SP500 LDN TRADING UPDATE 01/04/25

SP500 LDN TRADING UPDATE 01/04/25

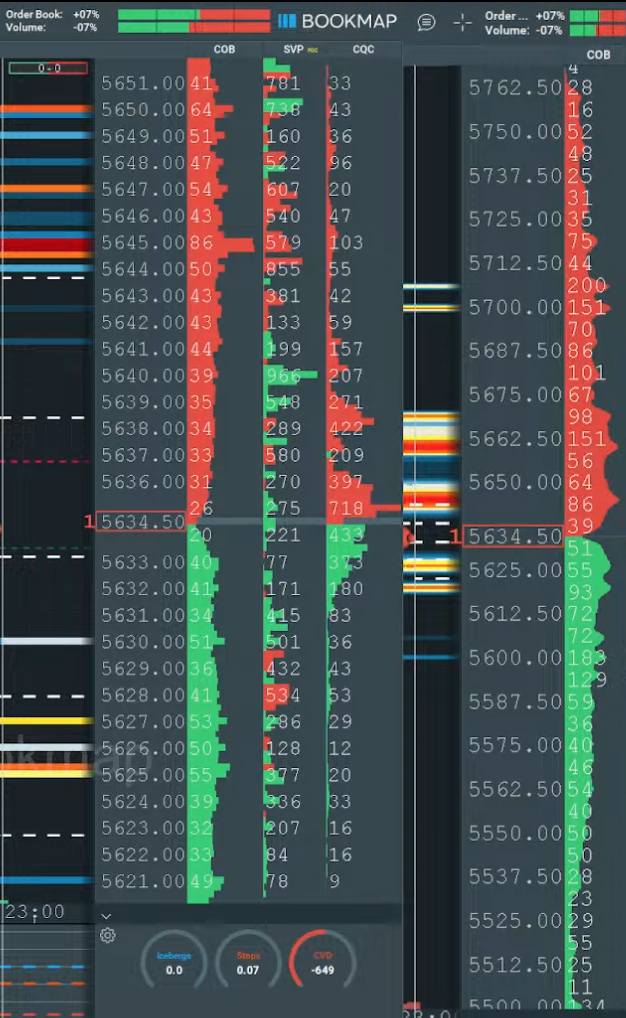

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5550/60

WEEKLY RANGE RES 5746 SUP 5458

DAILY BULL BEAR ZONE 5595/5605

DAILY RANGE RES 5687 SUP 5601

2 SIGMA RES 5798 SUP 5490

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BB ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

SHORT ON TEST/REJECT WEEKLY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES SUMMARY: MONTH-END UPDATE

Date: March 31, 2025 | Time: 8:46 PM UTC

Market Performance:

- S&P 500: +55 bps, closed at 5,611, with a Market-on-Close (MOC) imbalance of $15.3B to buy ($5B buy post-NDX).

- Nasdaq 100 (NDX): -2 bps, closed at 19,278.

- Russell 2000 (R2K): -56 bps, closed at 2,011.

- Dow Jones: +100 bps, closed at 42,001.

Volume:

16.3 billion shares traded across U.S. equity exchanges, higher than the year-to-date daily average of 15.4 billion shares.

Other Markets:

- VIX: +291 bps, closed at 22.28.

- Crude Oil: +288 bps, closed at $71.36.

- U.S. 10-Year Yield: -4 bps, at 4.21%.

- Gold: +125 bps, at $3,123.

- DXY (Dollar Index): +15 bps, at 104.20.

- Bitcoin: +4 bps, at $82,567.

Market Highlights:

The week started on a volatile note, driven by political rhetoric from Trump over the weekend, which created early weakness. Month-end pension demand provided late-session support, with a final pension rebalancing estimate of +$37B in equities to buy (96th percentile since January 2000). The S&P 500 MOC imbalance of $15.3B to buy marked the largest buy imbalance in recorded data.

Long/short stagflation pair strategies were notable, finishing +106 bps, making it the best-performing basket pair year-to-date. This marks the largest monthly gain for the pair since March 2022 and positions it for one of the biggest monthly moves on record.

Sector Insights:

Mega-cap tech continued to underperform, with the group closing -21 bps and the NDX lagging. This marks six consecutive down weeks for GSTMTMEG, the longest streak since the 2022 sell-off. Sentiment was further dampened by a report highlighting slower tech spending due to cheaper and more efficient models. Investors are questioning when these names will regain their defensive appeal.

The travel sector faced pressure, with Virgin Atlantic issuing a profit warning due to signs of slowing U.S. transatlantic flight demand. The GS Travel Basket dropped -117 bps, returning to recent lows, reflecting recession fears and a broader slowdown.

Flows and Positioning:

- Activity Levels: Overall activity was moderate, rated a 5 on a 1-10 scale.

- Net Flows: Finished +81 bps better to buy. However, large orders (LOs) were significant net sellers, with over -$3B net for sale on the day, particularly in Discretionary, Tech, Financials, and Macro Products. Hedge funds (HFs) were balanced.

- Sector Flows: Large-cap pharma saw notable demand, benefiting from rotational flows within healthcare and the broader market, especially in non-obesity names.

Additional Fund Flow Dynamics:

The corporate blackout window is impacting supportive flows, with an estimated 87% of S&P 500 companies currently in blackout ahead of Q1 earnings. This figure is expected to rise to ~90% by the end of the week, contributing to a seasonal low point for the March 20–April 15 period (based on data since 1928). Clearing this week’s hurdles could pave the way for a short-term relief rally.

Positioning Metrics:

- CTAs: Currently out of focus.

- Institutional Positioning: Cleaner heading into "liberation day" on Wednesday. GS Positioning Indicator hit -1.2 this week, the lowest since April 2023 but still above levels seen in past major drawdowns over the last 15 years.

- Retail Investors: Paused buying at the end of last week. It remains to be seen what will re-engage this group and whether they step back in to buy dips.

DERIVS: As the market braces for a pivotal week in tariff policy, the SPX implied weekly move is approximately 2.60%, with the term structure showing an inversion at the front end of the curve. Prior to today’s session, dealers held a short position of $2.6 billion in S&P gamma at spot—marking the lowest level since September 2023 and the fourth-lowest reading on record.

After the market opened lower, we observed clients monetizing and rolling short-dated downside protection across all major U.S. indices. Additionally, there was notable profit-taking in VIX upside as skew remained elevated and volatility saw a modest uptick during the day. Despite the S&P recovering and grinding higher from the morning lows, clients appeared hesitant to chase the move, adopting a cautious "wait-and-see" approach ahead of the tariff announcements.

The Wednesday PM straddle is currently pricing in a 1.6% move.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!