SP500 LDN TRADING UPDATE 30/04/25

SP500 LDN TRADING UPDATE 30/04/25

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5482/92

WEEKLY RANGE RES 5700 SUP 5400

DAILY BULL BEAR ZONE 5550/60

DAILY RANGE RES 5643 SUP 5522

2 SIGMA RES 5930 SUP 5234

5610 - 5339 GAP LEVELS

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS SUBTRACT CIRCA 25 POINTS)

WEEKLY ACTION AREA VIDEO https://www.youtube.com/watch?v=ZrfpPpegL-k&t=80s

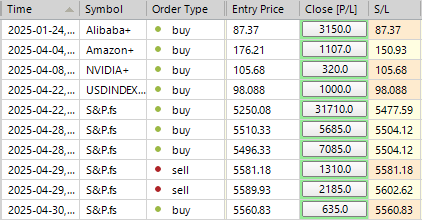

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON TEST/REJECT DAILY RANGE SUPPORT TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

Key Focus:

- Despite misses in consumer confidence and job openings, underlying support comes from choppy actions like re-leveraging, buybacks, and pensions. High retail sentiment (GSCBHRSB Index) is up +130bps, while expensive software (GSCBSF8X Index) rose +70bps.

- Main takeaway from recent earnings reports is that shorts are being rewarded. Popular shorts include PII (-380bps), PCAR (-310bps), REGN (-82bps), and NXPI (-820bps). Popular longs are SHW (+520bps) and CCK (+740bps).

- Crude oil is down 2.5%, influenced by Bessent's commentary on the China trade war, increasing Kazakhstan production, and downbeat energy earnings from CVI and RIG.

- Healthcare sector shows strength with GLP-1 exposed names (GSHLCBMI Index) up +350bps, driven by HIMS' +26% increase after announcing a partnership with Novo Nordisk to offer Wegovy on the Hims & Hers platform.

- Trading volume surpassed 10 billion shares today, exceeding yesterday's total. LGMK and DMN together account for 40% of today's turnover, with LGMK trading 2.3 billion shares and DMN 2.2 billion shares.

- PB Data for Monday, April 28: Global equities were net sold for the first time in five sessions (-0.8 SDs 1-year), driven by short sales and, to a lesser extent, long sales (2 to 1). Every major region experienced net selling, led by North America and Developed Market Asia.

Our Franchise:

- Our floor activity level is rated a 4 on a 1-10 scale. We are 710bps better for sale, primarily driven by LO supply in Info Tech, Healthcare, and Macro sectors.

- LOs are leaning 25% better for sale, selling Info Tech, Healthcare, and Macro sectors while buying Consumer Staples and Utilities.

- HFs are selling Financials and Energy sectors, while buying Healthcare and Communication Services.

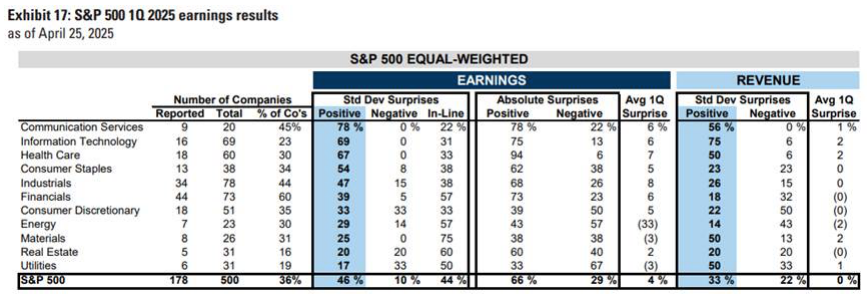

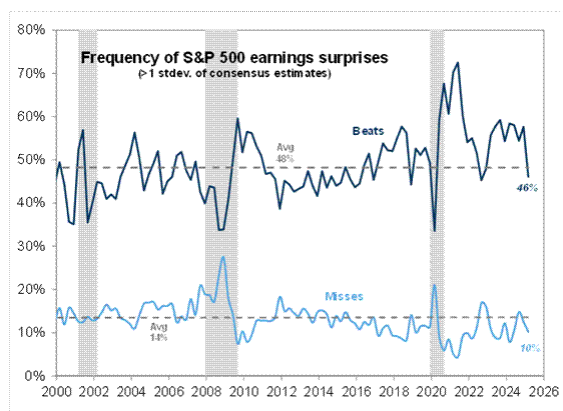

Focus will remain on microeconomic factors, with 40% of the S&P market capitalization reporting this week, including Microsoft (Wednesday), Amazon (Thursday), and Apple (Thursday). The good news is that the Technology, Media, and Telecommunications sectors (communications services and information technology) are leading the market in terms of earnings per share and revenue beats so far during the first quarter earnings season. The bad news is that earnings beats are not being rewarded. In the current macro environment, stocks that beat expectations on T+1 are only outperforming by 50 basis points, compared to the historical average of 101 basis points. Meanwhile, stocks that miss expectations have underperformed by 247 basis points, versus the historical average of 206 basis points.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!