SP500 LDN TRADING UPDATE 11/04/25

SP500 LDN TRADING UPDATE 11/04/25

WEEKLY & DAILY LEVELS

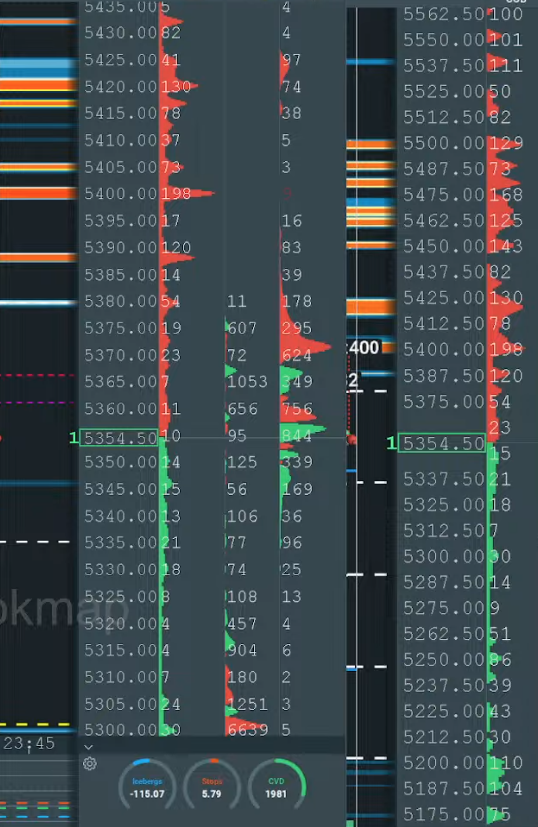

WEEKLY BULL BEAR ZONE 5050/60

WEEKLY RANGE RES 5443 SUP 4749

DAILY BULL BEAR ZONE 5385/95

DAILY RANGE RES 5359 SUP 5249

2 SIGMA RES 5515 SUP 5029

5610 GAP FILL

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS – 35 POINTS)

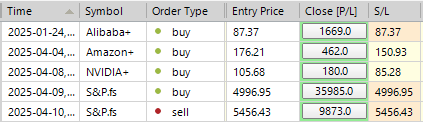

TRADES & TARGETS

SHORT ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE SUP

LONG ON ACCEPTANCE ABOVE DAILY BULL BEAR ZONE TARGET 5450 > 5515

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: MARKET FATIGUE

FICC and Equities | 11 April 2025 |

The S&P 500 closed down 346 points at 5,268, with a Market-On-Close (MOC) order of $3 billion to buy. The Nasdaq (NDX) fell 419 basis points to 18,343, the Russell 2000 (R2K) dropped 437 basis points to 1,840, and the Dow decreased by 250 basis points to 39,593. A total of 23.7 billion shares were traded across all U.S. equity exchanges, significantly higher than the year-to-date daily average of 16.4 billion shares. The VIX surged 21% to 40.72. Crude oil decreased 351 basis points to 60.14, the U.S. 10-year Treasury yield rose 8 basis points to 4.42%, gold gained 357 basis points to 3,188, the dollar index (DXY) fell 175 basis points to 101.10, and Bitcoin declined 396 basis points to $79,880.

Excluding Thursday and Friday (April 3 & 4), today marked the worst day for the S&P 500 since September 2022, yet it felt relatively subdued by the day's end. Fatigue was a recurring theme in discussions today. Single stock desk flows slowed considerably as top-down market flows continued to dominate volumes and drive price action, with ETF trading still elevated at 41%. There was strong demand for the Magnificent 7 stocks from long-only investors early on, but it waned as the session progressed. Hedge fund demand did not transition from macro product covering to long positions in single stocks. Yesterday's covering bid was exceptionally strong. Our Prime Brokerage data indicated that yesterday saw the largest notional net buying in U.S. equities in over a decade (+4.4 standard deviations), driven almost entirely by short covering. It was the largest U.S. short covering since August 2015 and the fourth largest in the past 15 years (+6.3 Z score). U.S.-listed ETF shorts were net covered by 4.7%, marking the largest percentage covering since September 2024 and the fifth largest in the past five years.

Global Fundamental Long/Short Hedge Funds are down 360 basis points year-to-date after yesterday, with significant performance declines again today. Systematic Long/Short Hedge Funds are down 1% in April but remain up 10.2% for the year. Leverage ratio update: Overall book gross leverage increased by 2.3 points to 284.3% (84th percentile for 1-year, 97th percentile for 5-year). Overall book net leverage rose by 3.0 points to 68% (2nd percentile for 1-year, 19th percentile for 5-year).

Our activity level was at a 6 on a scale of 1-10, with investors largely inactive. Our floor finished roughly flat compared to a 30-day average of -81 basis points. Long-Only investors ended as net sellers by $3 billion, with supply concentrated in Tech and Banks. Hedge Fund flows were mixed and balanced between buying and selling.

A late-day tweet stirred the market: @CGasparino reported that the Trump Administration is considering delisting Chinese public company shares on U.S. exchanges. Sources indicate that incoming SEC chair Paul Atkins may address the delisting issue once he assumes office, amid ongoing trade tensions.

DERIVATIVES: Spot prices declined, and short-dated volatilities surged this morning as the market reacted to evolving tariff policies. Trading volumes were notably muted today. We observed some monetization of downside in high-yield corporate bonds (HYG) and adjustments to short-dated S&P 500 downside hedges. During the morning selloff, front-end volatilities spiked as the VIX briefly exceeded 50. In the afternoon, as markets rallied off the lows, volatilities moderated slightly but remained elevated. The lack of activity suggests investors are likely to stay on the sidelines with minimal net exposure until there is more clarity on trade policy. Looking ahead, earnings reports will be in focus, starting with several banks tomorrow. The Friday straddle closed at approximately 2.70%

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!