No Pain, no Gain.

How quickly and to what extent will the price war between Saudi Arabia and Russia result in the clearing of the oil supply from price-sensitive producers, enough to clear the glut? It is difficult to answer now, but the prospects are excellent: according to the calculations of the Norwegian agency Rystad Energy, only four US shale companies can survive long-term oil price below $30. The rest of companies in the sector will have to raise capital floating more debt, drifting away further from steady state, as rising debt service costs should increase the theoretical cost-effective price of a barrel.

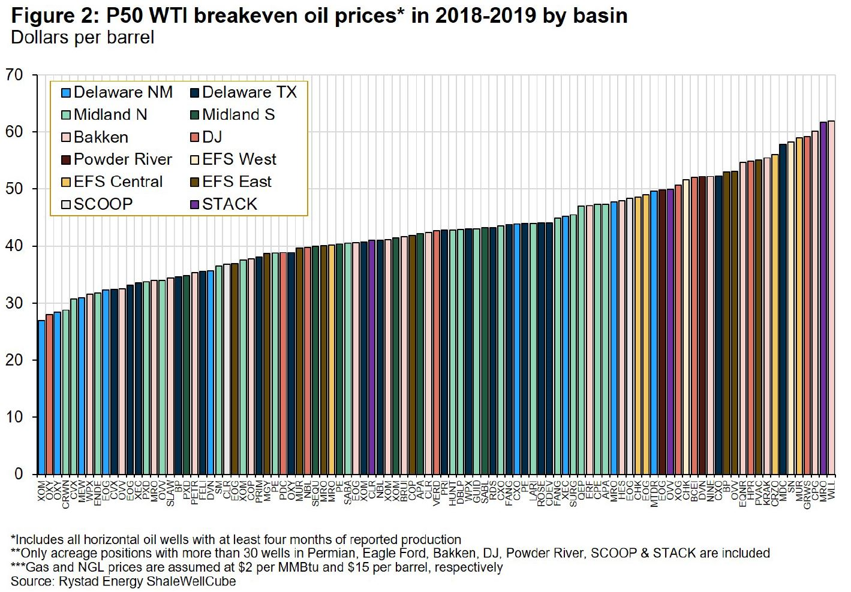

Exxon Mobil, Occidental Petroleum Corp, and Crownquest Operating rigs in the Perm basin are profitable at $31 per barrel. For other shale companies, the number of which exceeds 100, current price is too low to safely expand or maintain production:

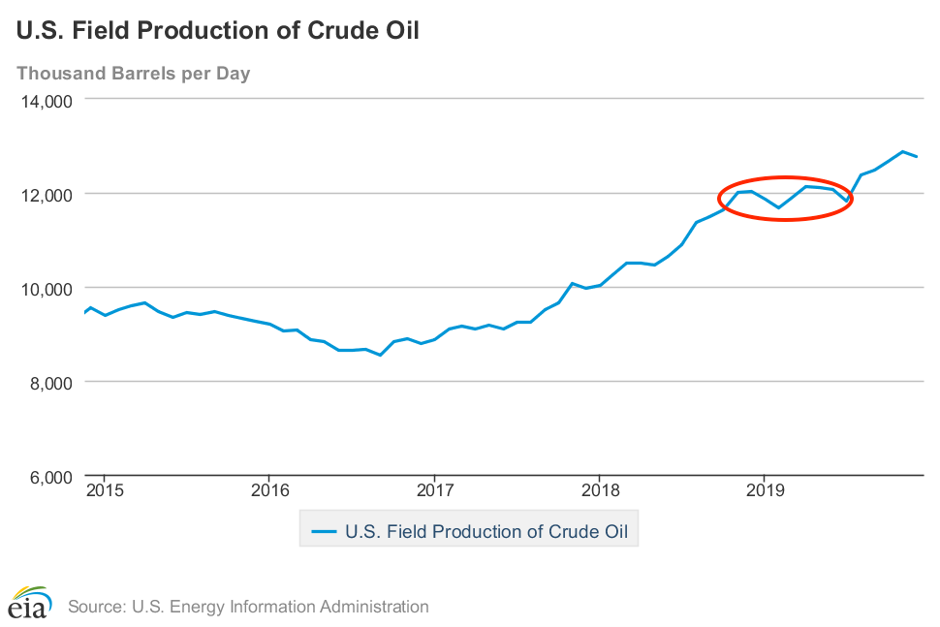

Despite flexibility, shale oil fields are known for their quick depletion, which implies fluctuations in output if companies do not invest in exploration in a timely manner in order to maintain stable production level. The source of investment can be either retained earnings or capital raised through shares or bonds issuance. Under certain conditions, change in oil price affect both of these investment channels what can be seen from the change of shale oil output in response to the sharp decline in WTI price at the end of 2018, from $76 to $43 per barrel:

