The FTSE Finish Line: April 1 - 2025

The FTSE Finish Line: April 1 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group

The FTSE 100 hovered near the flatline on Tuesday, rebounding from a near three-week low hit in the prior session, as cautious market sentiment persisted amid concerns over potential retaliatory tariffs from the U.S. The healthcare sector led gains in the index, climbing 1.6%, bolstered by a 1.7% rise in AstraZeneca shares after the company reported promising Phase IIb trial results for its cholesterol-lowering drug. Industrial miners also advanced, up 1.4%, as copper prices in London rebounded from a two-week low, driven by positive economic data from China. On Tuesday, Business Minister Jonathan Reynolds expressed optimism that U.S. tariffs imposed by President Donald Trump could soon be lifted if both nations agree on a framework for a new economic partnership. Global markets, however, remain unsettled over the looming tariffs, fueling fears of a potential economic slowdown. A business survey released on Tuesday highlighted a tough March for British manufacturers, with new orders plummeting and optimism waning due to the dual pressures of potential U.S. tariffs and upcoming domestic tax hikes. Additional data revealed that house prices stagnated in March, with the property market expected to stay subdued following recent tax increases on transactions. Meanwhile, grocery price inflation rose last month, adding to the financial strain on consumers already grappling with a series of cost-of-living challenges.

British politicians are striving to avoid tariffs on 'Liberation Day.' While Goldman Sachs predicts the UK will escape severe impacts, they have slightly reduced growth forecasts. Goldman assumes the U.S. will impose tariffs on UK imports but expects the UK to avoid reciprocal measures due to balanced trade. However, trade fragmentation is expected to weigh more heavily on UK growth than direct export losses. Their updated global outlook anticipates higher U.S. tariffs on economies like the EU, leading to downgraded 2025 growth forecasts for the U.S., Eurozone, and UK. The UK's 2025 real GDP growth forecast is now 0.8%, down from 0.9%.

Single Stock Stories & Broker Updates:

J Sainsbury shares fall ~3%, top loser on FTSE100, after Exane BNP Paribas downgrades to "neutral" from "outperform." Asda launched a price cut campaign, prompting speculation that Sainsbury will react but not fully match the cuts. The stock holds a "buy" rating on average, with a median price target of $300. Shares are down ~14% this year.

British convenience food manufacturer Greencore rose 3.5%, leading the FTSE 250 index. The company anticipates FY25 adjusted operating profit will exceed market expectations, projecting between 112 million and 115 million pounds ($144.6-$148.5 million). Greencore experienced strong revenue and volume growth in Q2, bolstered by customer expansion and new business. However, GNC is down approximately 13% year-to-date.

Serica Energy shares fell nearly 2%, now down about 1% for the year. The company cut its 2025 output forecast to 33,000-37,000 boepd from 40,000 boepd due to issues at the Triton platform, causing a stock decline of up to 7.3% before recovering slightly.

Travis Perkins fell 13%, its lowest since July 2009, citing a challenging start to 2025 due to high interest rates and construction market uncertainty. The company reported a 25% drop in 2024 profit and expects 2025 adjusted operating profit to be similar to FY24's 141 million pounds (~$182 million). TPK has lost ~25% as of the last close.

