Should we Expect more Downside Next Week After Friday Sell-off?

The end of this week saw USD gaining some bullish momentum thanks to a modest sell-off in risk assets. U. Michigan's report on inflation expectations and consumer optimism may tame the rise of US currency, if it indicates an improvement in the situation in January-February as it should draw some risk-on into the markets.

In my opinion, there are no particular reasons for a strong downward movement in risk assets, given positive news background in the US. House Democratic leader Pelosi supported bullish sentiment on Thursday saying that she expects the US administration to complete spending proposal in two weeks.

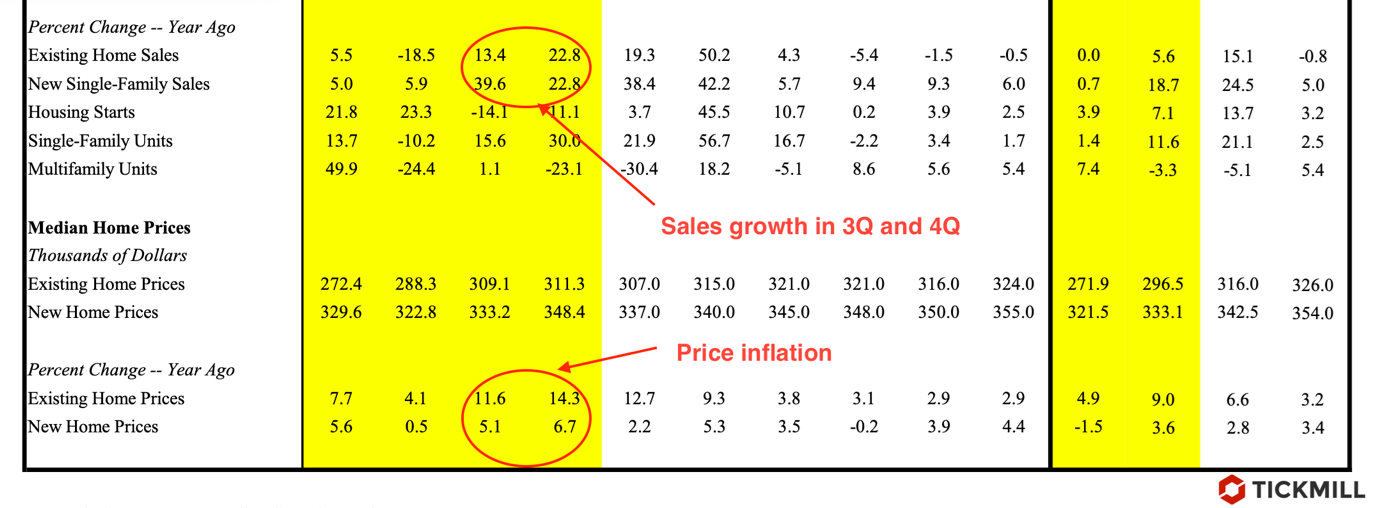

Among other eco data, inflation in the US housing market was a sheer surprise – the report from the US National Association of Realtors report showed that the median price of existing home increased by as much as 14.3% in the fourth quarter of 2020 with sales rising by astonishing 22.8% YoY:

This rapid rise in prices has not been observed in almost 30 years, and with this pace of growth of prices it’s difficult to believe that US consumer is broke.

