Precious Metals Monday 19-08-19

Gold

Gold prices have started the week on a softer footing following a solid session last week, which saw prices trading up to levels not seen since early 2013. Despite the generally higher prices, we have seen some volatility over recent days as ongoing fluctuations in the US / China trade story continue to impact price action. Having tested the major 1522.75 level last week, gold prices were shunted lower as the market reacted to the surprise announcement of a change in tariff plans. The US Treasury Dept issued a statement saying that some of the goods due to fall under the new 10% tariffs as of September 1st, will now be exempt until December 15th. The market reacted with a wave of optimism, sending equities higher and safe havens lower.

However, the rally in risk sentiment was short lived as focus then switched onto rising fears of a global recession. The latest data out of Germany showed GDP in the eurozone’s second largest economy has contracted over Q2. This means that the country is now on the brink of a recession for the first time in ten years, compounding fears over the health of the broader eurozone economy.

Recessionary fears were then heightened by movements in US Treasury Yields as yields on the 2Y note moved above yields on the 10Y note. This is the first time such a crossover has happened since 2007 and historically, such moves have preceded recessions in the US. Indeed, a slew of investment banks have recently been warning about the risk of a recession in the US.

However, at the start of this week, focus is once again back on the US / China trade story with equities trading positively in reaction to Trump’s comments on the progress of the talks. Trumps aid talks were going very well although the two sides aren’t yet ready to sign a deal. The market is hopeful that following Trump’s concession over the new trade tariffs, the two sides will work hard to make a deal happen this time.

Technical Perspective

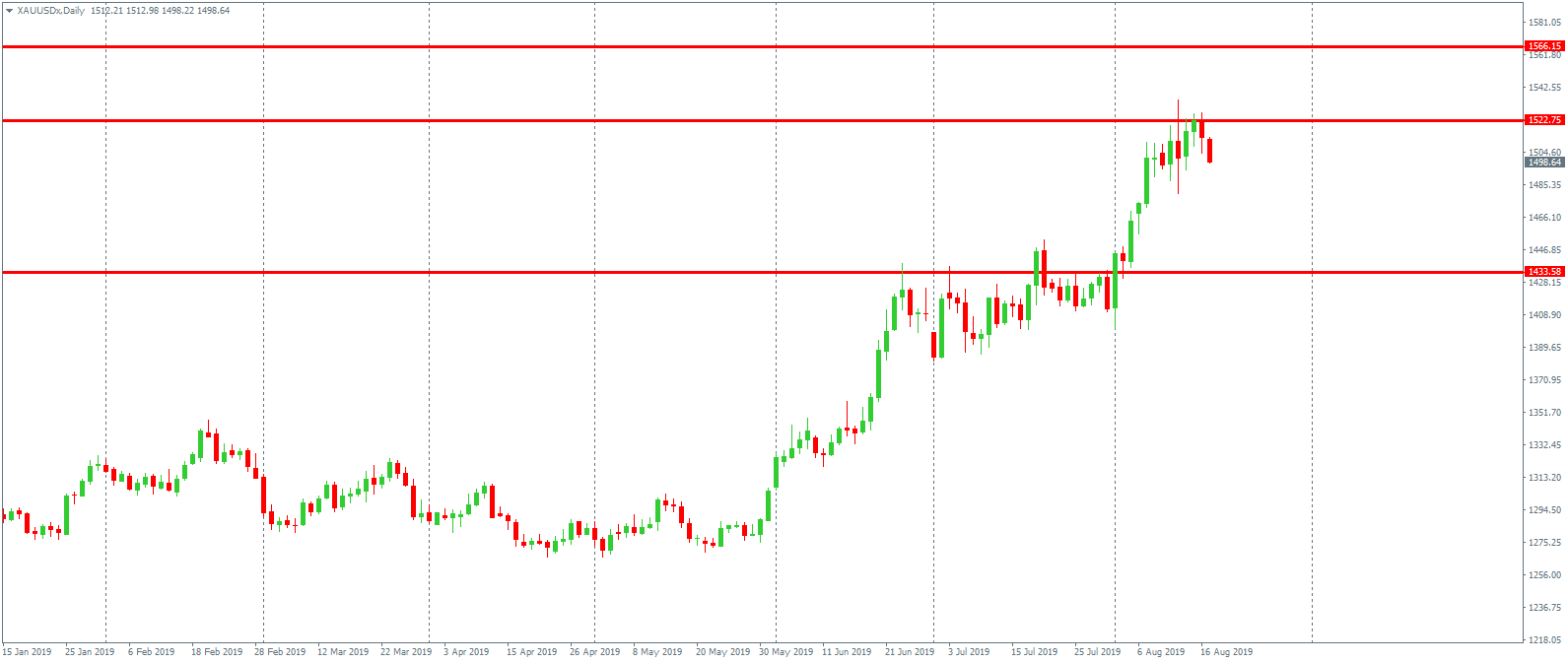

Last week’s rally in gold saw price breaking above the 1522.75 level briefly. This is a significant long term level in gold, marking the lows in 2012 and mid 2011, and has not been retested since it broke in 2013. Back above this level and focus will be on a test of the 1566.15 level next. However, If we continue to trade lower from here, bulls will be looking to use a retest of the 1433.58 level as support.

