Preview of August NFP Report: Downbeat Surprise Unlikely to Spur too Much Weakness in USD

The data from US released this week fueled risk appetite, as it increased the odds of a downbeat NFP surprise. In turn, weak NFP report should make the Fed more cautious in terms of QE tapering pace, which is a powerful factor of support of US equities, as well as sovereign debt outside the United States. Higher interest rates on bonds outside of US compared with yields on US Treasuries is a key factor of supply of USD.

Here are consensus estimates for traditionally tracked NFP indicators:

- The number of jobs in August increased by 725K;

- The unemployment rate fell by 0.2% to 5.2%;

- Average wages increased by 0.3% on a monthly basis, slowing down by 0.1% compared to the previous month;

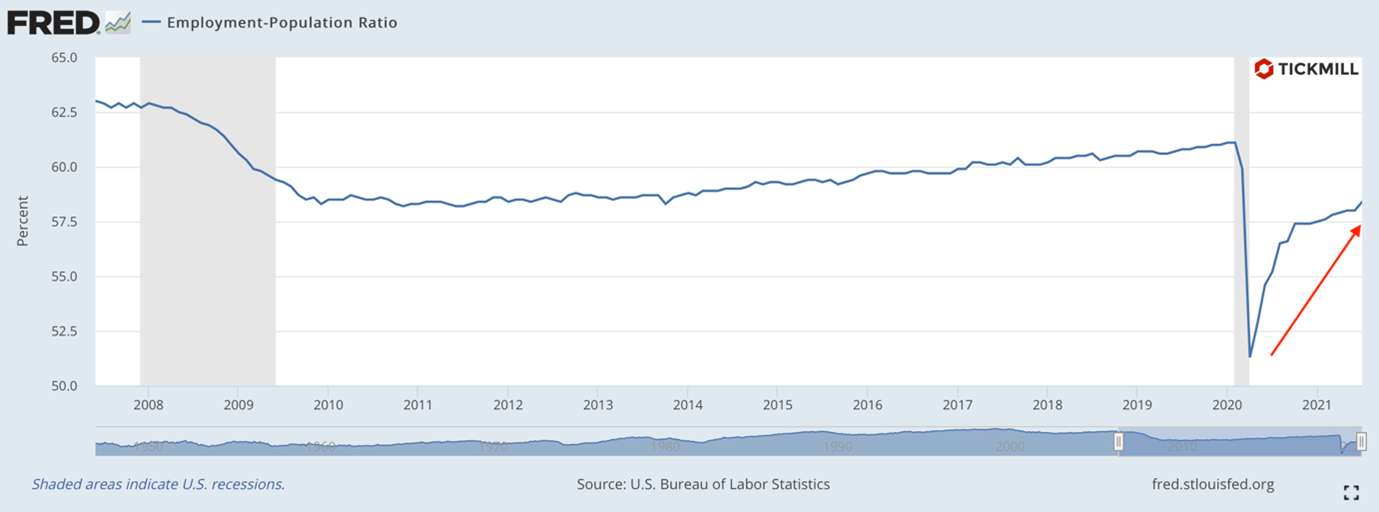

Nevertheless, in the current regime (recovery from the pandemic and self-isolation), as well as with the current priorities of the Fed (employment instead of inflation), the main focus of the markets will be on the metrics of population involvement in the labor market: U6 unemployment (unemployed + demotivated to look for work) (decreased to 9.2% in July from 9.7% in August, 7% before the pandemic), the ratio of employed to the total population (58.4% in July versus 61.1% before the pandemic), the level of labor force participation (61.7% in July versus 63.2% before the pandemic).

Here, for example, is the ratio of the employed to the entire population on the chart. The recovery is taking place at a slower pace than unemployment and is still far from the pre-crisis level:

This explains low interest rates of the Fed, which says that significant progress in hiring is an essential condition for policy tightening.

ADP once again fell short of the forecast, printing almost half the forecast (374K versus 613K) on Wednesday. Of course, the link with the NFP has recently weakened, but all the same, unpleasant aftertaste remained after the report. It was hard not to notice the market reaction: the dollar continued to cede ground to its opponents, while risk assets continued to gradually move upward. Market participants were apparently pricing softer transition of the Fed to a hawkish policy.

ISM and Markit data released on Thursday also pointed to slowing pace of hiring in manufacturing sector with delta strain impact on activity cited as the key reason of setback. The hiring index in the sector from ISM came below neutral 50 points at 49 points indicating contraction.

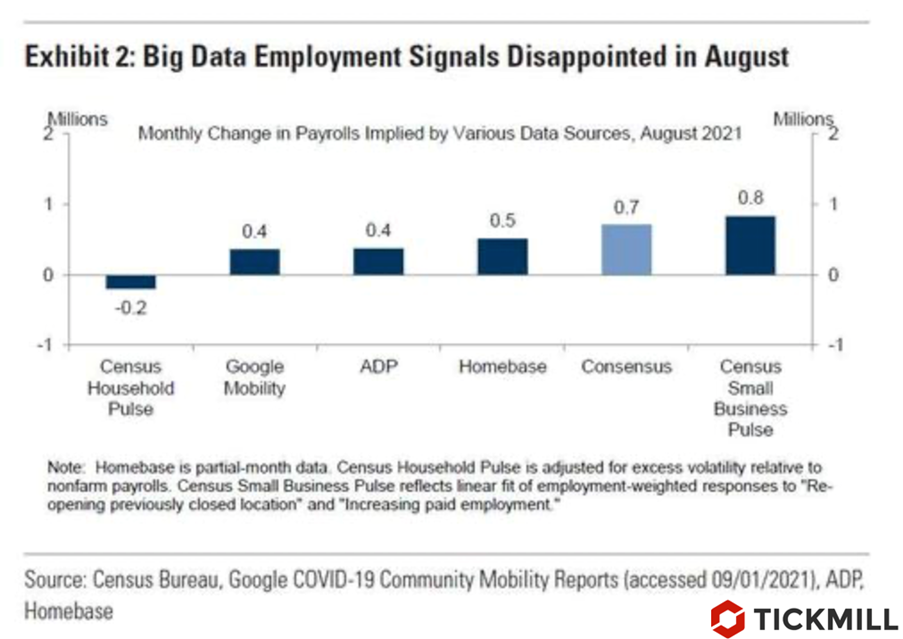

In the meantime, regarding the impact of the delta strain, Goldman also assessed economic damage from the outbreak as sizeable in its forecast, indicating that high-frequency indicators in the reporting period indicated less-than-consensus job growth. For example, job growth based on Google's consumer mobility indices is estimated at just 400K. Most of the other indicators are also lower than consensus:

Since most of dovish NFP expectations have been factored inin assets prices as preliminary labor market data were released this week, amoderately negative deviation of 50-100K from consensus is unlikely to spurrisk assets and significantly strengthen downtrend in the dollar. However, thisimplies that an upbeat surprise may catch markets off-guard with potential forUSD to reverse all its recent losses before September Fed meeting. It will alsobe tough for risk assets to sustain their recent rally, therefore the risk of equitiescorrection with a significant positive surprise in the data is high. With aslight Payrolls miss, the calm in risk assets will be probably extended andsome extra risk-on pressure on the data surprise should allow USD bears totarget August low at 91.90:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.