SP500 LDN TRADING UPDATE 21/05/25

SP500 LDN TRADING UPDATE 21/05/25

WEEKLY & DAILY LEVELS

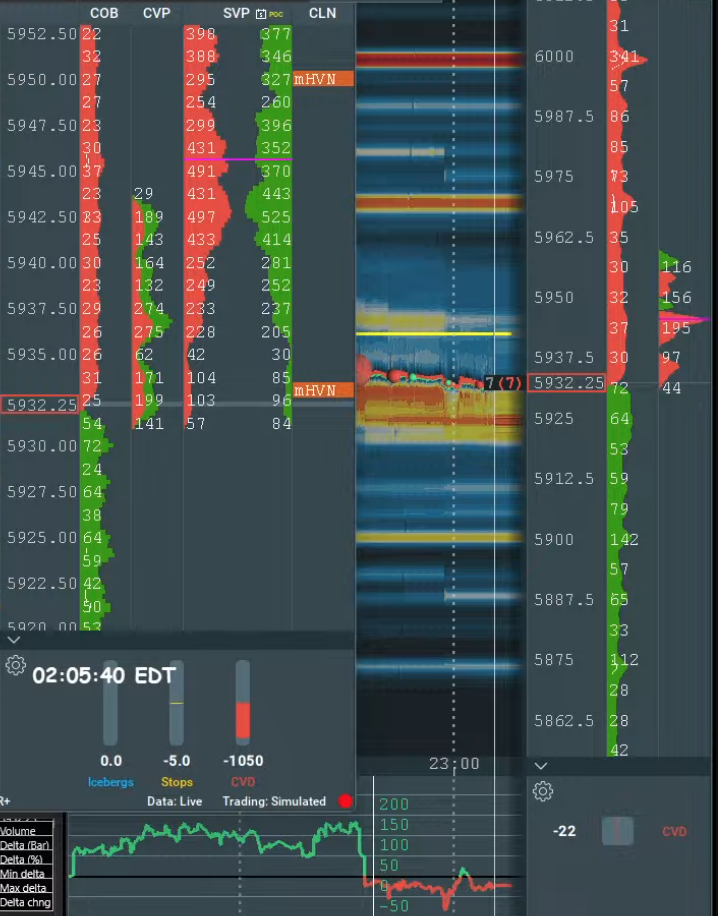

WEEKLY BULL BEAR ZONE 5860/50

WEEKLY RANGE RES 6049 SUP 5849

DAILY BULL BEAR ZONE 5905/5895

DAILY RANGE RES 6015 SUP 5893

2 SIGMA RES 6076 SUP 5832

GAP LEVELS 5806

VIX BULL BEAR ZONE 18.25

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS SUBTRACT CIRCA 20 POINTS)

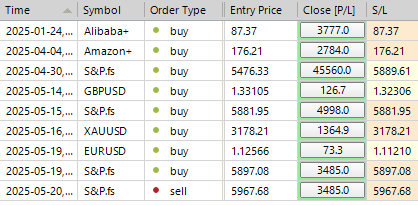

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: CONTINUED CHOP

FICC and Equities | 20 May 2025 |

Market Overview:

- S&P 500: -39bps, closing at 5,940, with a MOC of $500mm to SELL.

- Nasdaq 100 (NDX): -37bps, closing at 21,367.

- Russell 2000 (R2K): +5bps, closing at 2,105.

- Dow Jones: -27bps, closing at 42,677.

- Volume: 16.4bn shares traded across U.S. equity exchanges vs YTD daily average of 16.5bn.

- Volatility (VIX): -28bps, closing at 18.09.

- Commodities: Crude -21bps at $62.56; Gold unchanged at $3,290.

- Rates: U.S. 10YR yield +3bps at 4.48%.

- Currencies: DXY -38bps at 100.04.

- Crypto: Bitcoin +119bps, closing at $106,747.

Key Themes:

U.S. equities ended lower after a quiet, rangebound session. Big Tech underperformed significantly, with Megacap Tech down -82bps. Google’s I/O keynote at 1 PM failed to deliver groundbreaking announcements, leading to a sell-the-news reaction. The U.S. 10-year yield edged closer to 4.5%, driven by hotter-than-expected Canada CPI data and Trump’s tax commentary earlier in the day.

Liquidity in the S&P 500 Top of Book showed signs of improvement, averaging $9mm today (vs the historical $13mm). CTAs and Corporates remained active buyers this week, with ~90% of SPX in their open period. CTAs are projected to be buyers across all scenarios through Friday. Sentiment is gradually improving, with the AAIIBULL Index hovering at 35 (up from 19 at recent lows).

Sector and Stock Highlights:

- Retail: Focus remains on key retail earnings this week. HD closed -55bps after reporting a modest comp beat and positive sales commentary for early Q2. AS surged +19% following a strong quarter and guidance, nearing all-time highs. Conversely, travel-related names underperformed after VIK (-5%) disappointed on earnings and pricing commentary. This weakness extended to cruise lines (RCL/NCLH) and airlines (DAL/UAL).

- Corporate Developments: VSCO adopted a shareholder rights plan in response to BBRC stake-building.

- Tesla (TSLA): Gained on Elon Musk’s remarks about staying on as CEO and positive demand outlook. Musk also noted plans for "a thousand robotaxis in Austin within months" during a CNBC interview.

Market Sentiment and Positioning:

Markets have rallied nearly 20% off April lows and are now positive YTD, closing last week +1% on the year. The SPX recovered its 200-day moving average, hedge fund net exposures are off recent lows, and grosses are at five-year highs. The GS sentiment indicator is inching higher, though still in negative territory. Long-only investors are cautiously stepping in with “offer-wanted” requests, but uncertainty persists.

Key question: Is this a bear-market rally, or are investors beginning to overlook tariff concerns and positioning for sustained buying in U.S. equities?

Floor Activity:

Activity levels on the floor were moderate, rated a 5/10. The floor closed +1.1% to buy vs a 30-day average of +120bps. Flows were muted, with both Long-Only (LO) and Hedge Funds (HF) as small net sellers. Supply was concentrated in macro products and tech across both groups. Notably, all sectors saw net selling from both LOs and HFs.

Derivatives Update:

Flows remained quiet as the market traded sideways for most of the day. A significant sell-off in the final hour led to a spot down/vol down dynamic. When SPX spot dropped slightly more than the 1-day straddle, June volatility declined by ~0.25v in fixed-strike space. As markets recovered, volatility continued to compress into the close. Despite muted client flows, some clients positioned for short-dated upside using 1x2 call spreads. The desk views call spreads as an attractive delta replacement, given elevated call skew, particularly in short-dated NDX. The week’s remaining straddle closed at ~1.20%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!