The FTSE Finish Line: April 16 - 2025

The FTSE Finish Line: April 16 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group

Britain's benchmark index fell on Wednesday as Bunzl's shares reached a multi-year low after the business supplies distributor cut its annual forecast. A weaker domestic inflation report also failed to boost investor confidence. Both domestic indexes had surged in the previous session after U.S. President Donald Trump hinted at possible exemptions for auto-related tariffs. Bunzl declined by 23.1%, marking its worst day on record, following its revision of the 2025 forecast and suspension of its share buyback plan. This decline affected the industrial sub-index, which fell by 11%. On Wednesday, the UK's annual CPI inflation rate slowed for the second consecutive month in March, dropping to 2.6% from 2.8% in February, slightly below Bloomberg's consensus median of 2.7%. After aligning with the Bank of England's (BoE) expectations in February, the latest inflation figure fell short of the BoE's projections from their February Monetary Policy Report, which anticipated a 2.7% rate for March. However, with headline inflation expected to rise sharply from April due to one-off tax and price increases, the Monetary Policy Committee (MPC) is likely to remain cautious about reducing interest rates too quickly. Despite this, markets anticipate that the latest inflation reading supports a continued gradual easing in monetary policy. The data was released ahead of the Bank of England's interest rate decision next month, where traders anticipate a quarter-point rate cut by the central bank. Global stocks also declined on Wednesday due to U.S. restrictions on chip sales to China. Nvidia warned of $5.5 billion in charges from these export controls, with its shares dropping 5.7% in premarket trading. Despite overall losses, the precious metals and mining sub-index increased by 4.8% to reach a peak not seen in over three years, as gold prices surpassed $3,300 due to safe-haven demand.

Single Stock Stories & Broker Updates:

Shares of business supply distributor Bunzl slumped by as much as 24.4%, marking their lowest point since June 2021. BNZL has revised its 2025 projections downward and halted its share buyback program, attributing these moves to challenges in its North American operations and broader economic uncertainties. As of the last trading session, the stock has decreased by 30% year-to-date.

Shares of Oxford Instruments, a nanotechnology tools maker, rose 7.39%. OXIG expects 13% growth in FY 2025 adjusted operating profit and 9% growth in revenue. CEO Richard Tyson expressed satisfaction with the company's pivot away from certain markets in China. Jefferies analysts noted the U.S. tariffs could impact FY 2026, with risks of U.S. customers delaying deliveries until tariffs are clarified. The stock has increased 23.57% this year up to Tuesday's close.

Mitie Group surges 4.8% to 127.8p after raising annual profit outlook for double-digit revenue growth. The company initiates a £125 million share buyback and estimates profits to be around £230 million with a 13% revenue growth year-over-year. MTO is up approximately 10% this year.

