USD may Extend the Rally on the FOMC Hawkish Surprise

The dollar rose sharply on Friday, breaking through a corrective channel and bouncing off a key bullish support line (scenario discussed on Friday):

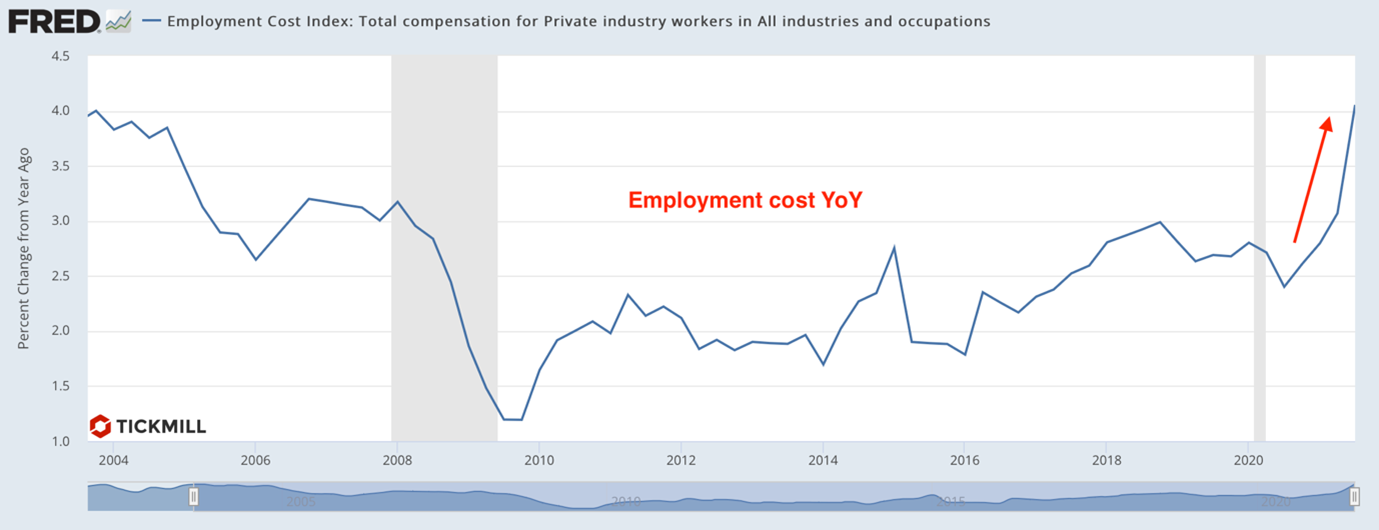

One of the key drivers of the rally was the US inflation report. Despite the fact that consumer inflation (Core PCE) rose by 3.6%, falling short of the forecast of 3.7%, the market was more concerned about dynamics of the labor cost index in the US - in the third quarter it rose by 1.3% against the forecast of 0.9%. Recall that both the Fed and the ECB have repeatedly said that a "second round" of inflationary effects may occur if inflation seeps into wages, since in this case further growth in consumer demand and accompanying inflation can be expected. In the meantime, the annual growth rate of labor costs in the United States is now at its highest level in more than 15 years:

Today, the US Dollar index is consolidating around 94 points ahead of the release of two important news this week - the decisions of the Fed and the NFP. After the latest update on labor costs data, chances are high that the Fed will announce the start of QE rollback on Wednesday. Further dollar upside will undoubtedly depend on pace of bond purchase tapering. The closest target for USD index is the previous resistance at 94.50-94.75, which the dollar is likely to test on Wednesday before the Fed decision.

It should also be noted that along with increased chances of imminent tightening of the Fed's policy, long-dated US Treasury bonds are beginning to price in future slowdown in inflation, possibly pricing in Fed policy error (i.e., that Fed starts to tighten too early, harming growth and inflation). This translates into decline of the spread between 10 and 2-year US Treasury bond yields:

Nevertheless, the USD retains its short-term bullish prospects.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.