The FTSE Finish Line: January 7 - 2025

The FTSE Finish Line: January 7 - 2025

FTSE Recovers Early Losses To Trade In The Green For The Day

The UK's FTSE 100 faced downward pressure early on Tuesday due to declines in major financial and healthcare stocks, while attention stayed on global economic data to assess trends in monetary policy. The blue-chip index initially traded in the red before recovering to regain the flatline and trade modestly in the green, up 0.3%. The exporter-heavy FTSE 100 faced pressure from a stronger pound, which reached its highest point in a week against the dollar. On a positive note, the retail sector saw a 1.2% increase, with clothing retailer Next rising by 3.2% after it raised its annual profit forecast for the fourth time in six months due to a successful Christmas season. UK stocks experienced volatility in the previous session, rising after a report indicated that U.S. President-elect Donald Trump's aides were considering tariff plans that would apply to all countries but only affect essential imports. However, Trump refuted the report, claiming it inaccurately suggested that his tariffs would be reduced. This week, attention will turn to the December U.S. nonfarm payrolls report set to be released on Friday, which is a key indicator for assessing the Federal Reserve's interest rate trajectory for 2025. Additionally, activity in the UK's construction sector expanded at its slowest rate in six months in December, while British house prices unexpectedly fell last month for the first time since March.

Single Stock Stories:

Next's shares rose by 3.2% to 9,864p, making it the top gainer on the FTSE 100 index. The clothing retailer has raised its pre-tax profit outlook for the year ending January 2025 for the fourth time in six months, now projecting £1.010 billion ($1.27 billion), up from the previous forecast of £1.005 billion. The company reported a better-than-expected 6% increase in full-price sales for the nine weeks leading up to December 28. It also forecasts full-price sales growth of 3.5% and a pre-tax profit of £1.046 billion for the fiscal year 2025-2026. As of the last close, Next's stock is up 0.6% year-to-date.

Shares of British thread manufacturer Coats Group fell 3.6% to 89.8p. This decline follows the announcement that the company's chief financial officer, Jackie Callaway, will step down from her role on May 21. Coats has appointed Hannah Nichols as her successor. Analysts at Jefferies commented that Callaway's resignation might surprise the market, noting her substantial contributions to improving the group's profitability and pension status. Despite this recent drop, Coats saw a growth of approximately 27% in 2024.

Shares of Team Internet Group surged by 28.1% to 116.6p after the company's board announced it received two separate acquisition proposals, one from TowerBrook Capital Partners (U.K.) LLP and the other from Verdane Fund Manager AB. Both offers are priced at 125p in cash per share. The company stated that it is currently evaluating both proposals with its advisers. Despite this recent uptick, the stock had declined by approximately 23% in 2024.

Broker Updates:

Shares of Raspberry Pi Holdings dropped 6% to 571.50p, making it the largest percentage loser on the FTSE 250 index. HSBC has downgraded the tech company's stock to "reduce" from "buy" and increased the target price to 500p from 440p. Out of 3 brokerages, 2 have rated the stock as "buy" or higher, while 1 has rated it "sell" or lower; the median target price is 448p according to LSEG data.

