The FTSE Finish Line: February 27 - 2025

The FTSE Finish Line: February 27 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group

UK's FTSE 100 rose 0.6% on Thursday, outperforming other European markets amid U.S. tariff threats. Rolls-Royce surged nearly 19% to a record high, driving an 11% sector boost, after raising mid-term targets and surpassing profit estimates. The London Stock Exchange Group gained 2.2% on growth projections, while Aviva rose 1.9% after exceeding profit expectations. Meanwhile, WPP plummeted 15.6% on a larger-than-expected drop in organic revenue. In Europe, the STOXX 600 fell as tariff-sensitive stocks declined following U.S. President Trump's 25% tariff announcement on EU cars and products. UK Prime Minister Keir Starmer is set to discuss tariffs with Trump in Washington..

Single Stock Stories & Broker Updates:

Shares of advertising group WPP drop 19%, the lowest level since November 2020. The stock could face its worst day since August 1992; it is the biggest loser on the FTSE 100, which is down 0.17%. WPP reports a 1% organic revenue decline for 2024; it expects flat or up to a 2% revenue decline in the first half, with improvement in the second half. JPM analysts believe the shares will remain under pressure until growth accelerates in the second half and there is clarity on the Mars review, which will influence potential growth through 2026. The shares have fallen 60% in 2024.

Ocado's shares have dropped approximately 15%, potentially leading to the worst day since September 2023; it is currently the top loser on the FTSE mid-caps with a -0.9% loss. Co. delays robotic warehouse roll-out with Kroger to 2026. Reports pre-tax loss of 374.3 million pounds for year ending Dec 1, 2024, slightly better than the 387 million pounds loss in 2022-23. JP Morgan analysts expect no significant changes to consensus estimates. Stock down ~6.5% YTD after current losses.

Shares of Taylor Wimpey dropped 3.3%, making it a top percentage loser on the FTSE 100. The UK homebuilder reported an over 32% decline in 2024 pre-tax profit to 320.3 million pounds, missing estimates of 400.8 million pounds. FY24 operating profit fell by about 12% to 416.2 million pounds. However, TW anticipates meeting 2025 operating profit estimates of 444 million pounds. Investors expressed frustration over a lack of top-line growth despite a 16% larger order book compared to last year. The stock is down approximately 16% over the past year.

Shares of Hiscox Ltd rose 6.2%, the highest since September 2024. The stock is a top gainer on the FTSE 100 and announced a $175 million buyback starting with an $87.5 million tranche to be completed by Q3 2025. Insurance contract written premium grew 3.7% to $4.77 billion year over year. Jefferies expects a positive response to FY 2024 results and buyback, considering wildfire exposure reasonable. The stock is up 7.2% over the last 12 months.

Shares of British wealth manager St James's fell 4.4%, making it one of the top losers on the FTSE 100, which is up 0.1%. SJP reported 2024 net inflows of 4.3 billion pounds ($5.43 billion), down from 5.1 billion pounds ($6.44 billion) in 2023. Nine of 15 analysts rate the stock "buy" or higher, with a median price target of 1,150 pence. The stock has risen 26.97% in 2024.

