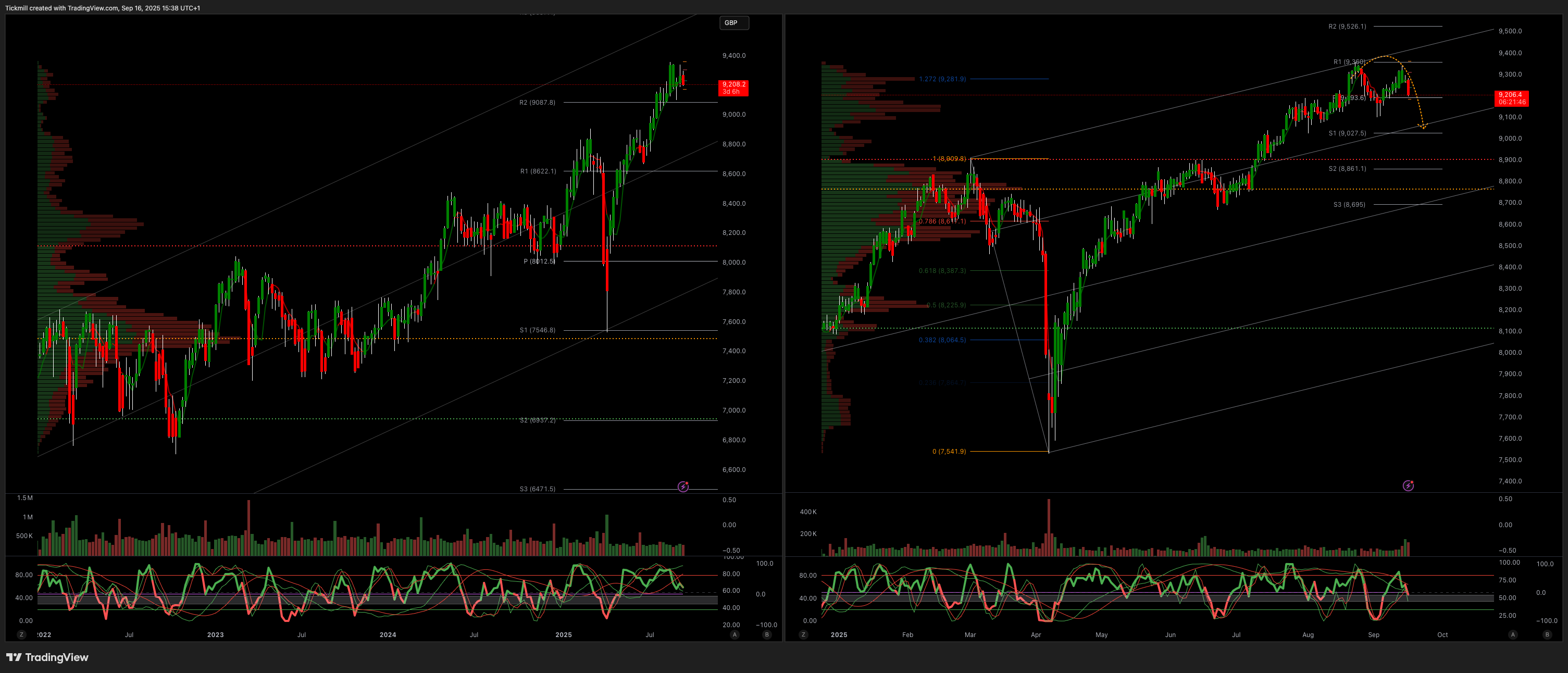

The FTSE Finish Line 16/9/25

London's FTSE 100 index dropped on Tuesday as investors considered varied corporate reports and remained wary ahead of central bank meetings, although rising metal miners helped to limit the declines. The latest UK labour market data presents a mixed picture. The ONS Labour Force Survey (LFS) reported a solid increase in employment over the three months to July, while more up-to-date HMRC figures revealed payrolls dropped for the seventh consecutive month in August. Meanwhile, job vacancies continued to decline, pay growth slowed, and other indicators—such as S&P’s Report on Jobs and the employment component of the UK PMIs—point to subdued hiring activity. Together, these factors suggest the UK labour market is still cooling, albeit at a slower pace than before. The Bank of England is expected to keep interest rates steady this week, following a rate cut in August. Furthermore, U.S. President Donald Trump is scheduled to arrive in Britain late on Tuesday for a second state visit, during which the two countries will finalise agreements valued at over $10 billion.

Shares of Haleon, a British consumer healthcare company, fell by 2.3% to 348.5p. The stock is among the biggest losers on the FTSE 100 index, which has risen 13.3% year-to-date. Barclays has lowered the company's rating to "Equal Weight" from "Overweight" and reduced the price target from 430p to 380p. The brokerage points out that the main challenge for Haleon is the difficult situation in the U.S., where both consumer spending is slowing down and there are destocking pressures. Furthermore, there are concerns about the near-term outlook in Latin America due to macroeconomic weakness in Europe and pricing pressures in Germany. Out of the 18 analysts covering the stock, 10 have a "Buy" or higher rating, seven have a "Hold," and one rates it as a "Sell," with a median price target of 425p, according to data from LSEG. Including the current session's losses, the stock is down 7.84% year-to-date.

British low-cost airline EasyJet has dropped 2.5% to 461.1p, becoming the biggest loser on the FTSE 100 index. JPM has reduced its rating on the stock to 'neutral' from 'overweight' and has placed it under negative catalyst watch, lowering the price target from 670p to 500p. The brokerage predicts a larger winter pre-tax loss for the company in H126E. "Weaker pricing is expected to persist into winter as rising capacity growth from EZJ and competitors coincides with a saturated UK leisure market," along with possible consumer uncertainty due to the UK budget - JPM. Additionally, JPM anticipates that September 26E will present more challenges regarding forex-fuel costs. The firm notes that the company still has the opportunity to enhance medium-term earnings by expanding its Holidays division and realizing upgauging benefits. In total, considering session movements, EZJ has decreased by approximately 18% while the FTSE has increased by about 13%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!