SP500 LDN TRADING UPDATE 10/7/25

SP500 LDN TRADING UPDATE 10/7/25

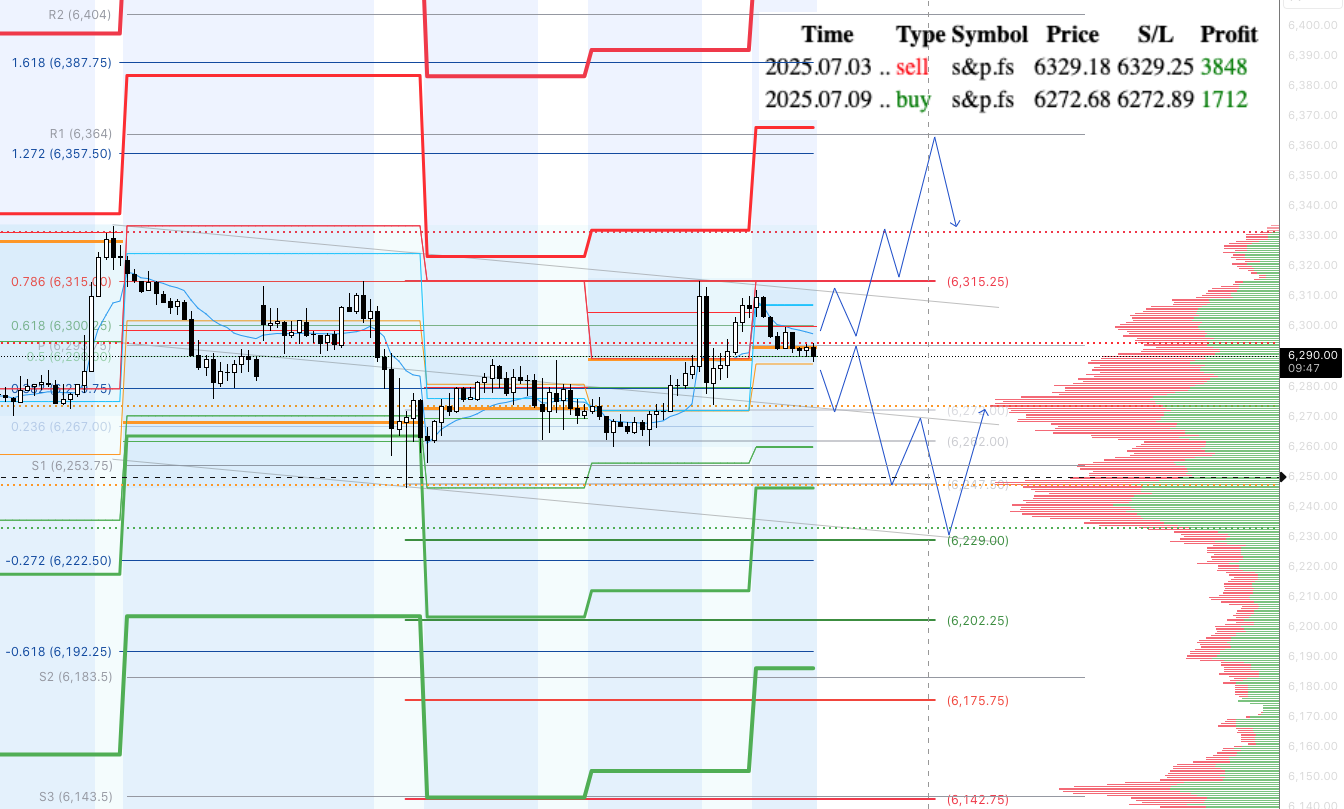

WEEKLY & DAILY LEVELS

***QUOTING ES1! CASH US500 EQUIVALENT LEVELS SUBTRACT ~50 POINTS***

WEEKLY BULL BEAR ZONE 6220/10

WEEKLY RANGE RES 6424 SUP 6224

DAILY BULL BEAR ZONE 6240/30

DAILY RANGE RES 6364 SUP 6247

2 SIGMA RES 6422 SUP 6189

GAP LEVELS 6324/6147/6077/6018/5843/5741/5710

VIX BULL JULY CONTRACT BEAR ZONE 21.35 DAILY BULL BEAR ZONE 17.25

DAILY MARKET CONDITION - BALANCE - 6333/6238

Balance: This refers to a market condition where prices move within a defined range, reflecting uncertainty as participants await further market-generated information. Our approach to balance includes favoring fade trades at the range extremes (highs/lows) while preparing for potential breakout scenarios if the balance shifts.

