Record Downturn in China's Services Sector Could Spark a New Wave of Risk-off

After spending a day in consolidation, greenback could find enough buying interest and continued to fall in price on Tuesday. The US currency index tests support at 92.50 level. Long-term US bond yields continue to pull back in disappointment after a slight surge ahead of Powell's speech, 10-year bonds offer 1.28% to maturity on Tuesday, compared to 1.35% at their peak last week. Fears of inflation, to which long-term bonds are particularly sensitive, appear to be weakening, and there is a growing risk that the Non-Farm Payrolls report will surprise this week from the negative side.

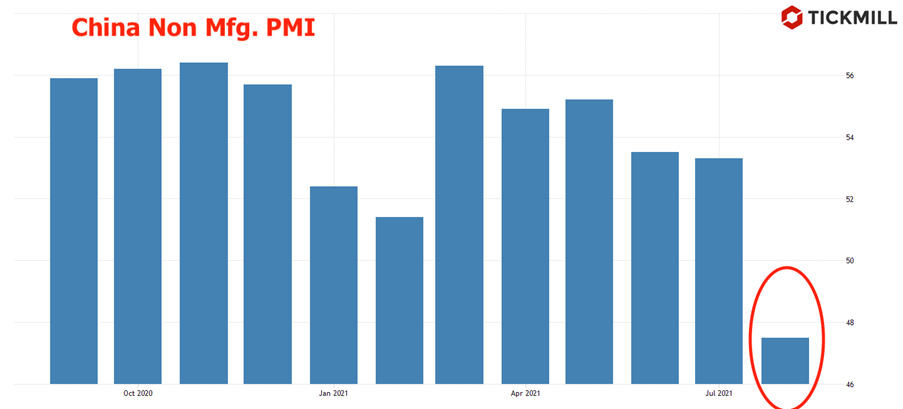

Sharp slowdown of activity in the Chinese services sector in August puts a deep dent on global recovery expectations. The corresponding official PMI gauge suddenly fell from healthy 53-56 points, landing in the depression zone at 47.5 points:

The pace of MoM deceleration was only higher only in February 2020, when China hit the economy with the lockdown. The strong negative surprise will likely make investors doubt that global economy will be able to maintain current pace of expansion and market bets for extension of stimulus measures may rise. Strangely enough, the dollar's sell-off intensified after release of the Chinese data:

Activity in the manufacturing sector also fell short of expectations, albeit to a much lesser extent: PMI has been declining for the fifth month in a row and in August it barely remained in the expansion zone at 50.1 points. The forecast was 50.2 points. Continuing at this pace, the index may find itself in depression zone as early as next month.

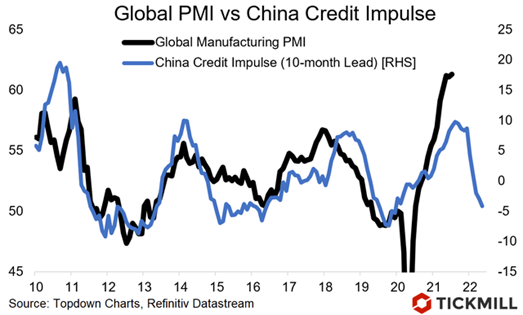

Market participants associate the weak data with the dynamics of credit impulse in China, which has been weakening in the past few months entering contraction zone:

Other fundamental factors include government crackdown on the tech and private tuition sectors (which should obviously suppress services sector activity), severe government response to the covid outbreak and reduced travel between provinces due to fears of being locked down in a non-hometown.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.