Nasdaq Reverses Back Under Prior 2024 Highs

-1731928444.png)

Nasdaq Reverses

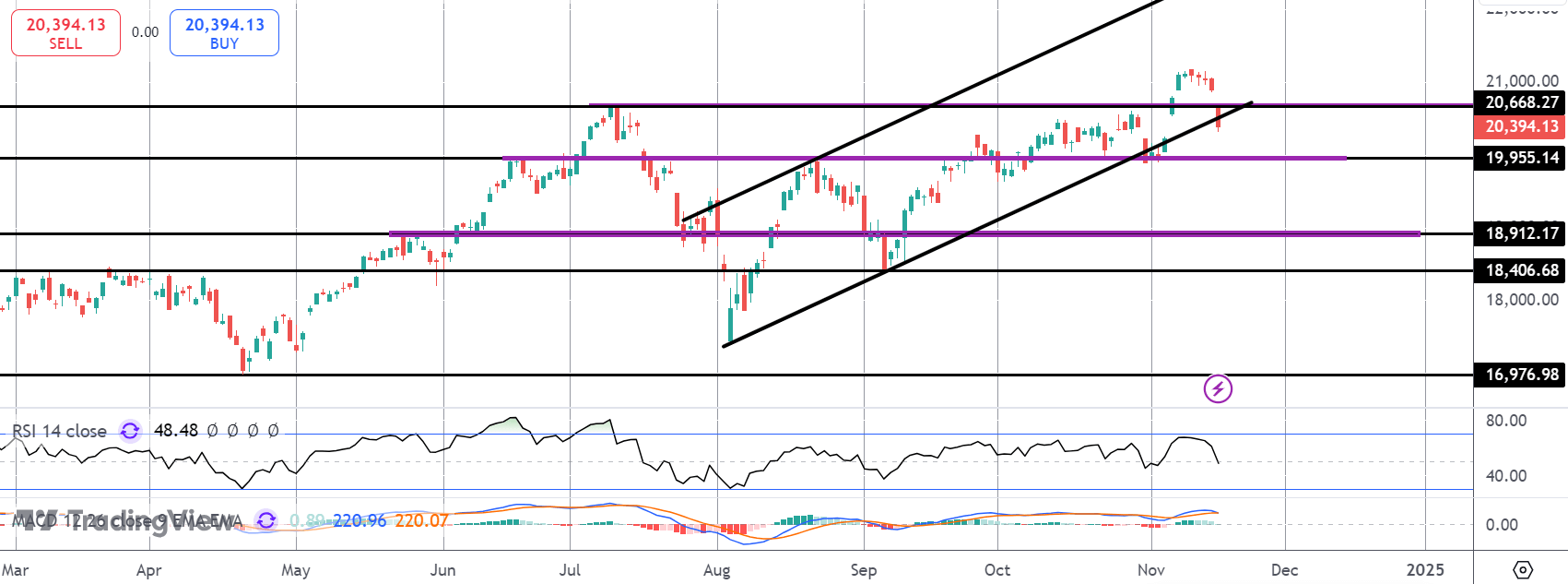

The Nasdaq is on watch this week following a heavy reversal last week that saw the index trading back under the prior 2024 highs around 20,668. The index is now at risk of posting a double top here, suggesting the room for a deeper correction lower unless bulls can get back above the level quickly. Upcoming Nvidia earnings on Wednesday are likely to be the key near-term catalyst. If the chipmaker posts strong results and a healthy outlook, Nasdaq should rally through the back end of the week. However, if Nvidia disappoints again, this could see the Nasdaq unwinding further.

Powell Comments

Last week, comments from Fed chairman Powell fuelled a long squeeze in the market. Powell warned that the economy remained robust and that the Fed, while on an easing path, was in no rush to cut rates. These comments saw a weakening of December Fed easing expectations, pushing USD higher and pulling stocks lower. If rate-cut expectations continue to fade, this dynamic is likely to persist fuelling a deeper push in the Nasdaq.

Fed Speak on Watch

Looking ahead this week, we’ll hear from a slew of Fed policymakers alongside US weekly jobless claims on Thursday and the latest PMIs on Friday. Fed speak in particular will be closely watched and poses volatility risks for USD and stocks given the fluctuating market pricing for a December cut.

Technical Views

Nasdaq

The reversal in the Nasdaq has seen the market trading back under the 20,668 level. Price is now testing the bull channel lows with the 19,955 support level sitting just beneath. Bulls need to defend this area to prevent a deeper drop towards the 18,912 level next. In the Signal Centre today we have a sell limit above market at 20,664, suggesting a preference to stay short into any bounces.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.