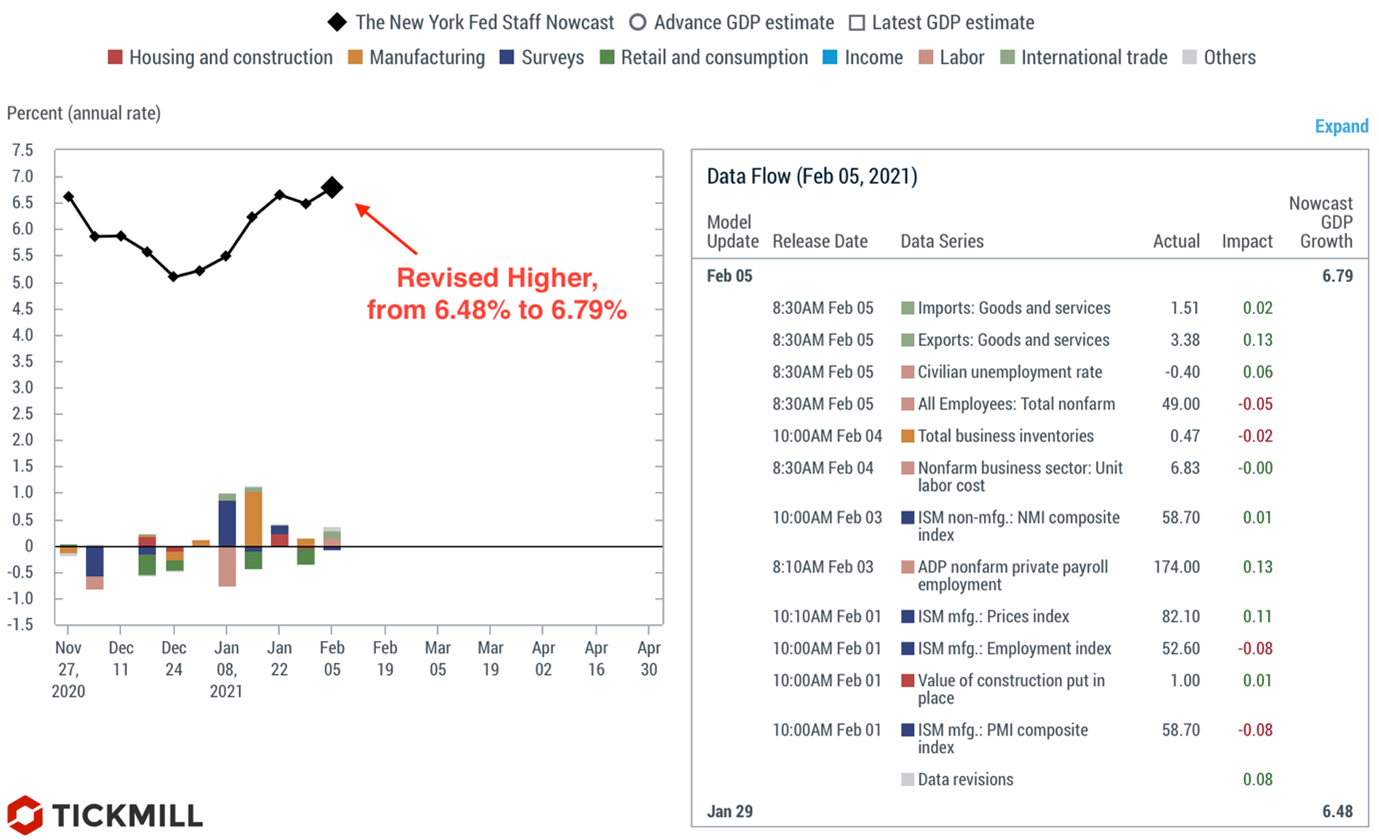

What also worth to mention is the US GDP forecast from the NY Fed. It is calculated taking into account the latest incoming economic data which makes contribution to the GDP and is updated once a week. The latest forecast was revised up to 6.79%, and since the beginning of the year we observe a stable positive trend:

Well, the main support factor this week was the Fed, which has not abandoned its promise to keep rates at zero for a long time. On Wednesday, Powell used more pessimistic language when describing the state of the labor market in the United States. The icing on the cake was repeating the mantra that it’s too early to even think about raising rates. Let’s keep in mind that the Fed stands pat on low rates despite incoming data showing strong signs of economic recovery what is itself a quite bullish factor for risk assets.

Other central banks are also supporting the stimulating environment - the Mexican central bank cut its rate by 25 bp to 4% yesterday. The decision of the Russian Central Bank today is likely to incorporate a tense sanctions situation, so the wording should also either indicate the willingness to maintain easing environment.

More positive than expected data on the British economy, judging by the reaction on the FX, was a surprise for investors. GDP in the fourth quarter grew by 1.0% (against the forecast of 0.5%). GBPUSD bounced from 1.3775 to 1.38, but failed to gain a foothold above.

Monday is a day off in the US and China is celebrating Lunar New Year. Expect calm moves on FX and equity markets.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.