These Moves in Asset Prices Should put Investors on Alert

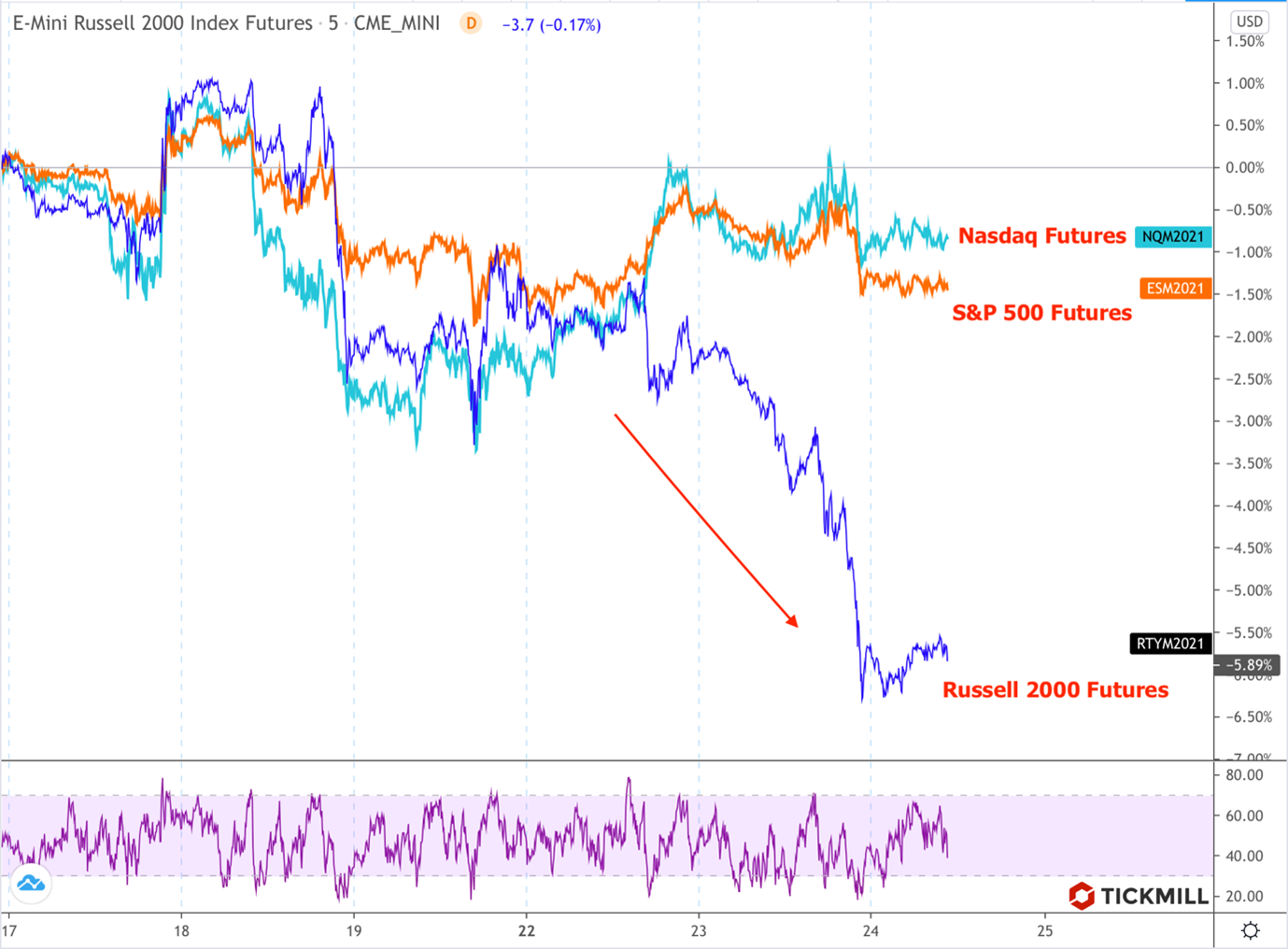

Risk assets were sold off moderately on Tuesday while there was a solid interest in debt assets, which is evident from synchronous fall of yields on sovereign debt of developed countries. This distinguishes Tuesday pullback from the dips that we saw earlier in February in March – in contrast, they were fueled by sharp sell-off in bond markets, i.e., rise in yields. If we assume that the idea of post-pandemic recovery still remains a dominant markettheme, rising bond prices together with falling stocks should put us on alert, as the pattern belongs to classic risk-off environment. So maybe investors started to doubt about recovery? Looks reasonable, considering that oil has spookingly grown a second leg down, and small-caps, which have experienced a renaissance since November, were sold aggressively:

