The FTSE Finish Line - September 10 - 2024

The FTSE Finish Line - September 10 - 2024

FTSE Fledgling Recovery Stalls, Pharma Giant Weighs On Sentiment

The FTSE 100 in London experienced a slight decline on Tuesday, as a result of a broad decline in the market. AstraZeneca's performance weighed on the benchmark index, and the UK's sluggish wage growth solidified expectations for additional interest rate cuts by the Bank of England. After experiencing its most successful day in over a month on Monday, the blue-chip FTSE 100 experienced a 0.6% decline. Similarly, the mid-cap FTSE 250 was also negative on the session.

AstraZeneca's shares experienced a 5.3% decline to 12,030 pence, placing them at the bottom of the FTSE 100 index. AstraZeneca's major lung cancer trial demonstrated that its experimental precision drug did not substantially enhance the overall survival outcomes of the patients. According to AstraZeneca, the overall survival in the TROPION-Lung01 trial did not achieve statistical significance.

On the positive side of the ledger Centamin, a gold miner that concentrates on Egypt, experiences a 23.4% increase in its stock price to 147.5 pence, the greatest level since October 2020. AngloGold Ashanti, a global miner listed in the United States, has reached an agreement to acquire Centamin in a $2.5 billion stock and cash transaction. This transaction will enable the company to expand its operations in Africa. The implied offer price of 163 pence per share is approximately 36% higher than Centamin's most recent closing price of 119.5 pence. As of the most recent close, Centamin's shares have increased by 20.4% year-to-date.

Investors will now focus on the United States' key inflation figures and Britain's gross domestic product numbers this week to gain additional insight into the central banks' policy easing trajectory in anticipation of their meetings later this month.

