Oil Sinks on Global Growth Fears

Crude Corrects on Tariff News

Crude oil prices have turned sharply lower through the back end of the week with the futures market dropping more than 3% from yesterday’s closing price, now down almost 5% from the month’s highs. An uptick in investor uncertainty linked to sweeping US trade tariffs, announced yesterday, has seen a sharp downturn in demand expectations. Risk markets were seen tanking across the board in response to the tariff announcement with global growth forecasts slashed accordingly.

Weakening US Demand

This outlook was amplified yesterday by a much larger-than-expected inventories surplus reported by the EIA, reflecting a fresh decline in US domestic demand. The EIA recorded an inventories surge of more than 6 million barrels, a stark contrast to the 3.3 million barrel decline seen over the prior week and well above the -0.4 million barrel decline the market was looking for.

Bearish Risks

Looking ahead, crude prices are vulnerable to further downside as traders digest the details of the new tariffs and the fallout develops. A drop in the US Dollar has the potential to offset some of the downside impact in crude. However, if US recession fears become more prominent again, crude should continue lower all the same. Focus now turns to tomorrow’s US jobs report where any undershooting of forecasts should push oil prices lower near-term.

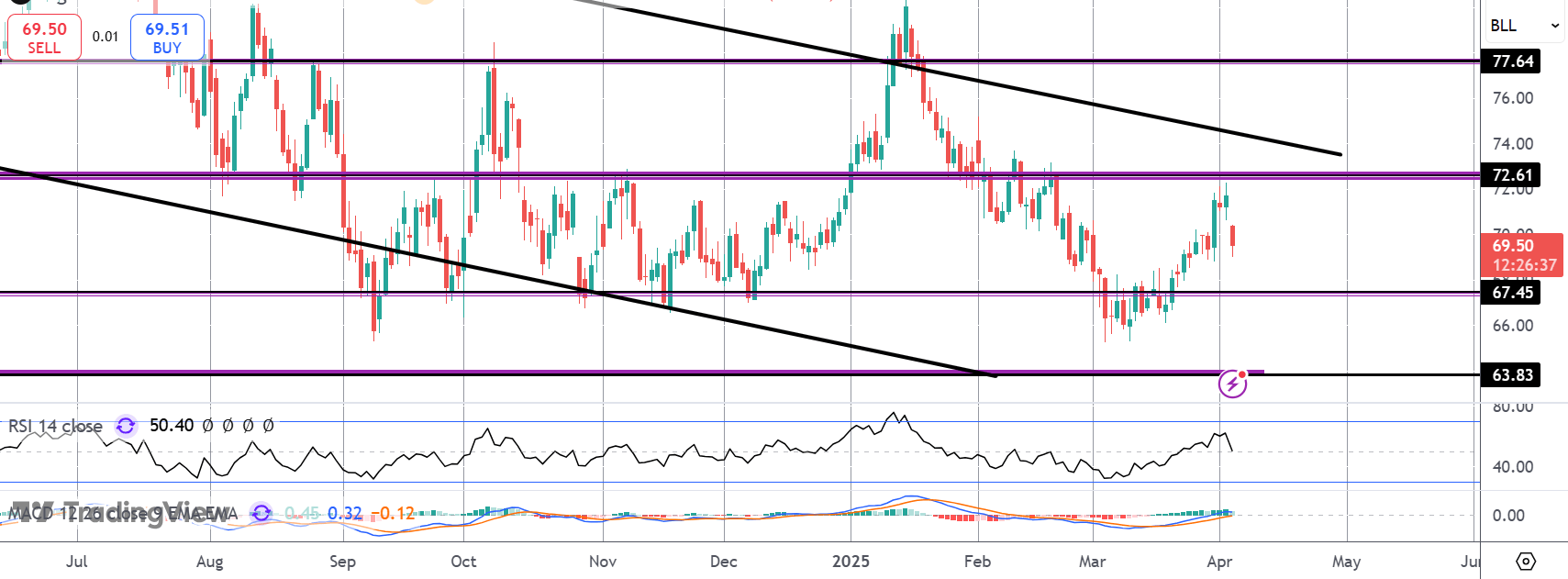

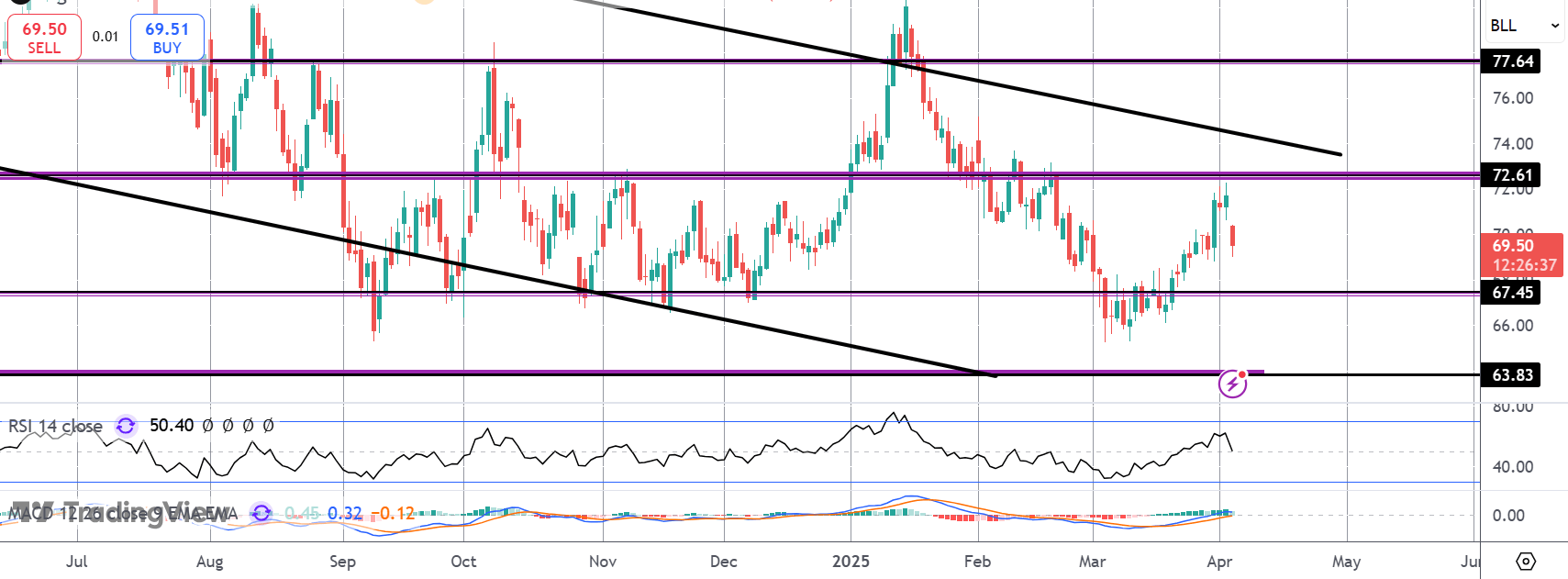

Technical Views

Crude

The rally in crude has stalled for now into the 72.61 level with price since retreating sharply lower. Momentum studies are turning lower here also, reflecting risks of a deeper push. 67.45 will be the next support to watch, with bulls needing to defend the level to prevent a deeper drop towards 63.83.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.