Oil Struggles to Price in Demand Shock but the Worst is Likely Over

Oil and risk assets started on a positive note on Monday, however, towards the middle of the European session, the upside move has largely stalled. There was no particular rush to buy in European equities, as the story with the second lockdown stringency is developing in an unfavorable scenario. Austria returned to restrictions comparable to March and announced mass testing. Fears of a tough national lockdown in the United States weren’t confirmed, however, some states (Washington, Michigan) have tightened coronavirus restrictions to prevent collapse of local healthcare system. On the side of high-frequency indicators, French road operator Vinci reported over the weekend that traffic on French highways dropped by 48%.

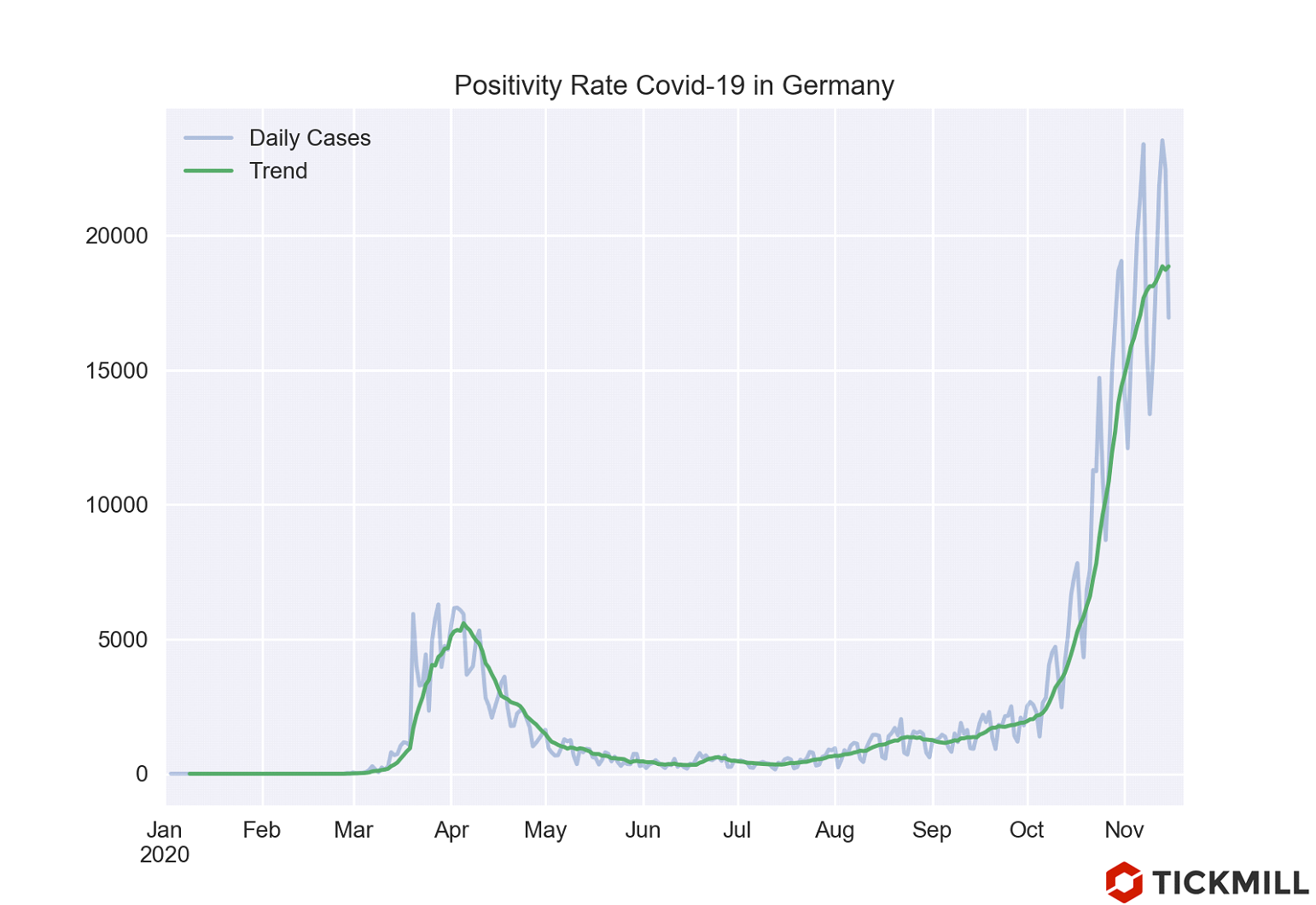

The shock to oil consumption due to lockdowns is likely to have been factored into the quotes to some extent, but it is unlikely that the hard lockdowns in the large EU economies have been factored in. Therefore, if negative news comes from Germany, France, Italy or Spain about the tightening of restrictions, oil quotes are likely to collapse. However, according to the latest data, the intensity of the daily growth of Covid-19 has been steadily decreasing:

The negative news for oil was a rather fast growth in Libya's production, from 100K b/d in August to 1.145M b/d in November.

COT data on oil showed that large speculators jumped into the train of the oil rally. In the last reporting week, they boosted their long Brent positions by 35.565 lots to about 130K lots. Nevertheless, most of the purchases occurred due to market participants covering short positions (they decreased by 27,082 lots).

Along with the rise in prices, shale production in the United States is also waking up. The number of drilling rigs increased by 10 units to 236. Since the beginning of August, rig count has risen by 64 units, but drilling capacities are still significantly lower than the pre-crisis level (683 units).

This week, the fate of the market will be determined, at least for the short term, by the meeting of the OPEC+ monitoring committee, which will discuss the implementation of output quotas and their possible extension into the 1Q of 2021. However, the final decision will be made at the meeting on November 30 and December 1. The monitoring committee can make a recommendation on the extension of output quotas, so the meeting promises to be interesting.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.