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

LONG ON ACCEPTANCE ABOVE 6315 TARGET 6333 > DAILY RAGE RES

SHORT ON TEST/REJECT DAILY RANGE RES TARGET 6333 > 6270 > DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: TECH LEADS THE CHARGE

FICC and Equities | July 9, 2025 |

Market Performance:

- S&P 500: +61 bps, closed at 6,263

- NASDAQ 100 (NDX): +72 bps, at 22,864

- Russell 2000 (R2K): +97 bps, at 2,250

- Dow Jones: +49 bps, at 44,458

Trading volume reached 17.9 billion shares across all U.S. equity exchanges, surpassing the year-to-date daily average of 16.8 billion shares.

Volatility & Commodities:

- VIX: -553 bps, at 15.88 (lowest since February)

- Crude Oil: -1 bps, at $68.33

- U.S. 10-Year Yield: +5 bps, at 4.33%

- Gold: +41 bps, at $3,315

- Dollar Index (DXY): -3 bps, at 97.49

- Bitcoin: +286 bps, at $111,803

Key Highlights:

- Tech Outperformance: Supercap tech stocks led the market rally, supported by AI-driven momentum. NVIDIA surged into breakout mode, reaching a $4 trillion market cap on news that China plans to purchase 115,000 NVDA chips for AI development. Despite this, retail engagement with NVDA remains below last year’s highs.

A notable stat from Callahan: NVIDIA’s market cap exceeds the combined valuation of the Staples, Energy, Utilities, REITs, and Materials GICS sectors and is approximately 80% of Industrials GICS.

- Other Tech Movers:

- AMZN: Lagged due to weak Prime Day sales (-41% so far).

- GOOG/L: Initially gained on Gemini OS headlines but wobbled intraday following reports of OpenAI’s AI web browser plans.

- AAPL: Underperformed the Mag7 by 3% over the past month, impacted by COO departure, GOOG’s Gemini rollout, and Navarro’s comments on tariff vulnerability.

FOMC Minutes:

The release of FOMC minutes was uneventful, confirming existing divisions among Fed officials:

1. Majority favor cuts later in the year, but not in July.

2. Some oppose cuts entirely in 2025.

3. A small group advocates cuts as early as the next meeting (likely Waller and Bowman).

A strong U.S. 10-Year auction supported easing yields across the curve. Additional tariff-related updates were minor and unchanged from April 2 (countries involved: Philippines, Brunei, Moldova, Algeria, Iraq, Libya).

Market Activity Levels:

Floor activity rated at 4/10, with overall sales down 272 bps compared to the 30-day average of -18 bps. Marginal skews observed:

- Long-Only Funds: Slight net sellers.

- Hedge Funds: Flat positioning.

Consumer staples continue to underperform, trailing the S&P 500 by 5% over the past month. This underperformance is attributed to funding shifts toward risk-on trades, fueled by AI/Tech resurgence and cyclicals driving the market to all-time highs.

PB Commentary:

Momentum remains uneasy and hasn’t fully unwound. As of COB July 8, 2025:

- Fundamental L/S: -0.16% DoD, -0.25% MTD (+6.1% YTD).

- Systematic L/S: Flat DoD, -0.82% MTD (+11.1% YTD).

Derivatives Update:

A subdued session as markets steadily climbed. Volatility and skew softened alongside the rally. Increased interest observed in megacap tech ahead of earnings season.

Notable activity includes a small VIX call spread buyer. The August 25–35 call spread priced at ~55c, offering ~18x max gross payout (ref 19.3f). This trade captures potential implied volatility spikes from upcoming CPI data (July 15/August 12), earnings reports, the August 1 trade deadline, NFP data, and the September FOMC meeting.

Weekly straddle pricing closed at ~0.64%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!