SP500 LDN TRADING UPDATE 17/04/25

SP500 LDN TRADING UPDATE 17/04/25

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5300/5290

WEEKLY RANGE RES 5640 SUP 5140

DAILY BULL BEAR ZONE 5376/86

DAILY RANGE RES 5385 SUP 5240

2 SIGMA RES 5623 SUP 4975

5610 GAP LEVELS

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS – 30 POINTS)

WEEKLY ACTION AREA VIDEO https://www.youtube.com/watch?v=mVH_FNAGEFM&t=17s

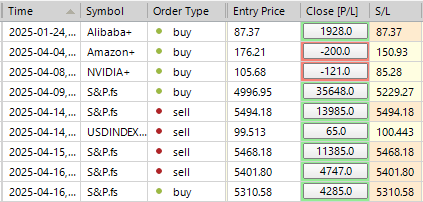

TRADES & TARGETS

SHORT ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE SUP

LONG ON ACCEPTANCE ABOVE DAILY BULL BEAR ZONE TARGET 5403>33>59

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: CHIPS DECLINE, POWELL REMAINS HAWKISH

FICC and Equities | April 16, 2025 | 8:13 PM UTC

U.S. stock markets closed sharply lower today. The S&P 500 fell by 224 basis points, closing at 5,275 with a Market-on-Close (MOC) order of $1.5 billion to buy. The Nasdaq 100 dropped 304 basis points to 18,257, the Russell 2000 decreased 89 basis points to 1,876, and the Dow Jones Industrial Average declined 173 basis points to 39,669. Trading volume was 15.7 billion shares, slightly below the year-to-date daily average of 16.4 billion shares. The VIX increased 784 basis points to 32.52, while crude oil rose 230 basis points to $62.74. The U.S. 10-year Treasury yield decreased 5 basis points to 4.28%, gold climbed 350 basis points to $3,354, the Dollar Index (DXY) fell 88 basis points to 99.39, and Bitcoin gained 54 basis points to $84,471.

The decline in stocks was driven by two main factors: 1) Semiconductor stocks were under pressure, with NVIDIA dropping 7% due to new export restrictions to China leading to a projected $5.5 billion write-down, and ASML falling 5% following an earnings miss and reduced guidance. 2) Federal Reserve Chair Jerome Powell's afternoon comments were interpreted as hawkish, suggesting a cautious approach to policy adjustments, emphasising the need for greater clarity.

Trading activity remained subdued despite market movements, with S&P 500 volumes down 38% compared to the 10-day average due to the shortened holiday week. Desk flows and overall market volumes continue to decline, indicating growing investor fatigue amid ongoing trade headline volatility. Defensive posturing was observed across sectors, with telecommunications, real estate investment trusts, and consumer staples performing well, while semiconductors, software, and internet stocks lagged. Mega-cap stocks such as Amazon and Meta underperformed, affected by increased cyclical concerns. Exchange-traded funds (ETFs) accounted for 33% of trading volume, consistent with recent elevated levels. The S&P 500's top-of-book liquidity remained weak at $2.94 million.

Market activity was rated a 4 on a 1-10 scale. Our floor finished 261 basis points better for sale compared to a 30-day average of -72 basis points. Skew was benign, with long-only and hedge funds being slight net sellers, driven by overlapping supply in tech and macro products. After the bell, CSX shares fell 2% post-earnings report, with Q1 EPS at $0.34 versus consensus of $0.37, and revenue at $3.42 billion versus $3.46 billion expected. EBITDA missed estimates at $1.04 billion versus $1.1 billion.

In derivatives, volatility caught a bid for the first time this week, although the May VIX futures underperformed the spot move by nearly 2 volatility points as the sell-off accelerated in the afternoon. Volatility desk flows remain somewhat muted, but clients rolled down index protection and added VIX upside post-expiry this morning. Regular options expiry is scheduled for tomorrow, with an estimated $2.6 trillion of notional options exposure set to expire, including $1.2 trillion in S&P 500 options and $480 billion in single stock options. This expiration is relatively smaller than that of April 2024. The straddle for the day currently implies a 1.70% move.

.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!