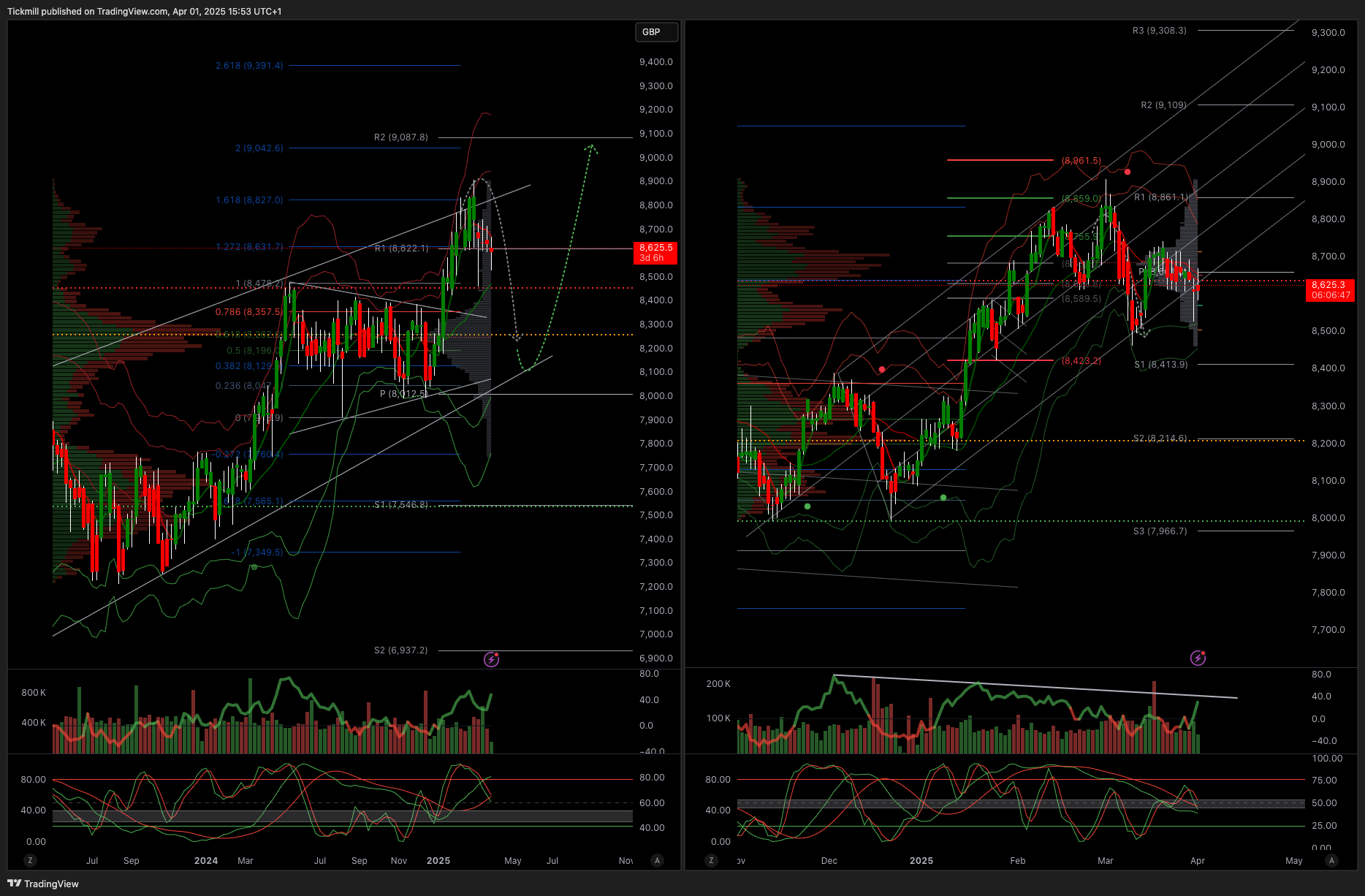

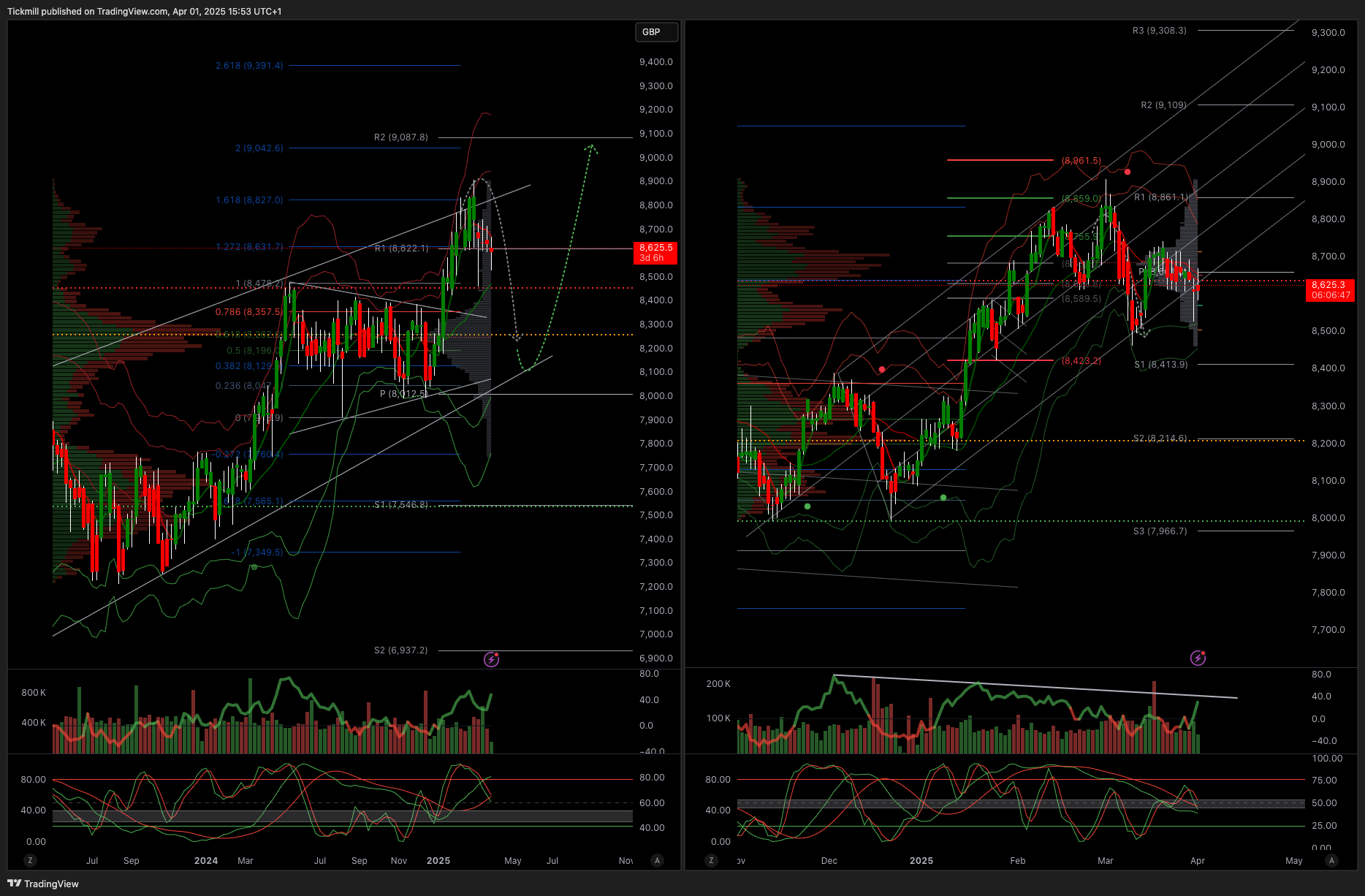

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8950

Primary support 8700

Below 8700 opens 8600

Primary objective 9050

Daily VWAP Bearish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!