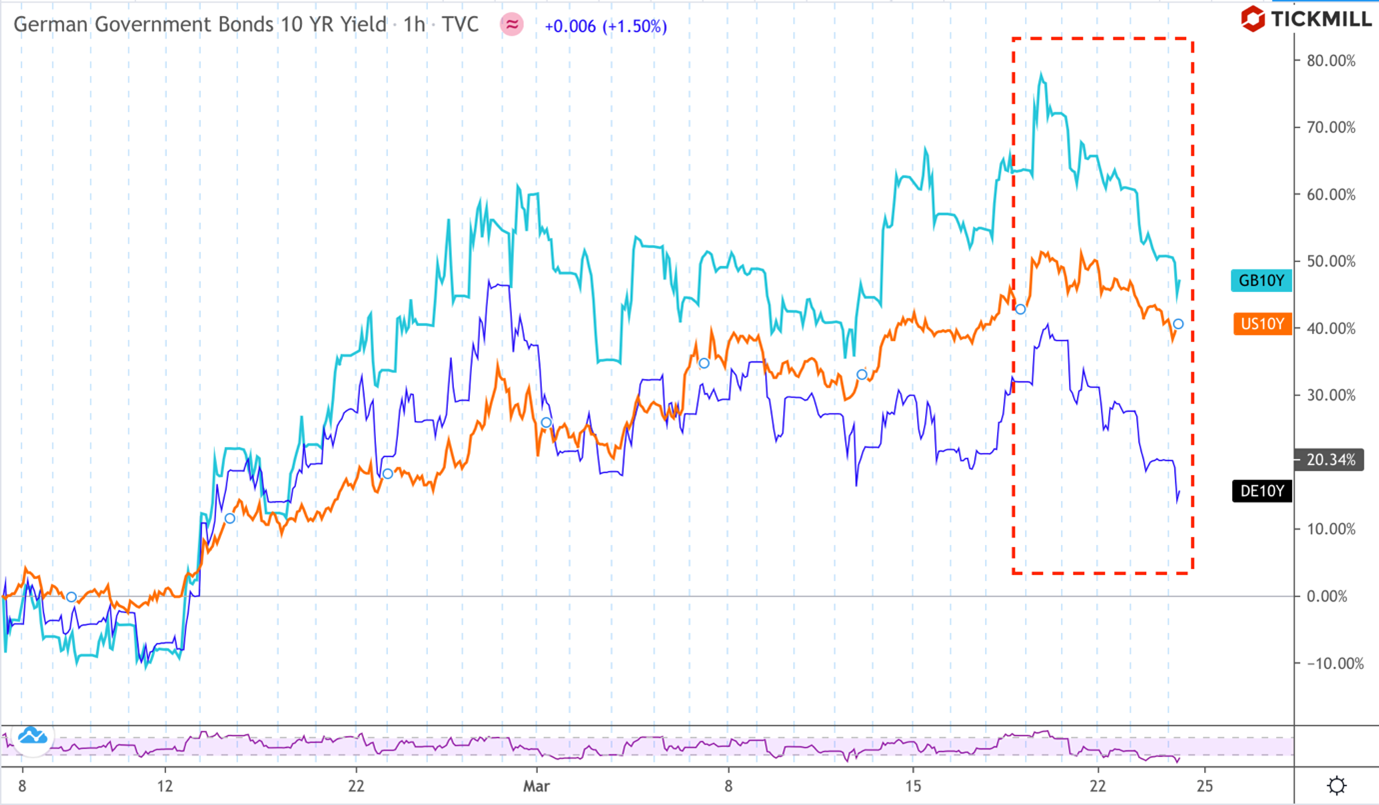

The yields on sovereign debt in developed countries began todecline at about the same time:

Oil prices bounced down from the trendline after thebreakout, in line with the idea described earlier:

Based on the widespread pullback movements in assets or asset indices, which were used to bet on the recovery, we can conclude that recovery euphoria gives way to more cautious markets. At least in the near-term. A key ingredient of continuation of recovery is a clear timeframe of lockdown lifting in the key economies, which markets currently lack for. With recent developments in vaccination programs and lockdowns, expected dates of getting key positive catalysts were delayed again. In my opinion, the case of consolidation in one week – one month horizon strengthens. On the technical side, some equity indices are currently playing with key resistance areas with little fundamental backdrop to expect true breakouts. Also, strong performance of equities relative to bonds let us expect a significant quarterly rebalancing of large funds which buy stocks and bonds. The rebalancing will obviously lead to paring down share of equities in portfolios and increasing exposure in well-fallen bonds.

The risks that sell-off will develop into a full-fledged bear market are small. The main recovery impetus is still in stock and has not been used up. This is the complete removal of lockdowns and release of pent-up demand. For example, it can be seen that forecasts of leading central banks and oil agencies have the biggest optimism in the third-fourth quarter of 2021 – they anticipate that the bulk of social restrictions will be lifted by that time giving essential boost to consumer mobility.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.