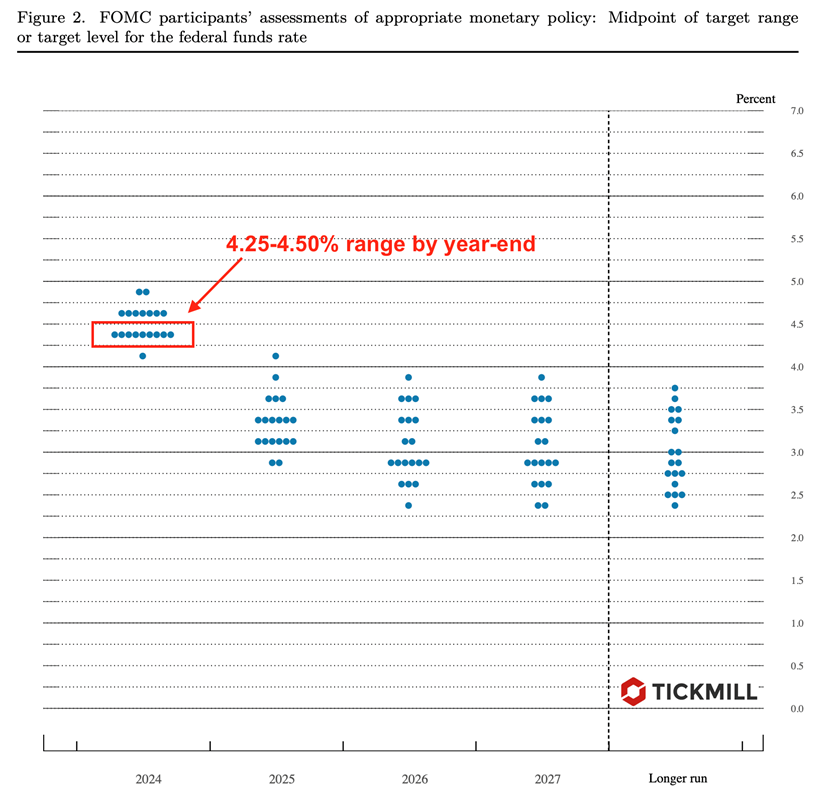

The Federal Reserve's decision to cut interest rates by 50 basis points marks a significant shift in its monetary policy stance. This move, aimed at reviving labor market strength amid declining inflation towards the 2% target, signals the commencement of an aggressive policy-easing cycle. The Fed's dot plot suggests a range of fed rate of 4.25%-4.50% by year-end, but market expectations are leaning towards even further cuts, potentially bringing rates down to the 4.00%-4.25% range:

This dovish outlook has naturally exerted downward pressure on the USD, as lower interest rates diminish the currency's appeal to yield-seeking investors.

In stark contrast, the Bank of England opted to keep its interest rates steady, underscoring a cautious approach in the face of persistent inflationary pressures. Similarly, the Bank of Japan (BoJ) maintained its interest rate at 0.25%. BoJ Governor Kazuo Ueda highlighted softer-than-anticipated inflation and reiterated the bank's readiness to adjust policy if necessary. These divergent monetary paths are causing the USD to struggle against both the GBP and the JPY, as investors recalibrate their strategies based on interest rate differentials.

The Euro is also gaining traction, with EUR/USD gathering strength and eyeing the 1.1230-1.1270 resistance zone:

Speculation is mounting that the European Central Bank will hold its Deposit Facility rate at 3.5% in the upcoming October meeting. While some ECB policymakers advocate for a gradual policy-easing approach, concerns about sticky services inflation persist. ECB President Christine Lagarde's upcoming speech could provide further insights into the bank's monetary policy trajectory.

Equity markets are exhibiting signs of profit-taking after the post-Fed rally, with both European equities and US futures trading slightly in the red. However, the losses are contained, suggesting that investors are cautiously reassessing their positions rather than initiating a broad sell-off.

Looking ahead, the US economic calendar is relatively light today, providing a respite for traders after a tumultuous week. However, the calm may be short-lived. Next week brings a slew of significant US economic data releases, including the final Q2 Gross Domestic Product figures and the Personal Consumption Expenditures Price Index—the Fed's preferred measure of inflation. These data points will be crucial for assessing the health of the US economy and could significantly influence market sentiment and USD valuation.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.