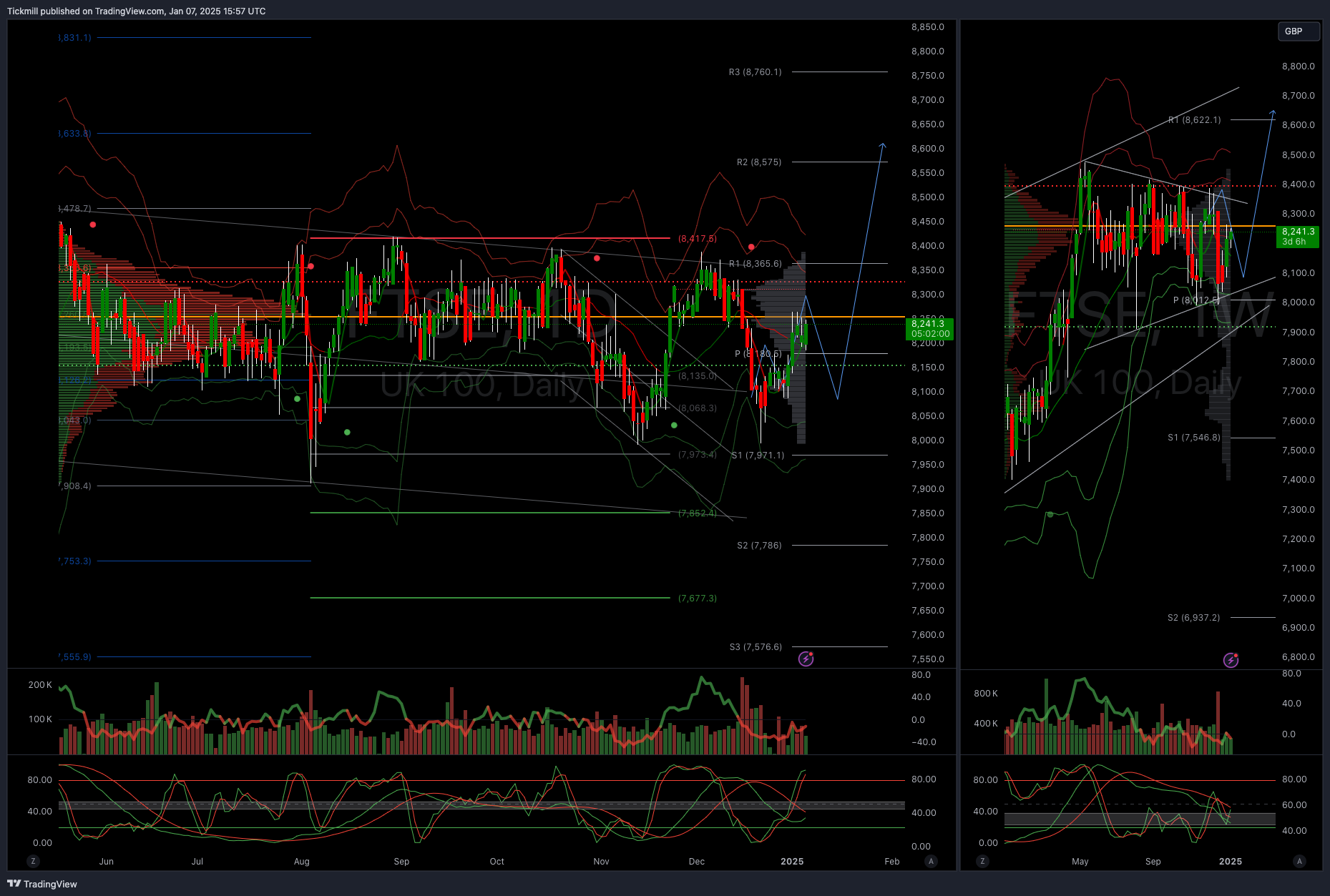

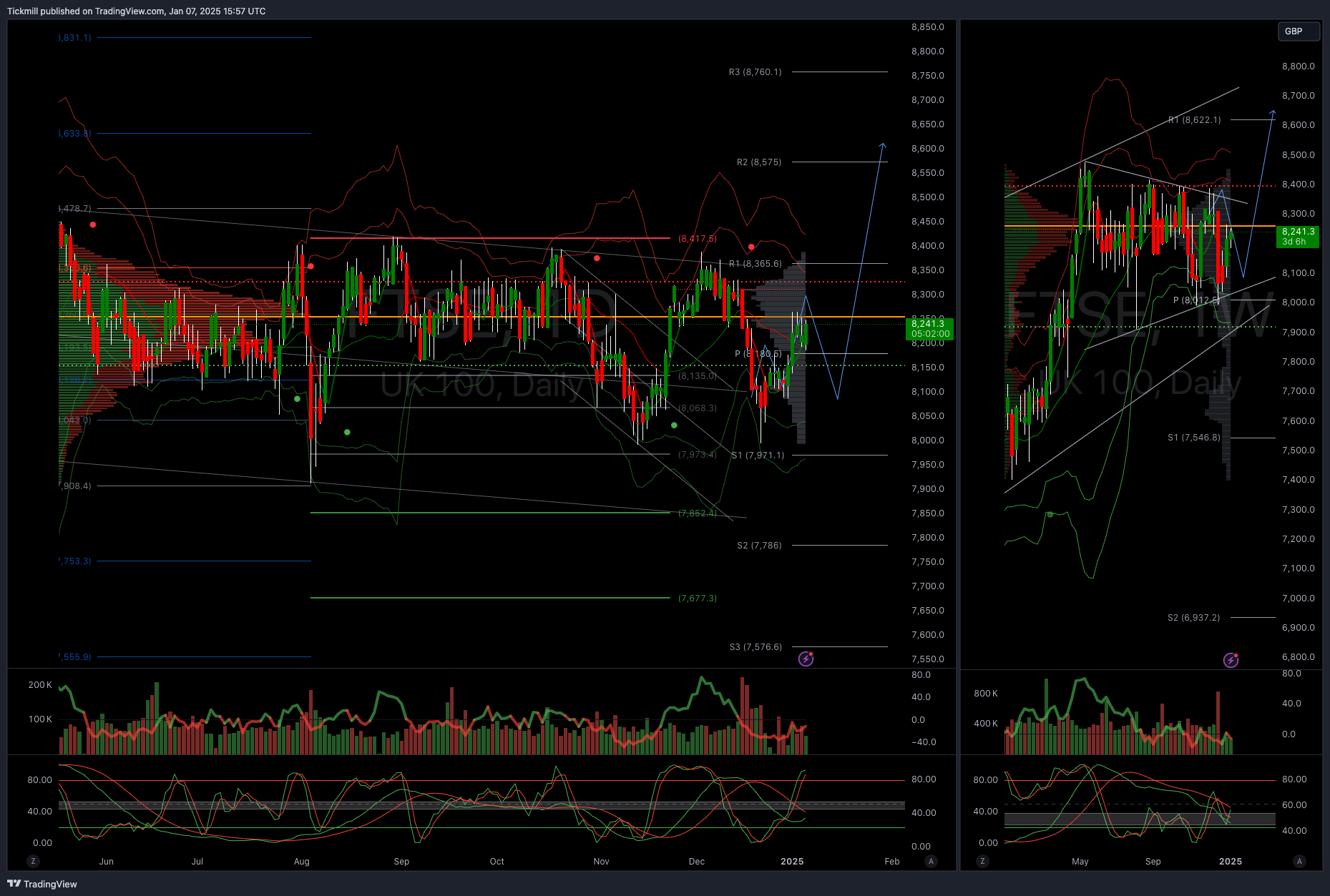

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Primary support 8000

Below 8000 opens 7855

Primary objective 8600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!