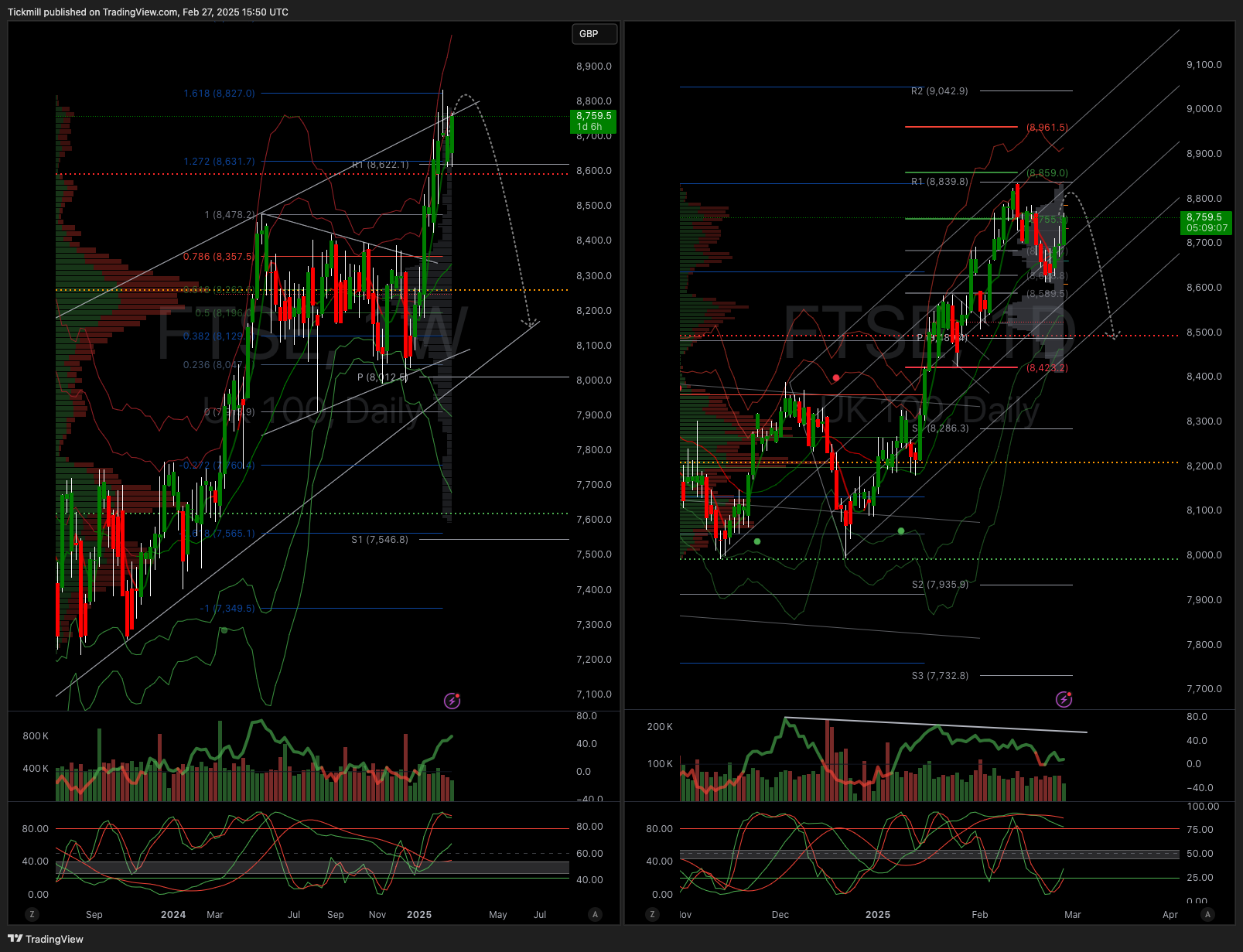

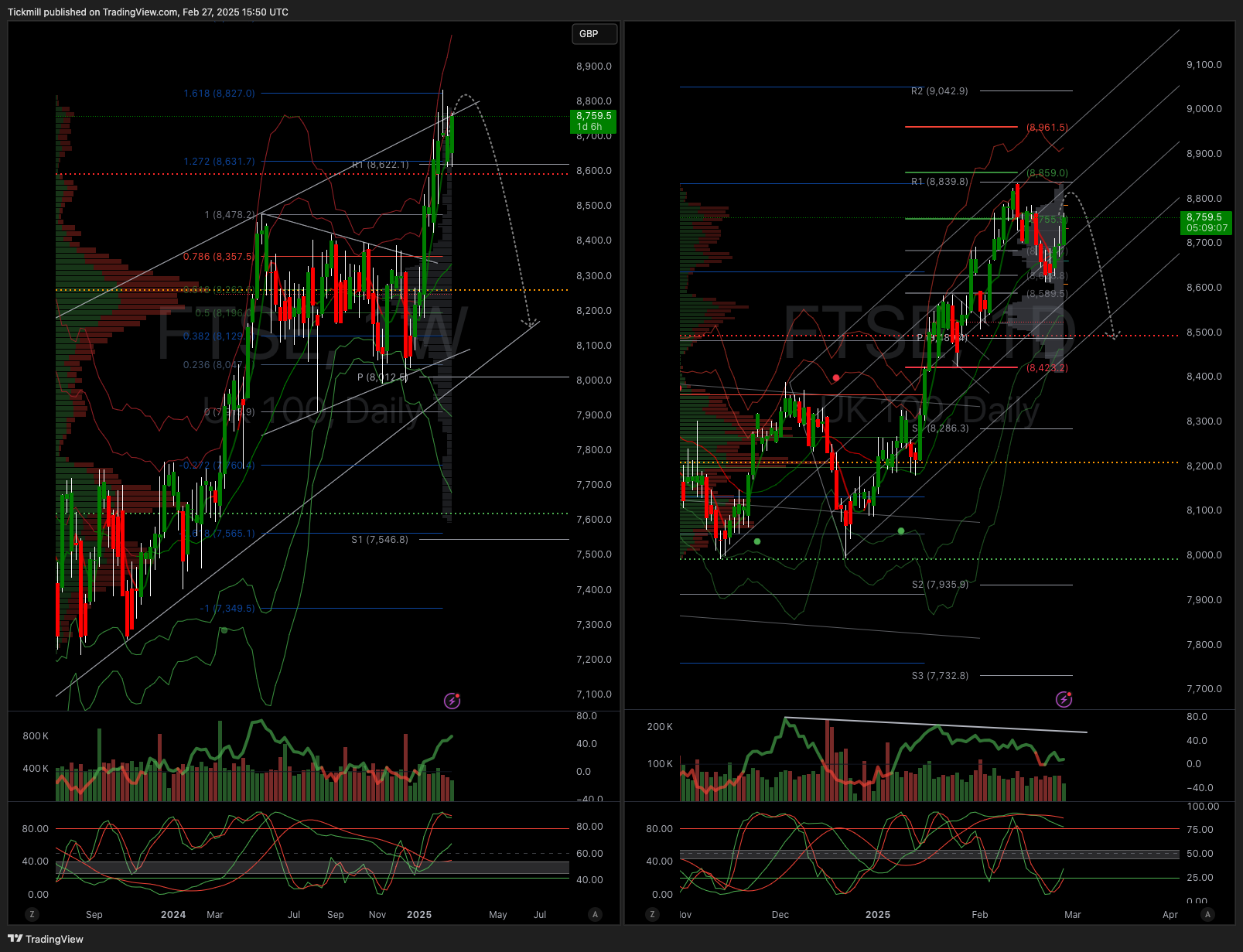

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8850

Primary support 8400

Below 8400 opens 8225

Primary objective 8500

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!