The FTSE Finish Line: June 13 - 2025

The FTSE Finish Line: June 13 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

London's FTSE 100 dipped on Friday following a record high closure in the prior session, as Israel's escalating military actions against Iran heightened geopolitical tensions. However, gains in energy stocks helped to mitigate the losses. At 0905 GMT, the benchmark FTSE 100 was down 0.5%, remaining less than 1% away from its intraday record peak and on track for its fifth consecutive week of growth. Israel initiated extensive strikes against Iran on Friday, targeting nuclear sites and missile production facilities to thwart Tehran's atomic weapon development, prompting Iran to respond with a launch of 100 drones. This situation has further contributed to the caution in global financial markets, which are already dealing with the repercussions of U.S. President Donald Trump's unpredictable tariff policies. The increased tensions in the oil-rich Middle East led to a surge in crude prices, which rose 7%, adversely affecting travel and leisure stocks.

Next week’s key macroeconomic events include: UK CPI (Wednesday) Headline inflation surged to 3.5% in April from 2.6% in March. However, the ONS later identified an error related to Vehicle Excise Duty (VED) rate increases, which overstated the inflation rate by approximately 0.1 percentage points. The timing of any correction remains uncertain. We anticipate headline inflation to ease slightly to 3.4%. Services inflation will be closely monitored after spiking to 5.4% in April, partly influenced by Easter-related timing effects. US Federal Reserve Policy Decision (Wednesday) The Federal Reserve is expected to keep interest rates unchanged for the fourth consecutive meeting since the last adjustment in December. Attention will centre around the Fed's forward guidance, with some officials signalling the possibility of rate cuts later this year. The meeting will also feature updates to economic forecasts, although changes to interest rate projections in the ‘dot plot’ are expected to be minimal. Bank of England Policy Decision (Thursday) The Bank of England is unlikely to reduce interest rates at its June policy meeting, with expectations positioned between May’s cut to 4.25% and a potential move in August. The Monetary Policy Committee (MPC) has reiterated its ‘gradual and careful’ approach to monetary easing, balancing the risks of persistent inflation against signs of a weakening labour market. The decision is unlikely to be unanimous, as we expect two members to advocate for an immediate rate cut.

Single Stock Stories & Broker Updates:

The British travel and leisure index drops 3.36% as Israel strikes Iran, leading to heightened tensions. Iran launches around 100 drones at Israel, which is working to intercept them. International Consolidated Airlines plummets 4.4%, the biggest loser on the FTSE 100, with Wizz Air down 5.2% and EasyJet losing 3.7%. Carnival Cruises falls 5.2% on the FTSE midcap index, while Intercontinental Hotels and Whitbread decrease by 2.7% and 2%, respectively.

UK oil and gas stocks rose following an Israeli strike on Iran, raising concerns about gas supply in the Middle East. BP gained 2.3%, Shell 1.6%, and Serica Energy reached 166p, up 2.5%. Other North Sea companies like EnQuest, Ithaca Energy, and Harbour Energy grew between 3.1% and 4.3%.

Industrial machinery and equipment manufacturer Renold surged 8.4% to reach 82.4p, marking its highest price since July 2015. MPE Bidco, a company partly owned by U.S. private equity firm MPE MgtCo, has agreed to acquire the firm in a cash deal valued at £186.7 million (approximately $252.61 million). Each Renold shareholder will receive 82p per share in cash, representing a 50% premium over RNO's closing price on May 19, the day before the offer was made. Including gains from the current session, the stock has risen 75.3% year-to-date.

British gas producer Energean saw its shares fall by as much as 7.7% to 794 pence. It is the biggest loser on the FTSE mid-cap index, which has decreased by 1%. The company has temporarily halted production and operations of its Power Floating Production Storage and Offloading system. This suspension is attributed to the recent geopolitical tensions in the Middle East. As of the last closing, the stock has plummeted by 22.9% this year.

