The FTSE Finish Line: February 12 - 2025

The FTSE Finish Line: February 12 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group

FTSE Gains As Pound Sinks Ahead Of GDP Data

London's key index remained close to record highs on Wednesday, supported by increases in real estate stocks, as investors prepared for upcoming regional data later in the week. The blue-chip FTSE 100 maintained a positive session gaining 0.14%, following a record rise earlier in the session. The real estate sector increased by 1.2%, and the home construction sector saw a rise of 1.7%. The pound is under increased pressure after U.S. inflation data came in higher than expected, resulting in a rise in U.S. yields. With the Bank of England expected to adopt a more dovish stance, the currency is likely to keep depreciating as we approach Thursday's GDP and output data, along with next week's UK employment and CPI reports. As the markets react to Fed Chair Powell's cautious approach to easing, the widening yield spreads between the U.S. and the UK are expected to support the dollar and keep GBP/USD around the 1.25 mark.

Single Stock Stories & Broker Updates:

Shares of homebuilder Barratt Redrow surged 9.4%, their highest since October 30, 2024, and led gains on the FTSE 100, which rose 0.1%. The company expects fiscal year adjusted pre-tax profit at the upper end of market forecasts (£243M-£588.4M, $302.75M-$733.09M) and launched a £100M annual share buyback. CEO David Thomas cited recovering customer demand and strong reservations amid stabilising economic, political, and lending conditions. Despite this, the stock fell 21.8% in 2024.

UK insurer Prudential surges 6%, the highest since October 2, on plans to partially divest its 49% stake in ICICI Prudential Asset Management, its Indian joint venture with ICICI Bank. Proceeds from the listing are intended to be returned to shareholders. Prudential shares are up ~7% YTD.

Close Brothers drops 1% to 361p after setting aside up to £165M ($205.4M) in H1 FY2025 for motor finance claims, reversing earlier 7% gains. The provision lowers its CET1 ratio to 12% (from 13.5% as of Dec. 31) but remains above the 9.7% regulatory minimum. Future provisions may follow pending a Supreme Court case. CBRO stock is up ~54% YTD as of last close.

Harbour Energy shares rose 1.25% to 242.90p after Goldman Sachs upgraded the stock to "neutral" from "sell," citing European gas prices supporting 2025 earnings and shareholder returns. The company slightly raised its 2024 production forecast in November, reflecting its acquisition of Wintershall Dea assets, which Goldman sees as beneficial diversification. Seven of eight brokerages rate the stock "buy" or higher, with a median price target of 342.50p (LSEG data). Harbour Energy shares fell 17.24% in 2024.

Indivior shares rose 6.5% after the FDA confirmed no outstanding issues with Sublocade label changes. Sublocade, a key drug for opioid use disorder, faces a delayed final review. Indivior's stock is down ~41.8% over the past year.

