US CPI Will Likely Surprise on the Upside Due to Labor Market Imbalances

On Wednesday, sellers in the sovereign debt markets take profits before release of the key inflation data point for the market (US CPI), yields pulled back from key resistance levels (2% on 10-year Treasuries, 0.25% on German Bunds). Another driver of the rally could be acknowledgment that there was an overreaction to the ECB and Fed meetings and actual pace of policy tightening could be slower. At the same time, demand for risk appears to be on the mend, European indices and futures for US indices rose, yield search puts constraint on early dollar rally, DXY continues to consolidate around 95.50 ahead of CPI print tomorrow:

Tomorrow's US CPI for January will decide the fate of the Fed's March rate hike by 50 bp (either make it a baseline scenario, or lower the chances). The report will be critical to answering the question of whether the Treasury sell-off continues and whether the 10-year rate goes beyond 2%, which could trigger a breakout move, as there was initial test of 2% key resistance zone yesterday.

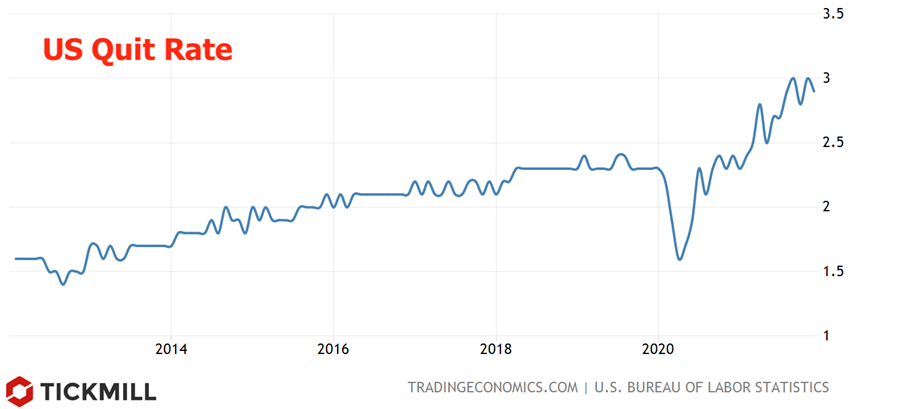

Even with consensus of 7.3% in headline inflation and 5.9% in core inflation, there is some room for a surprise on the upside, primarily due to strong wage growth due to ongoing labor market imbalances (0.7% MoM in January vs. 0.5% expected). The jobs quit rate in the United States remains at an all-time high together with a significant increase in wages, they fell into a positive feedback loop - the negotiating power is now on the side of workers which is quite unusual:

Today, representatives of the Fed Bowman and Mester will have their say, the focus is on assessing the persistence of pro-inflationary factors in the economy. Fed rate hike by 25 bp already priced in, the chance of 50 bp outcome is approximately 25%. The ECB releases winter forecasts for growth and inflation today, markets are focused on inflation estimates in 2023, since the ECB is expected lift-off the rate next year. The euro is likely to react positively to the report if the inflation estimate will be above 2%. Also, today there will be a QA session with ECB official Schnabel, who was one of the first to start sounding the alarm about inflation and will probably try to draw attention to this issue again.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.