The FTSE Finish Line: February 10 - 2025

The FTSE Finish Line: February 10 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group

FTSE At All-Time Highs As BP Surges On Activist Investment

The U.K. market reached new record highs on Monday morning, buoyed by significant increases in BP Plc, one of the world's largest oil and gas companies. Investors are also closely watching U.S. President Donald Trump's forthcoming actions regarding tariffs. Over the weekend, Trump indicated that he would reveal new 25% tariffs on all steel and aluminum imports, raising concerns about a potential global trade war and its effects on the world economy. China's tariffs on U.S. goods will take effect later today, and Trump has mentioned that he will announce corresponding tariffs on Tuesday or Wednesday that reflect the tariffs those countries impose on American exports.

Single Stock Stories:

BP has emerged as the top performer on the FTSE 100 following news that activist investor Elliott Investment Management has acquired a stake in the company. Shares of BP surged 5.6% to 457p, marking it as the biggest gainer on the FTSE 100. Elliott Investment Management, known for its push for corporate reforms, has reportedly built a position in the oil giant, though the exact size of the stake remains undisclosed. According to Bloomberg News, Elliott's holding in BP is described as "significant." The firm is said to be advocating for major strategic changes aimed at boosting shareholder value. So far this year, BP shares have climbed approximately 16%, reflecting growing investor confidence in the company.

Shares of Filtronic PLC, a UK-based designer and manufacturer, have increased by 13% to 105 pence, marking its highest point since November 2000. The company has secured a contract with SpaceX worth $20.9 million, which is set to be fulfilled in fiscal years 2025 and 2026. Filtronic now anticipates exceeding market expectations for revenue and profit in those fiscal years. As of the last close, the stock has risen approximately 38.16% year-to-date.

Ensilica's share price drops as much as 7.8% to 45.2p. The company makes mixed-signal Application Specific Integrated Circuits (ASICs) and reports a core profit of 200,000 pounds ($248,000), down from 500,000 pounds the previous year. HY revenue falls 3% year over year. ENSI says it invested 2.6 million pounds in intellectual property and tooling during the reported period, less than the 3 million pounds it spent the previous year. Stock rose about 9% in 2024.

Directa Plus's share price rises 8.3% to 6.50p, marking its highest level since January 6. The graphene-based product supplier's subsidiary, Setcar, secures a $1.5 million contract with Midia International SA and renews a €1.1 million ($1.1 million) agreement with Ford Otosan, a subsidiary of Ford Motor Company. As of the previous close, the stock had gained 7.69%.

