How the Oil Shock Affected Expectations of the Fed’s September Rate Cut?

A growing discord between the Fed’s top managers from the last meeting about when the preventive policy should begin and what its intensity should be is likely to expand with debates about the effects of the recent oil shock on the US economy. On the one hand, a jump in oil prices should quickly feed into fuel price inflation later creating pressure on consumer inflation. On the other hand, such inflation will be unfavourable, since it is not accompanied by a natural increase in incomes and a strengthening of consumer demand, since changes that cause price increases occur on the supply side.

Uncertainty of interpretation is also enhanced with the unclear extent of damage to refineries, the length of recovery of production to the norm and the prospect of selling US strategic reserves as hinted by Trump.

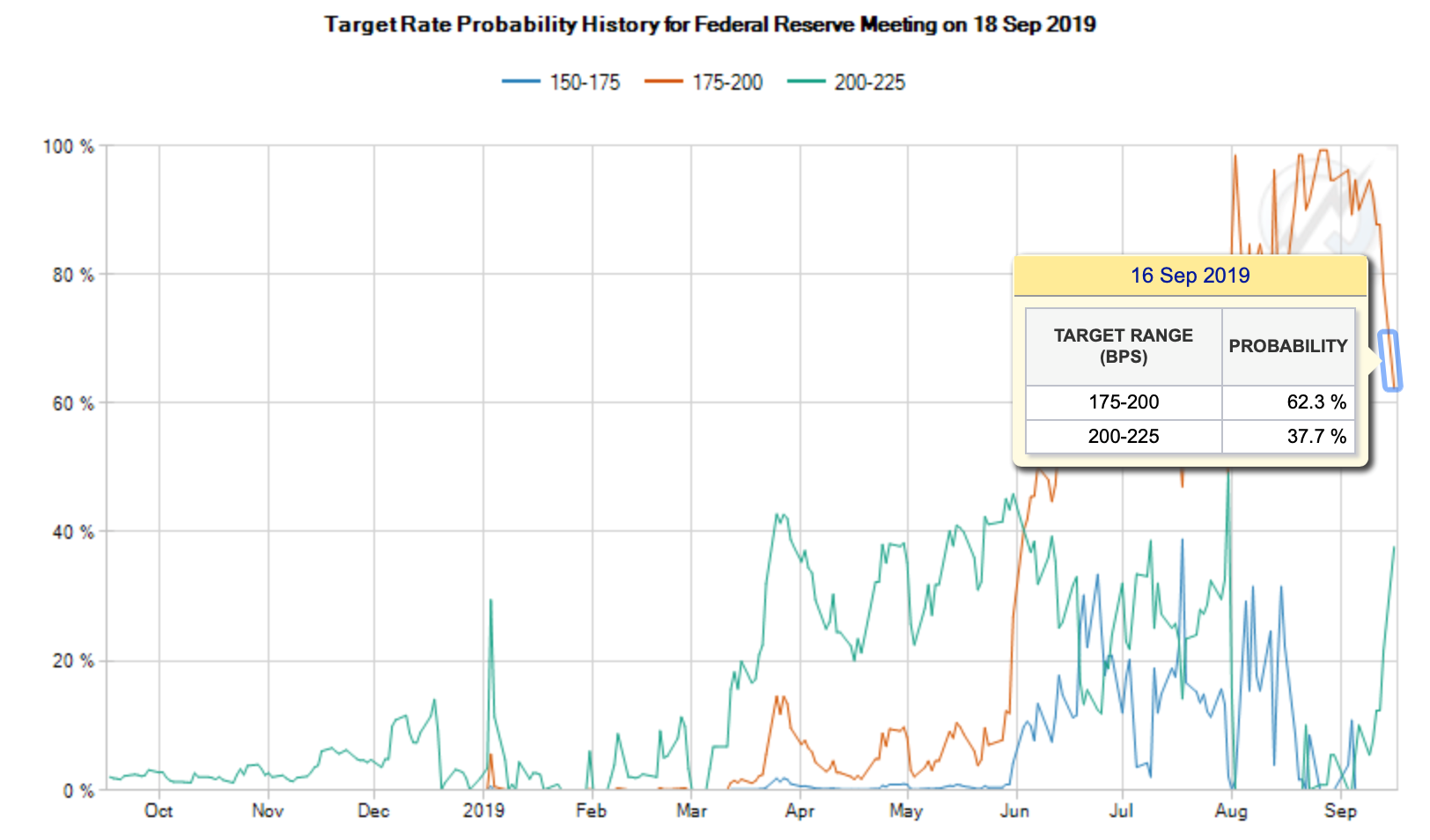

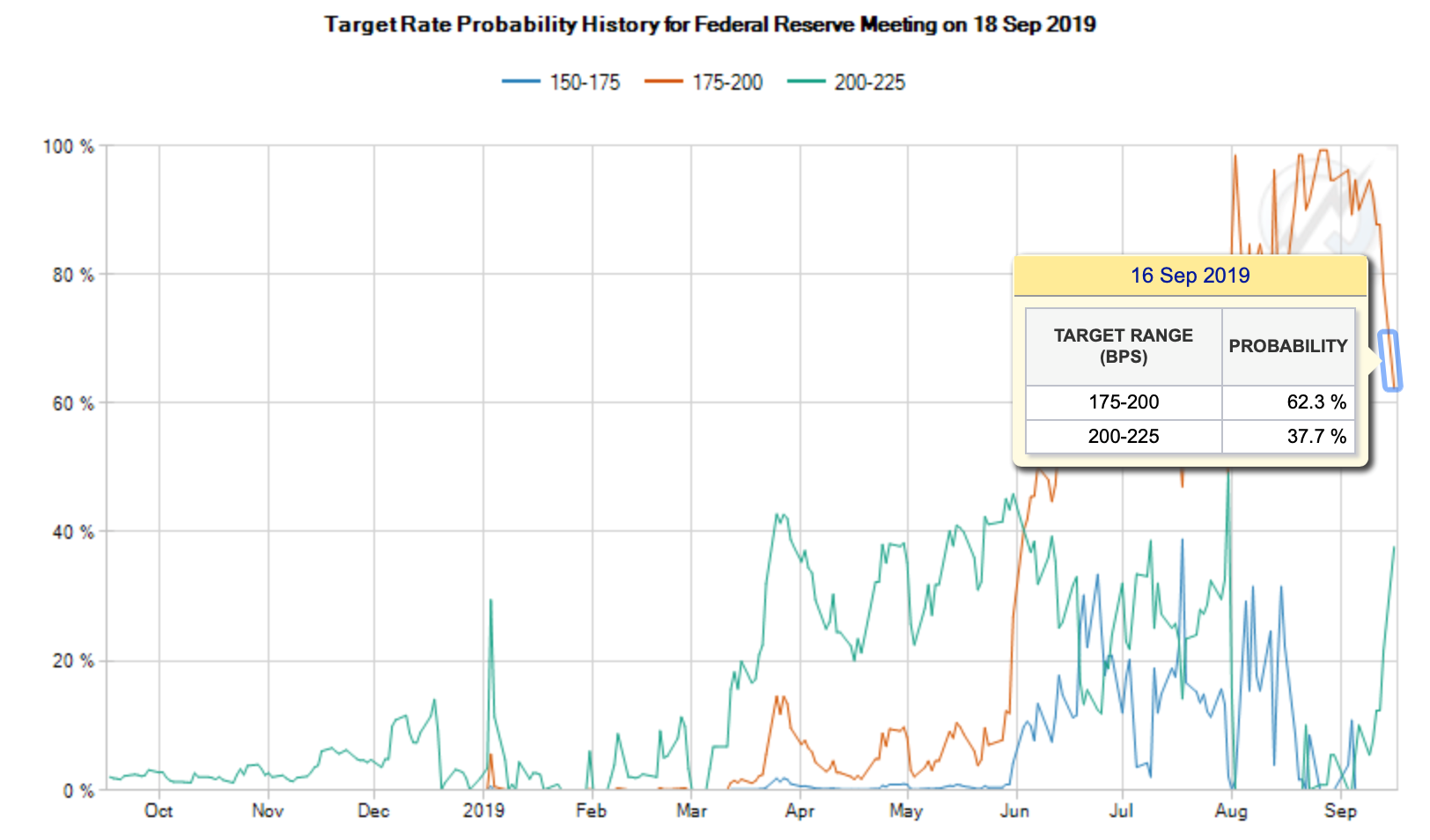

The treasury bond futures market seems to be leaning in favour of accelerating expected inflation and reviews the chances of Fed’s rate hike. If last Friday the chances of leaving the rate in the range of 200 - 225 bp amounted to 21.5%, then on Monday the chances of this outcome rose to 37.7%, i.e., in response to an incident in Saudi Arabia:

At the same time, among risky assets, there was a clear increase in risk aversion on Monday, as evidenced by an increase in VIX, a rise in the price of gold from $1,485 to $1,510 and a negative jump in the yield on 10-year treasury bonds from 1.9% to 1.8%, which so far continues to offset the expected inflation factor in the price of bonds.

In a situation of increased inflation risk with effects of indefinite duration and short time for making decision (just a couple of days!), some prominent doves such as Neil Kashkari and James Bullard will no longer be able to easily use the argument of weak inflation to lower rates. Their concern about the “unhealthy” yield curve is also less relevant, because the spread between the 10-year and two-year Treasury bonds has adjusted to 0.1%, the highest level for more than a month.

The heads of the Federal Reserve Bank of Cleveland and Philadelphia, Loretta Mester and Patrick Harker, will likely continue to defend the need for a pause in further credit easing.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.