Silver

Silver prices are under pressure this week also following last week’s impressive rally which saw price trading up to levels not seen since early 2018. With rising recessionary fears, the prospect of further easing from the Fed and the ECB is likely to keep metals supported in the near term. However, any further positive developments in the US / China trade story, are likely to weigh on metals via better risk sentiment. However, there is also upside risk for metals as any breakdown in talks will be heavily risk off, sending metals higher.

Technical Perspective

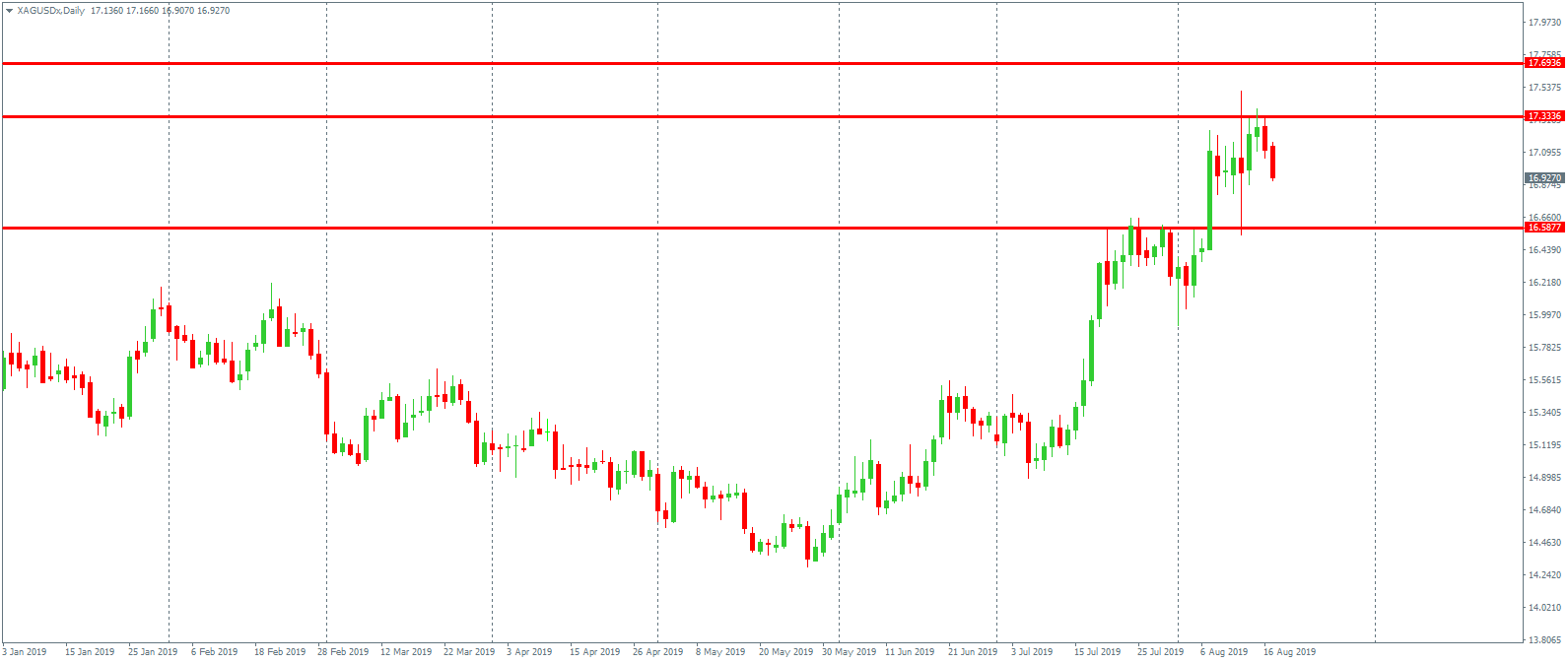

Silver prices surged further higher last week with the market breaking briefly above the 17.3336 level. Although price has traded a little lower since testing the level, while the market remains above the 16.5877 level, focus remains on further upside. The 2018 highs of 17.6936 will be the next key level to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.