The FTSE Finish Line - July 06 - 2023

The FTSE Finish Line - July 06 - 2023

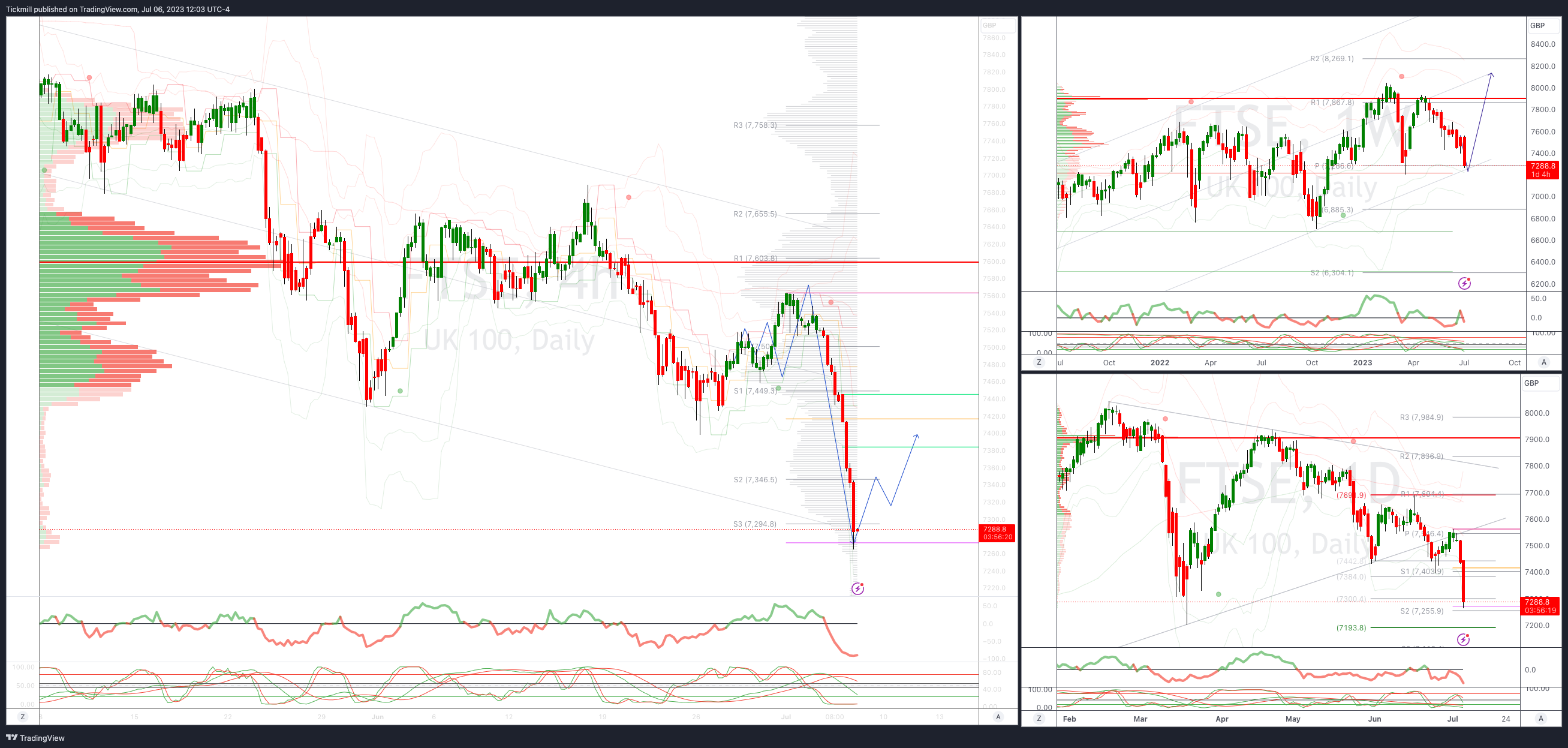

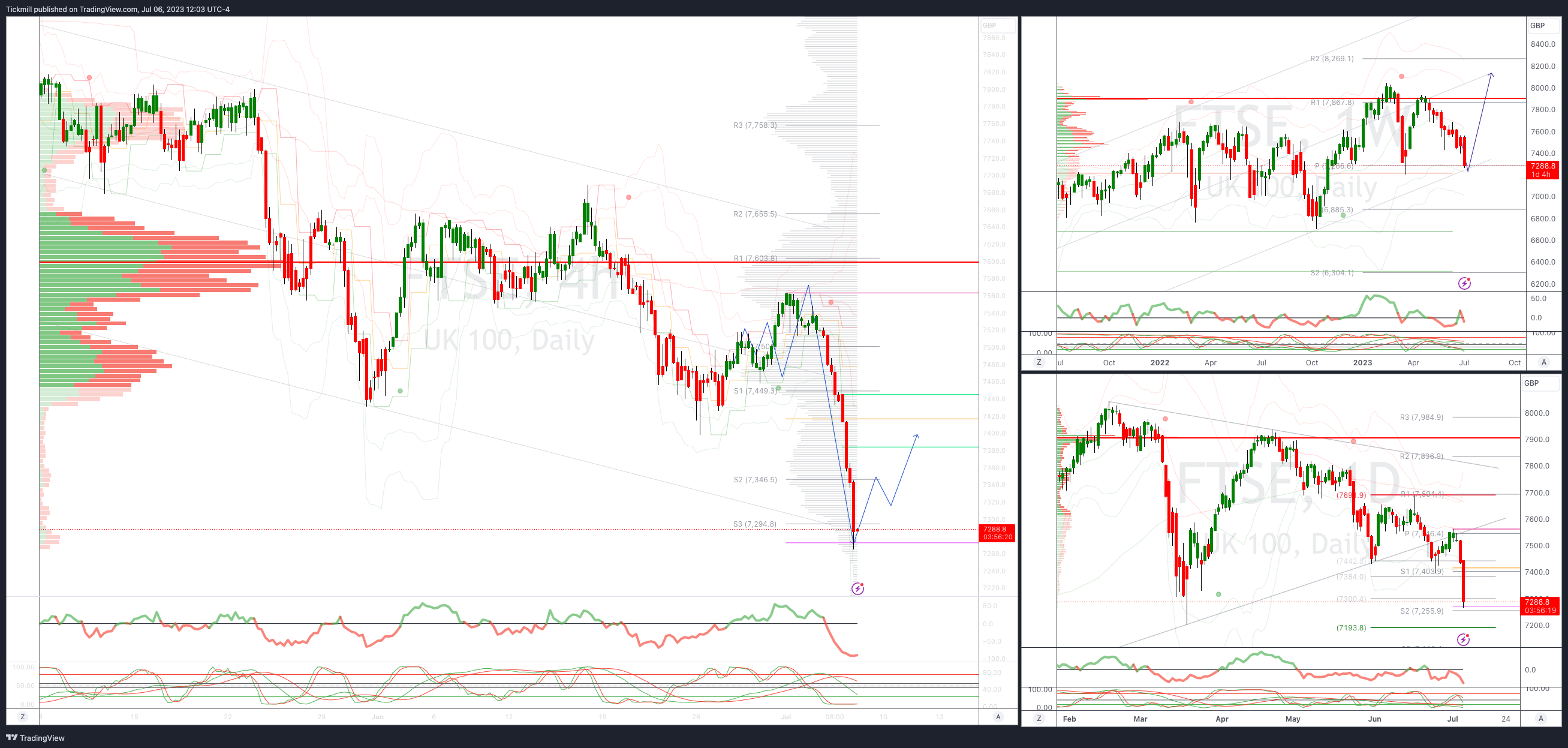

FTSE Hits A Three Month Low, Testing Pivotal 7270 Support

The FTSE 100 index has reached a three-month low due to the impact of rising interest rates on commercial landlords' property valuations. As interest rates increase, the value of properties owned by these landlords tends to decline, leading to a negative effect on their overall investment volumes. Additionally, higher borrowing costs further exacerbate the situation. All 28 constituents of the FTSE 100 index that are currently trading have experienced declines. Land Securities and British Land, two prominent players in the index, have seen their shares drop by 3.3% and 2.6%, respectively. The UK housebuilders' index has also fallen by 2.1% as all constituents of the index are trading in the red. This decline comes as a survey reveals that British house building experienced the sharpest decline in June, excluding two months during the early stages of the COVID-19 pandemic, in more than 14 years. The decrease in house building activity is attributed to higher borrowing costs, which have dampened demand and had a negative impact on the broader construction sector. In line with the overall index decline, The anticipation of higher interest rates has resulted in an increase in mortgage rates, further hampering housing demand and negatively affecting the performance of house building companies. FTSE 100 members Taylor Wimpey, Persimmon, and Barratt have all experienced declines ranging from 2.1% to 2.5%. The combination of weak homebuilding data and worries about potential rate hikes has contributed to the downward trend in the shares of UK housebuilders.

Industrial metal miners faced a decline of 1.8% in the UK benchmark index, reflecting the downward pressure on prices of most base metals. This drop in the mining sector is notable within the commodity-heavy FTSE 100 index, which has been underperforming compared to other global benchmarks this year. The volatility in resource prices, combined with an uncertain global outlook, has contributed to the challenges faced by the UK benchmark. As a result, investors have witnessed a decline in industrial metal miners as the prices of base metals have come under pressure, Antofagasta sits at the bottom end of the table down 5.58% followed by Glencore off 5.5% on the session.

On the positive side of a very negative ledger sits United Utilities, the water utility firm, which experienced a 1.8% increase in its share price following an upgrade from Morgan Stanley. The financial institution raised United Utilities' rating from "equal-weight" to "overweight."

FTSE Intraday Bullish Above Bearish below 7400 - Target Hit New Pattern Emerging

Above 7550 opens 7660

Primary resistance is 7600

Primary objective 7193

20 Day VWAP bearish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!