Technical Pullback Looms in EURUSD

The dollar rises a new high of this year (96.50 on DXY) amid Biden’s decision to extend the term of the current Fed Chairman Powell. Considering that Powell's main rival, Lael Brainard, is a champion of soft credit policy, the news had a positive effect on the dollar and a negative effect on the US sovereign debt, since fixed income definitely priced in the risk of the Fed changing its monetary policy to softer one under the new head so there was a retreat of those expectations. The yield on 2-year bonds increased by 6 bp, on 5-year bonds - by 7 bp. (new highs since the beginning of the pandemic), 10-year bond yields also rose, but local high of 1.70% hasn’t been challenged yet. Yields at the near end of the yield curve are predominantly responsive to news related to the Fed, while those at the far end to the news related to inflation.

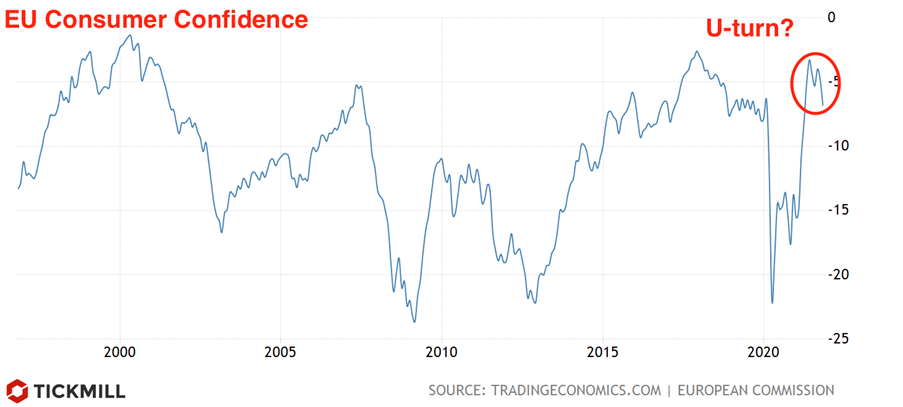

In the Eurozone, consumer confidence fell by 2 points to -6.8 points in November. Historically, a value of -5 points characterizes a fairly high level of consumer confidence, so we can talk about a possible tipping point in the positive trend:

Covid and new lockdowns in the EU are hitting consumer confidence, and market participants are likely to revise their forecasts for consumer spending growth this quarter. Accordingly, this will affect expectations related to when the ECB will phase out PEPP and start raising rates. Angela Merkel said yesterday that the current wave of covid is worse than previous ones and urged local authorities to impose tougher social restrictions. There is a risk that the rest of the EU will also be forced to return some of the restrictions by Christmas, despite the fact that their vaccination rates is higher than in Germany and Austria. Naturally, the current forecasts for the growth of the Eurozone are under threat, and the Euro is looking towards new lows.

Nevertheless, from a technical point of view, EURUSD is overbought, the RSI on the daily timeframe has dropped to 26 points. The last time such an intensity of decline was observed in February 2020 and a pullback is probably not far off:

Consolidation prevails in the foreign exchange market today. The wait-and-see attitude may remain in place until the release of minutes of the Fed's November meeting on Wednesday. The US economic calendar includes Markit reports and the Richmond Fed survey.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.