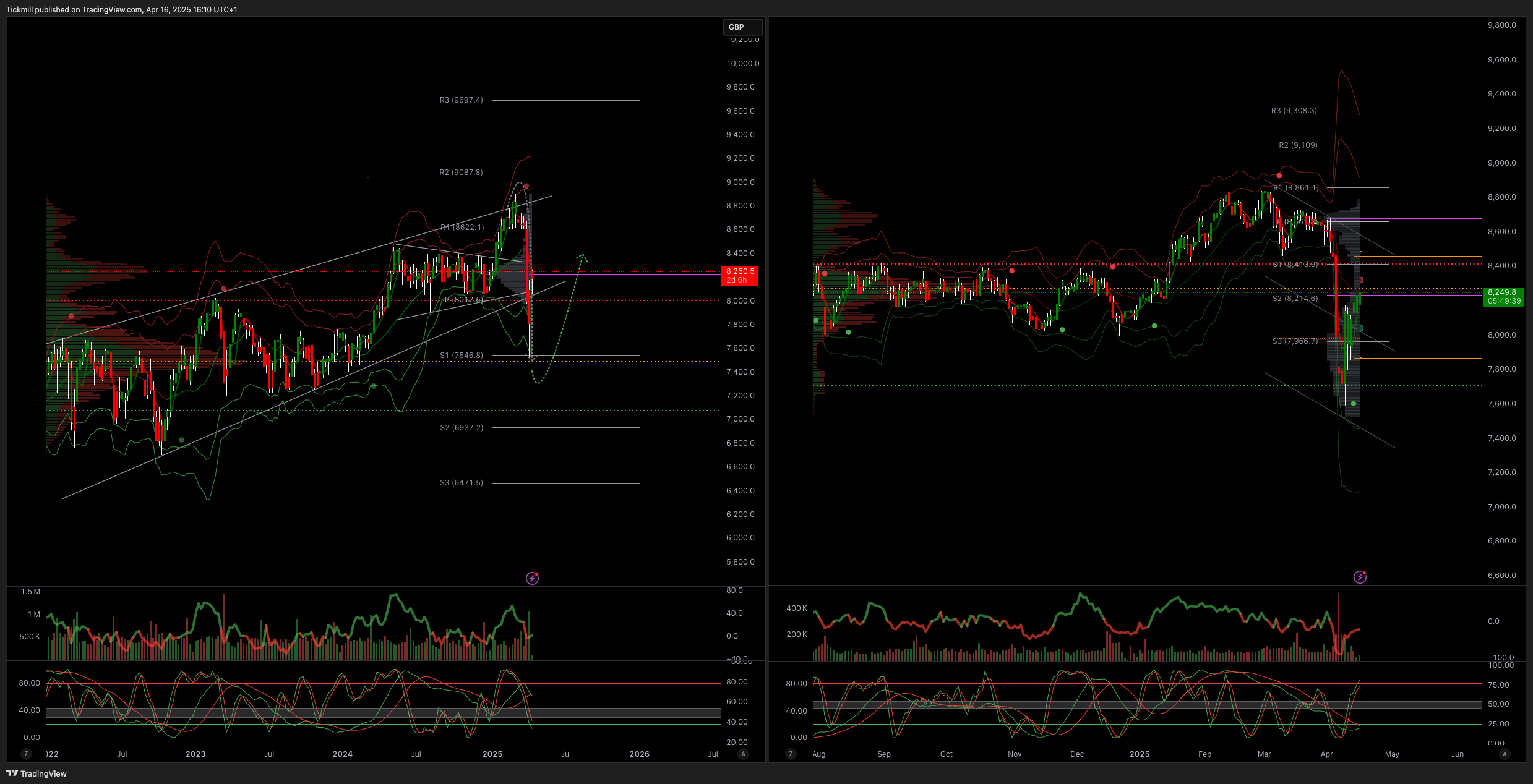

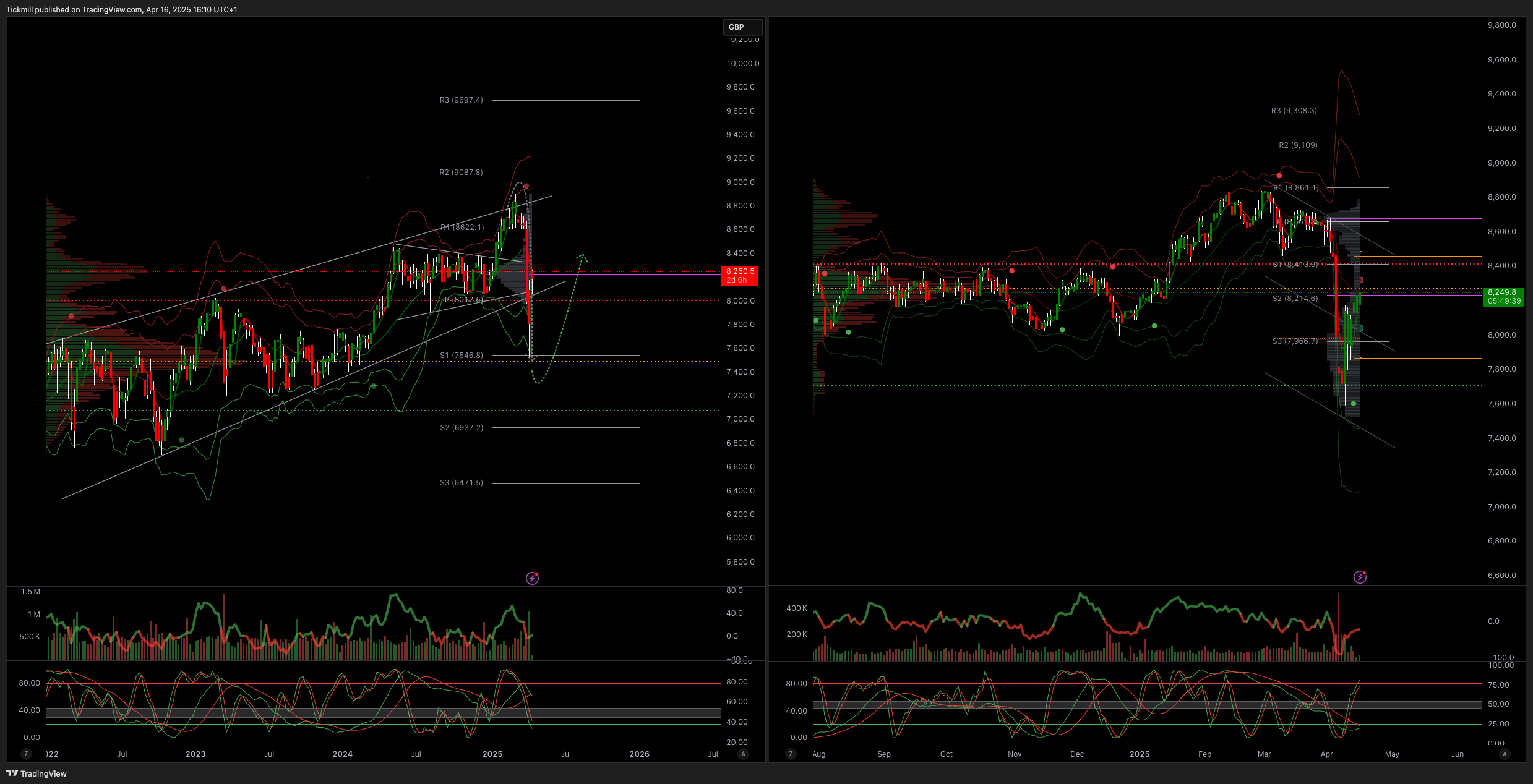

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 7600

Primary support 7500

Below 7400 opens 6850

Primary objective 8500

Daily VWAP Bullish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!