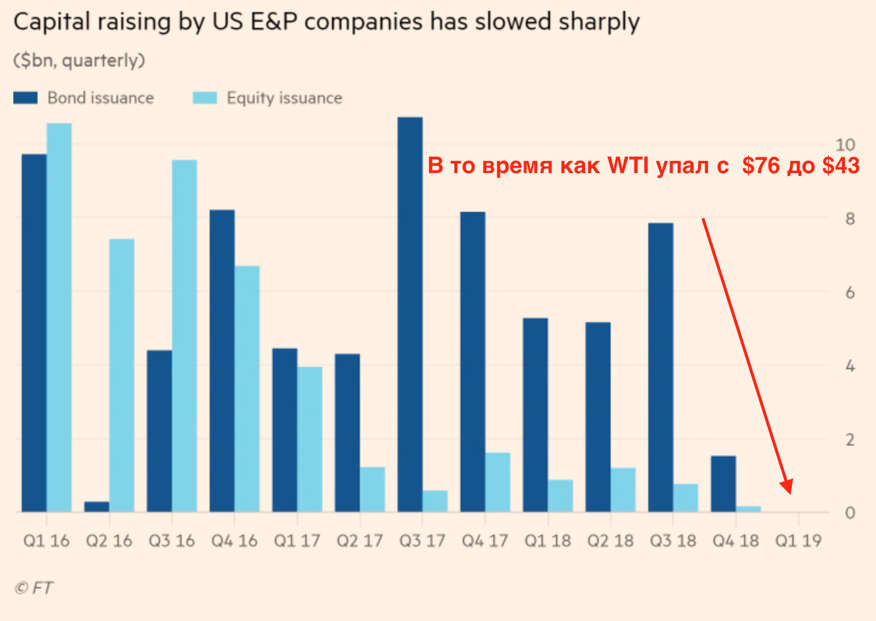

If a producer doesn’t hedge output, decreasing price should halt or at least slow down forward-looking investments in exploration of new fields both through retained earnings (because of pressure of existing investors to return cash) and through stock or bond issuance (spooked new investors). The second effect is clearly seen from the next chart:

Depletion of existing fields combined with slowing investments into exploration led to the slowdown in production from the end of 2018 to the middle of 2019:

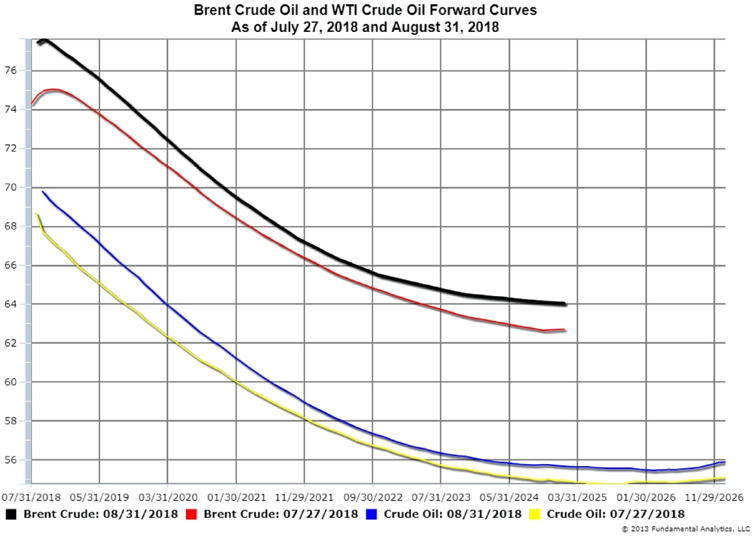

And the shale producer did not hedge production because of strong backwardation in the market in that time when it was profitable to sell oil in the spot market rather than selling futures:

Now, the huge gap between current price and the average breakeven price in the shale oil sector mixed with “flight to quality” in the fixed-income market (ditching junk bonds) is increasing likelihood that exploration of new fields will slow down significantly, which means that supply pressure will start to ease, balancing the fallout of the price war between OPEC and Russia. The only hurdle to this is the fact that shale producers have hedged production due to the favorable shape of the recent futures price curve what ensures some stability in the output in the medium-term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.