Silver Crashes To 11-Week Lows

Manufacturing Woes Hit Silver Sentiment

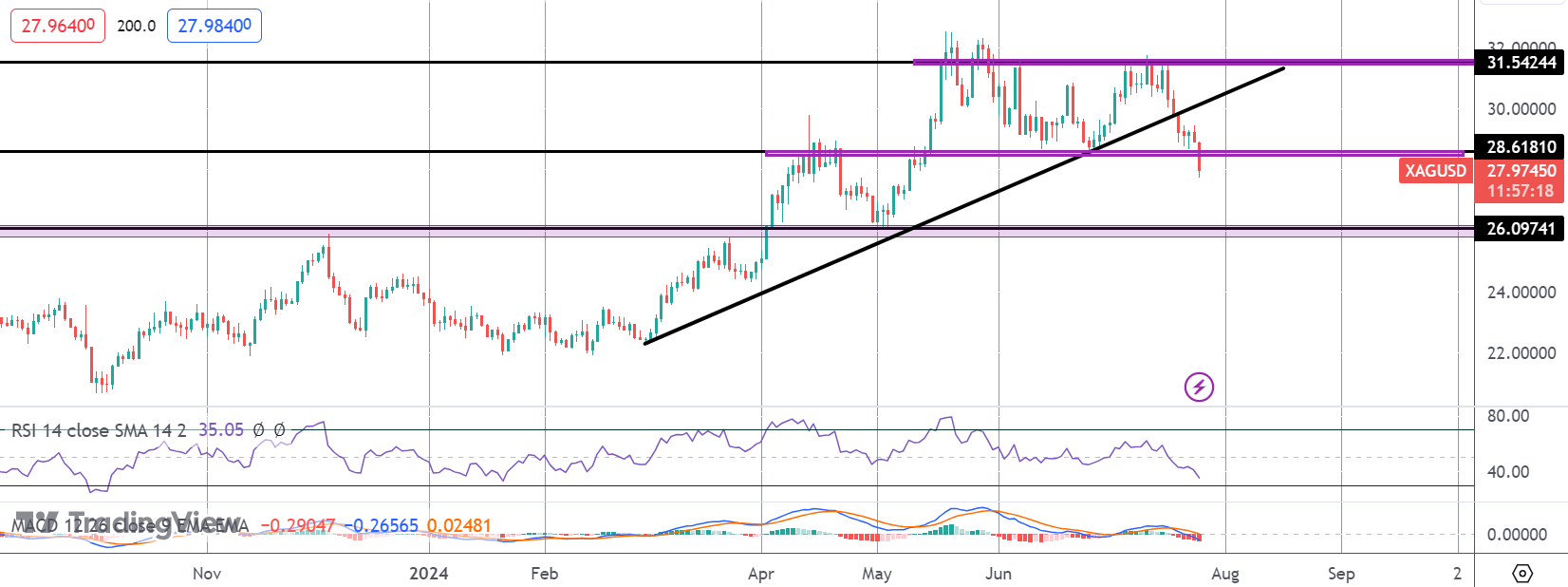

Silver prices are trading sharply lower today with the futures market breaking through key support at 28.6181. The market is now down more than 12% from the July highs, hitting fresh 11-week lows today. A slew of weaker-than-forecast manufacturing data this week has sparked fears that the global economy is slowing. On the back of weak industrial data out of China in recent months, factory sector readings in the US and eurozone are now trending lower, weighing heavily on the demand outlook for silver.

Elections Uncertainty & Fed Easing

Alongside the weakness in global manufacturing data seen this week, growing uncertainty around the US elections is also having a negative impact on sentiment. The prospect of a second Trump presidency brings the risk of renewed trade wars and heightened global geopolitical tensions. Indeed, for now it seems that election uncertainty is overtaking Fed easing expectations with metals lower despite the market pricing in a faster pace of rate cuts this year. Traders now see an initial rate cut in September followed by two further cuts by year-end. Indeed, the weakness in silver comes despite a softer US Dollar with DXY down almost 2% from the June highs.

US Data

Looking ahead this week we have a few key US data points to monitor with today’s preliminary Q2 GDP estimate the initial focus followed by core PCE tomorrow. Given the growing fears over the health of the US economy, a weak reading today will likely drive heavier selling in silver prices for now.

Technical Views

XAGUSD

The sell off in silver has seen the market breaking below a key support level this week at the 28.6181 level. With price extending the bull trend line break, and with momentum studies bearish, focus is on a continuation lower for now with 26.0974 the next support area to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.