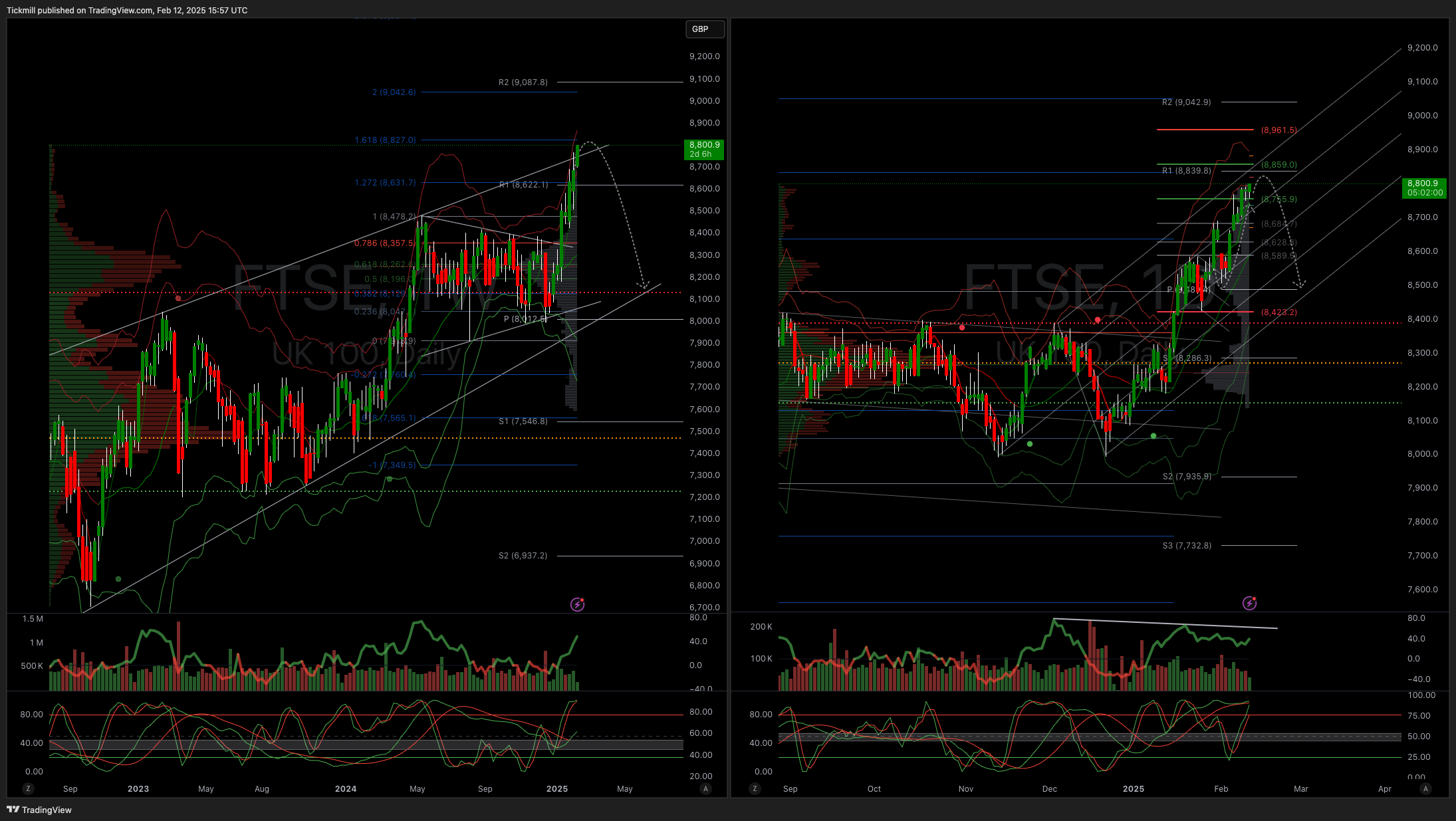

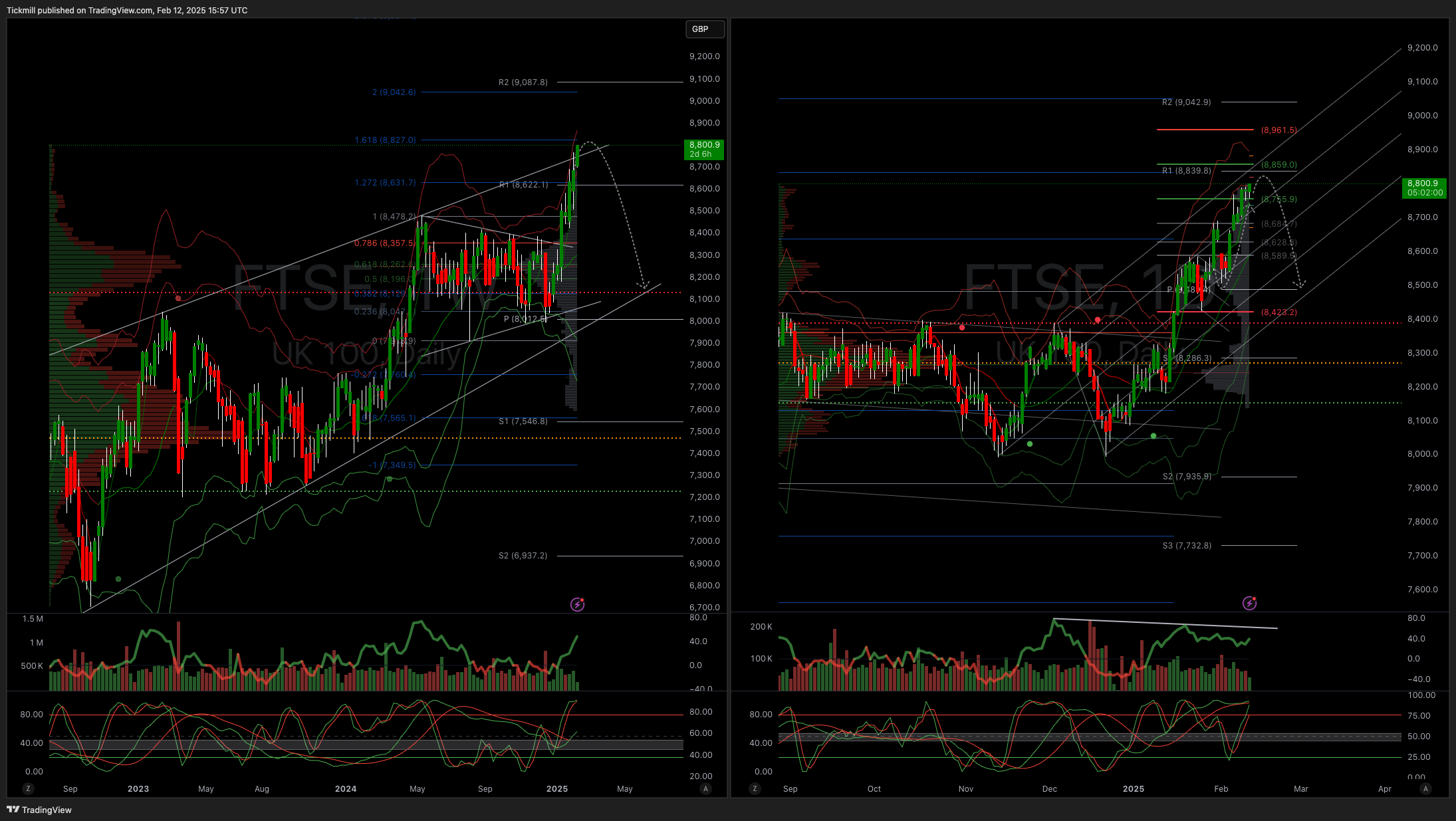

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8400

Primary support 8400

Below 8400 opens 8225

Primary objective 8600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!