Technical & Trade View

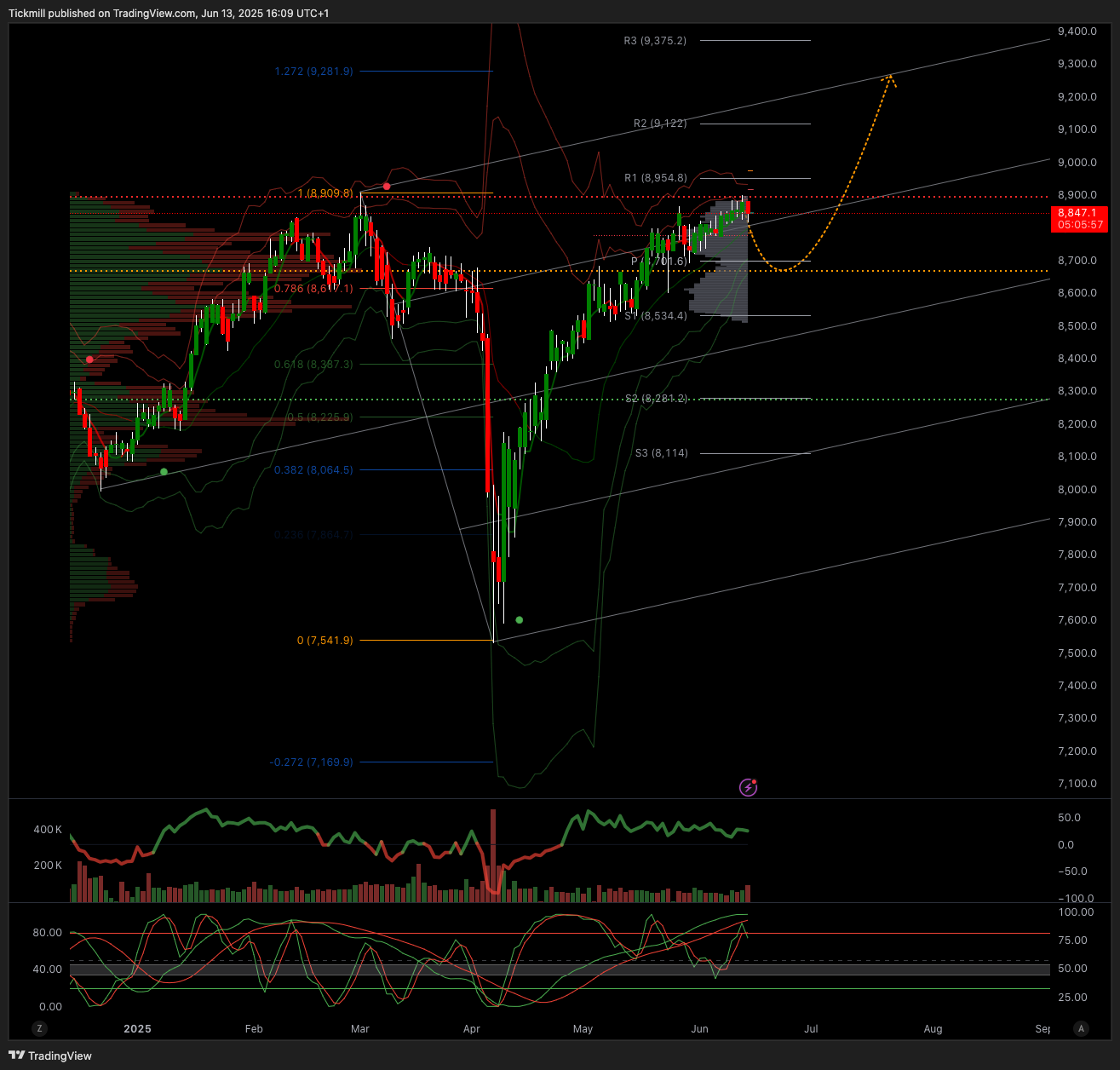

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8500

Below 8500 opens 8250

Primary objective 8900

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!