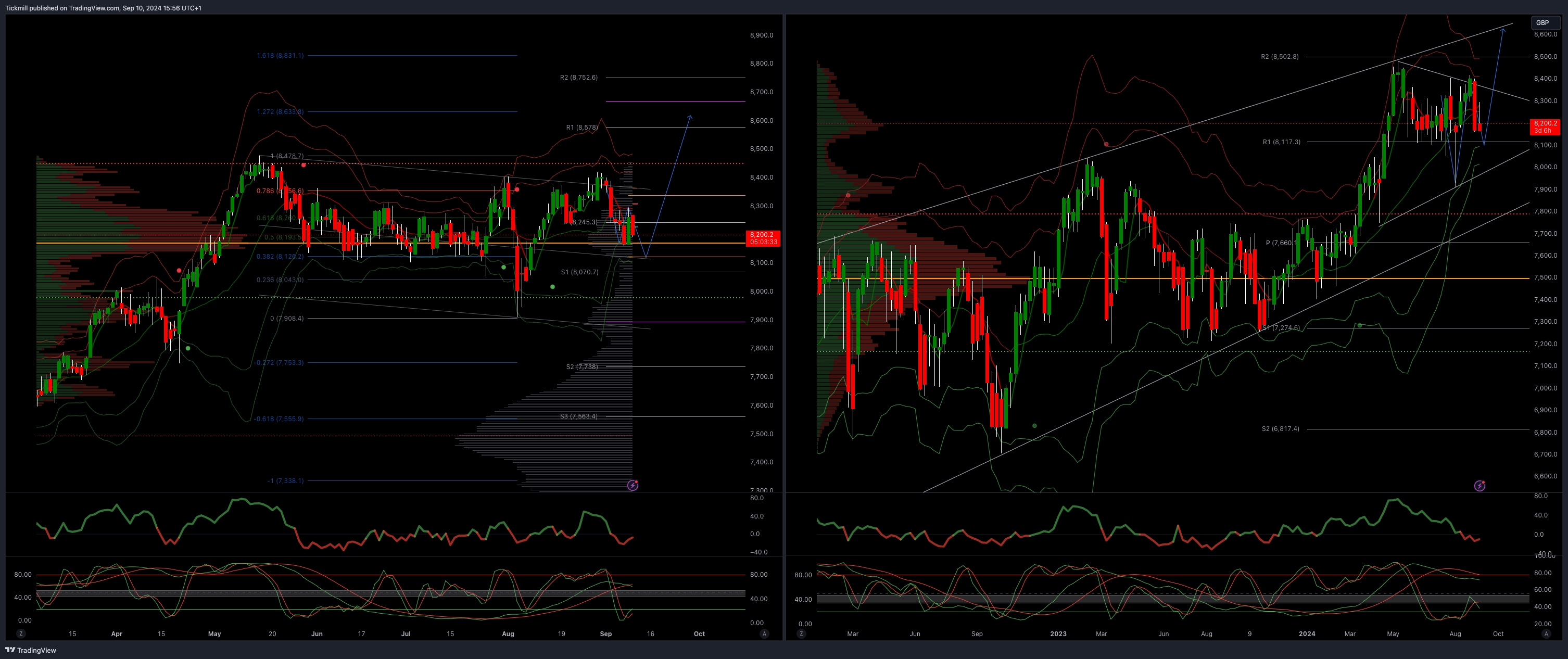

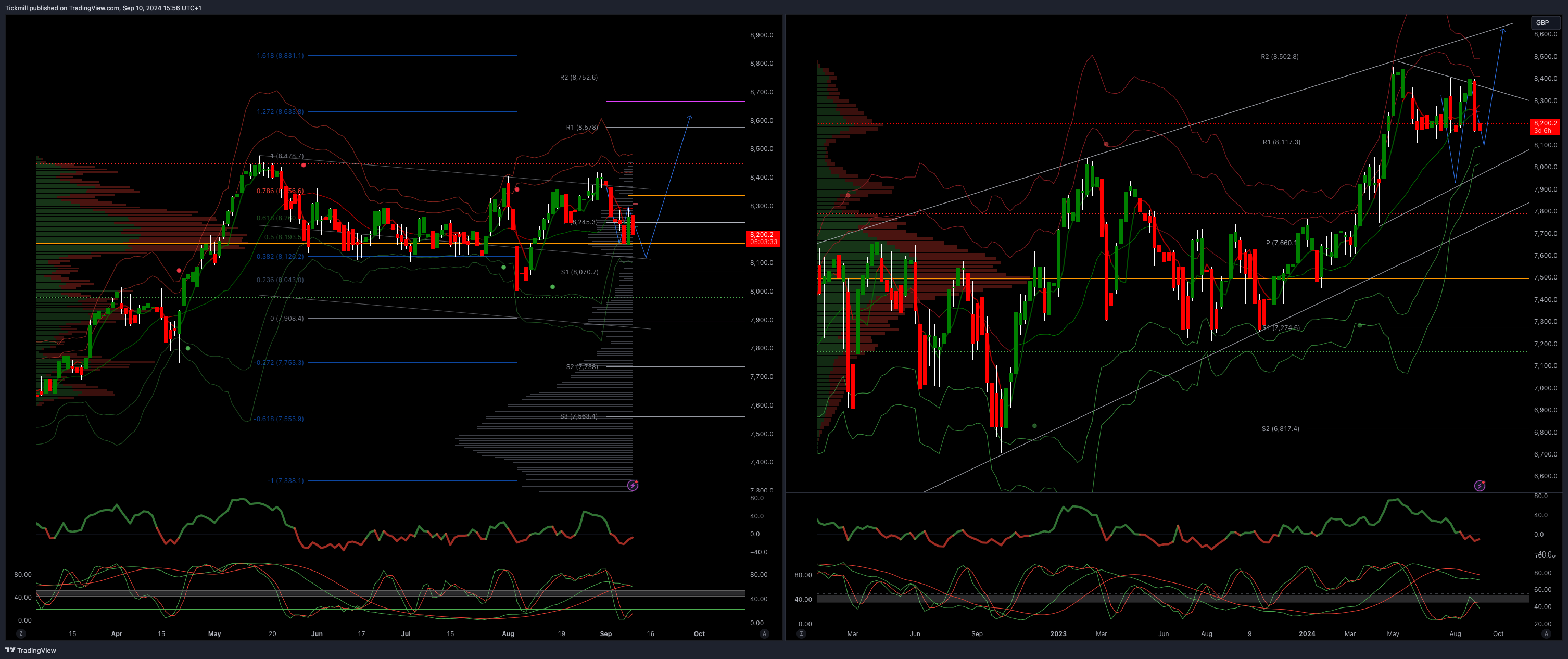

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Primary resistance 8400

Primary objective 8600

Daily VWAP Bearish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!