Stocks Will Likely Recover After the Trump’s Tweet and Here is why

The most notable event of Tuesday was probably the tweet of President Trump that he ordered to put a halt on White House talks with Congress on the fiscal aid ahead of the elections.

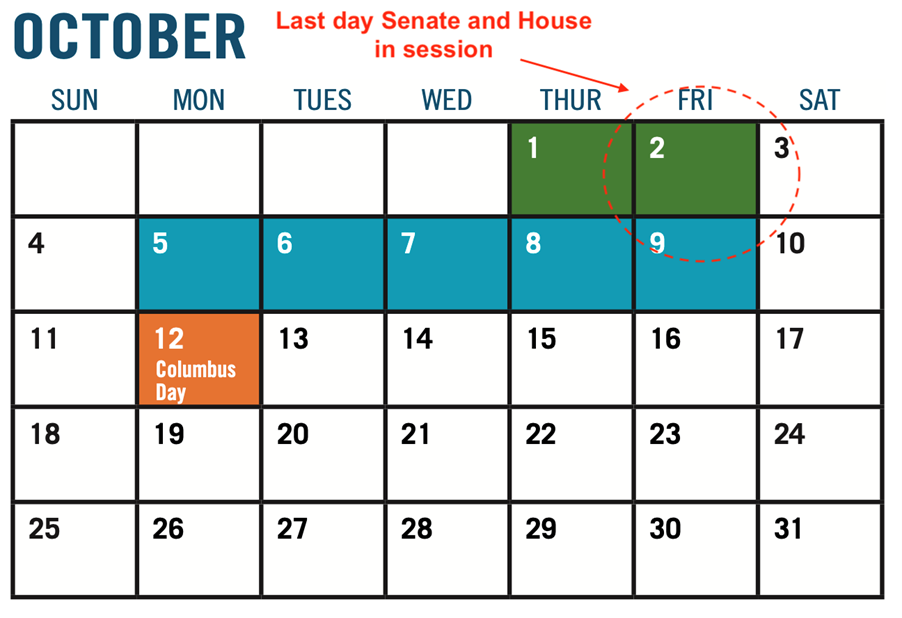

There is a chance though that market could overreact to the message as it was already clear last Friday that the aid can be approved no earlier than in November as lawmaking was put on pause in the US. The Senate went on October recess, which will last until early November:

Basically, what Trump ordered to do is to stop negotiations between the White House and Congress, further underlining that there is a sharp disagreement between the parties and depriving investors of fiscal rhetoric which supported market confidence since the start of August.

House Speaker Pelosi reacted sarcastically that Trump may have gone nuts from steroids he received during the treatment. Senate majority leader Mitch McConnell backed Trump's decision, saying that the Congress need to focus on the achievable.

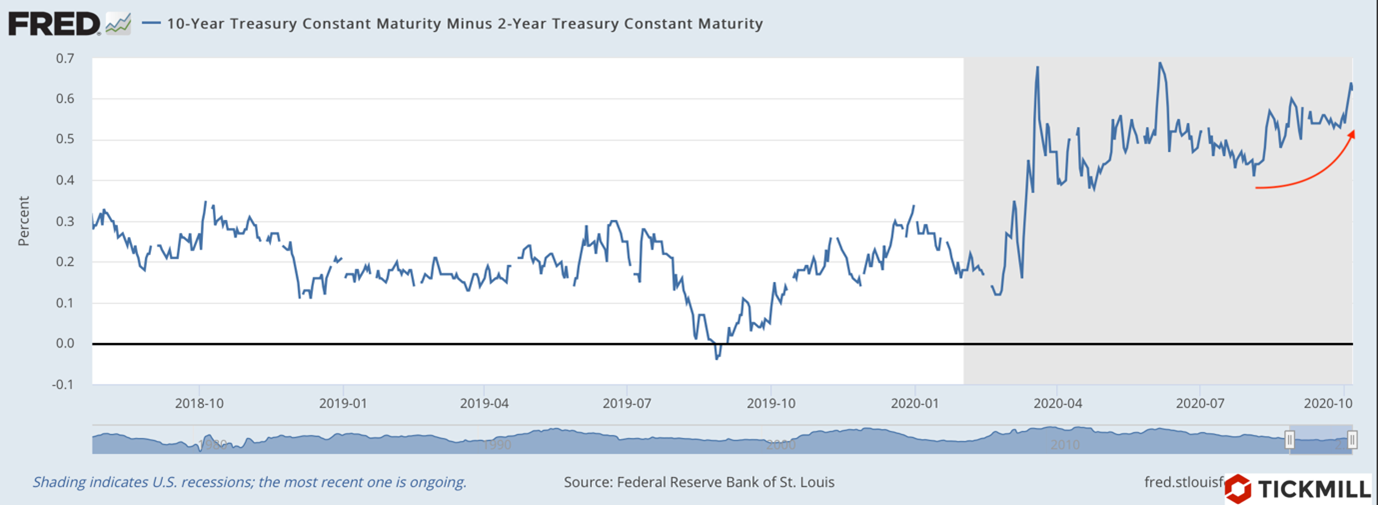

The yield on 10-year US Treasury bonds in less than a week rose from 0.65% to 0.79%, the highest level since the beginning of June.

Demand for bonds with longer maturity (10-year Treasury Notes) continued to fall relative to short-term securities (2-year bonds) as spread between the yields continued to widen. It means that the strategy of "rolling-over" investments appears to outweigh holding a long-term bond, which is a direct indication that despite stalling fiscal talks, market inflation expectations continued to increase…

…which is generally positive for stocks which are seen as good protection from inflation.

Futures on US stock indices quickly digested the negative news and are trading with moderate gain today. As I wrote last week, the pre-election fate of the fiscal deal became clear last Friday, so what we get from the White House and Congress now are politically motivated statements.

Today, Fed September Minutes release is due, which should offer some psychological support to market bulls as the regulator has a clear bias to talk about low rates, stimulus etc.

All in all, apart from notorious "pre-election volatility", it is difficult to see a reason for a stretched decline in the US indices.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.