The USD Volatility Rollercoaster: A Market Recap

Wednesday marked a pivotal moment as the Federal Open Market Committee (FOMC) unveiled its commitment to cut interest rates three times this year. This revelation blindsided markets, which had previously been priced in only two cuts. The abrupt repricing triggered significant weakness in the US Dollar, propelling equities to substantial gains.

Despite the Fed's intentions, recent economic indicators paint a mixed picture. S&P Global's Purchasing Managers Index (PMI) numbers not only indicated a surge in activity but also revealed a concerning uptick in prices paid. This unexpected inflationary pressure complicates the Fed's outlook, diverging from its initial projections.

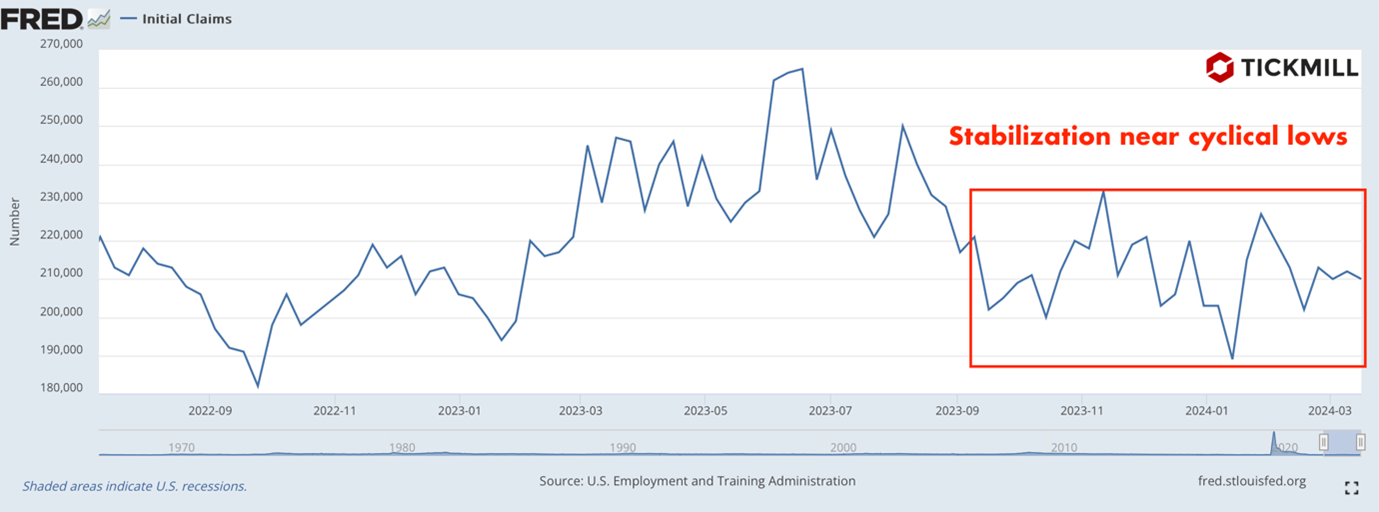

Initial jobless claims surprised on the upside, dropping to 210K and maintaining a low growth rate near the business cycle lows for multiple months since autumn 2023:

Equities have mirrored the USD's volatility, with indices fluctuating in response to unfolding events. Japanese and Chinese markets witnessed robust gains, exceeding 1.5%, while their European counterparts maintained stability below 1%. US equity futures, particularly the Nasdaq, surged nearly 1% ahead of the US opening bell, reflecting ongoing market optimism.

The US Dollar Index (DXY) saw a post-Fed meeting intensive sell-off followed by a resurgence on Thursday. The DXY's upward momentum attempted to offset losses incurred from Wednesday's repricing frenzy.

As investors navigate the USD's erratic movements, attention turns to potential bullish breakout scenarios. Thursday’s bounce in the DXY price prompts a reassessment of the risk of a medium-term supply line breakout, which would unlock the path for further USD appreciation:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.