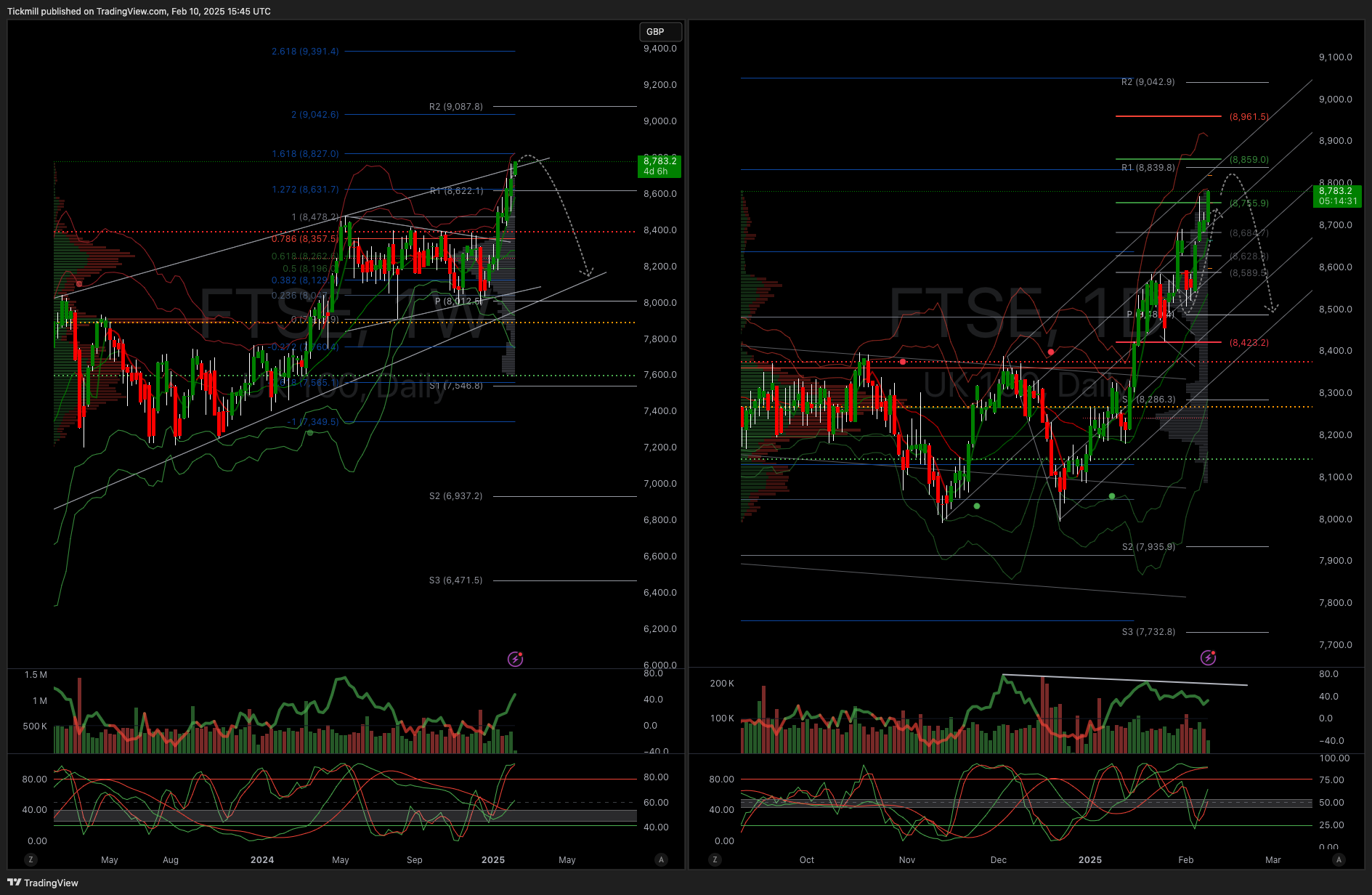

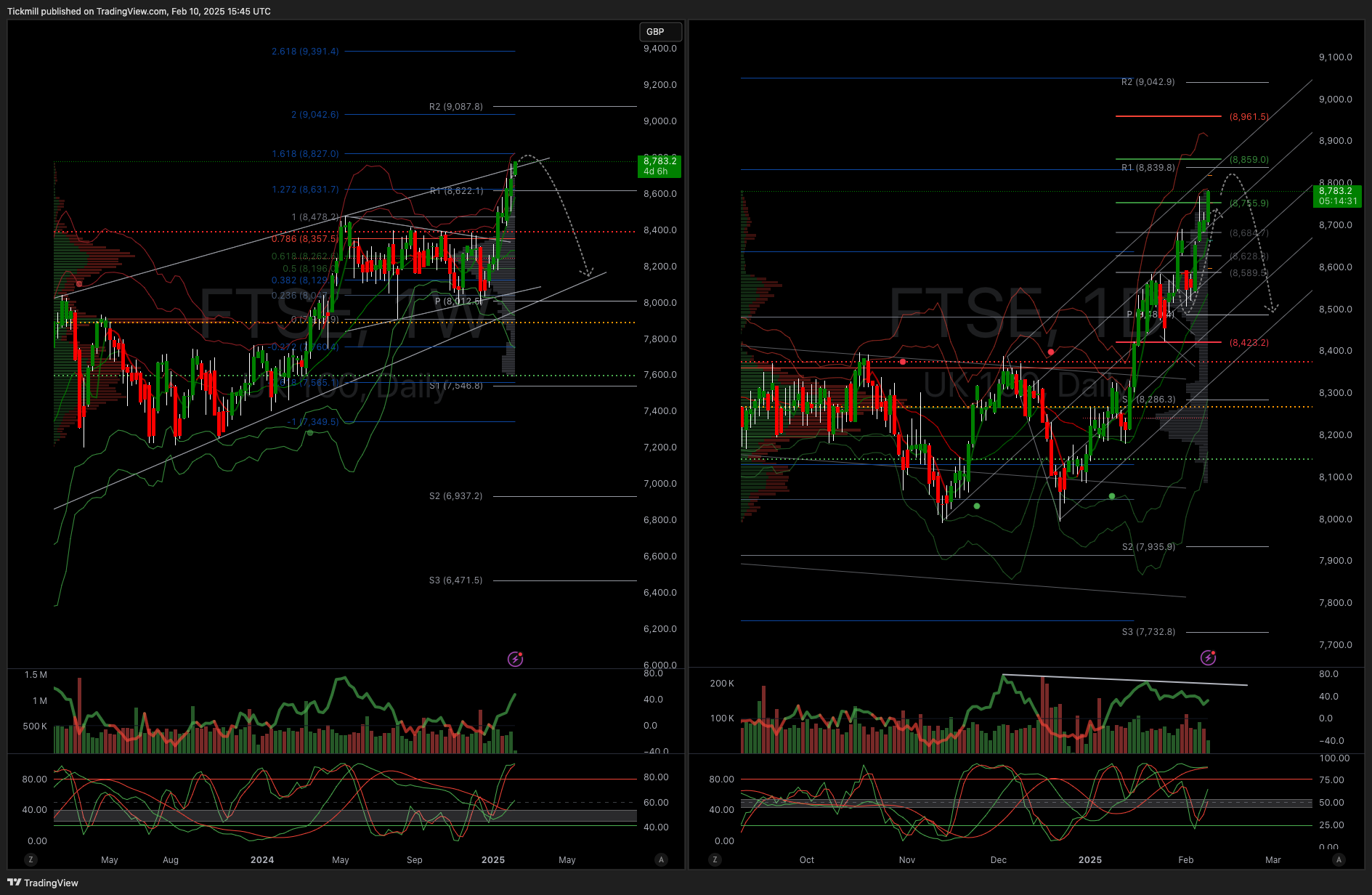

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8400

Primary support 8400

Below 8400 opens 8225

Primary objective 8600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!