A Model Comparison Between the Novel Coronavirus and SARS

Gold price has jumped to $1,580 during trading last Friday and early Monday as the economic effect of the quarantine of large cities in China, resulting in lower consumption and lower production volumes, poses a serious threat to the prospects for a global recovery at the beginning of 2020. The steepest drop to the decisive measures by the Chinese authorities has been observed in oil, which lost almost 10% since the announcements of the lockdown.

I guess Trump can forget about the fast of repair of the US trade deficit with China because recovery from the lockdown will likely take time and keep China foreign demand subdued.

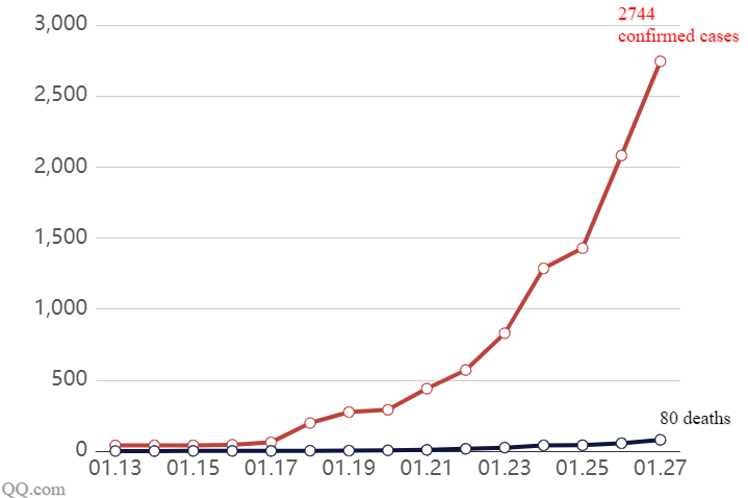

The loss of balance in gold and oil and the rise of volatility coincided with the announcement of the lockdowns on January 20-21. This most likely indicates that markets have been responding precisely to the economic aftermath of the lockdown and do not reflect concerns of the virus spread outside of China. Of the 2799 confirmed cases worldwide, 2744 (98%) are in China. What is also interesting, not a single case of the disease outside of China has been fatal, which raises the question of the adequacy/speed of treatment at the initial stages in China, where hospitals in the epicenter have been overloaded due to panic and some patients might not receive timely adequate treatment. Despite attempts by the media to impose hysteria, it’s important to realize that objectively the outbreak of the virus has been largely limited by China while markets are pricing in an economic impact of the lockdown. It is worth noting that WHO did not propose quarantining entire cities; this is a merit and the result of the strong political will of the Chinese authorities.

But even despite China’s attempt to be proactive, the number of confirmed cases is growing exponentially:

A turning point is not around the corner yet as clearly the spread is gaining momentum. For now, it is important to keep tab on updating figures to estimate if the momentum starts to slow down what should become a signal for market relief too.

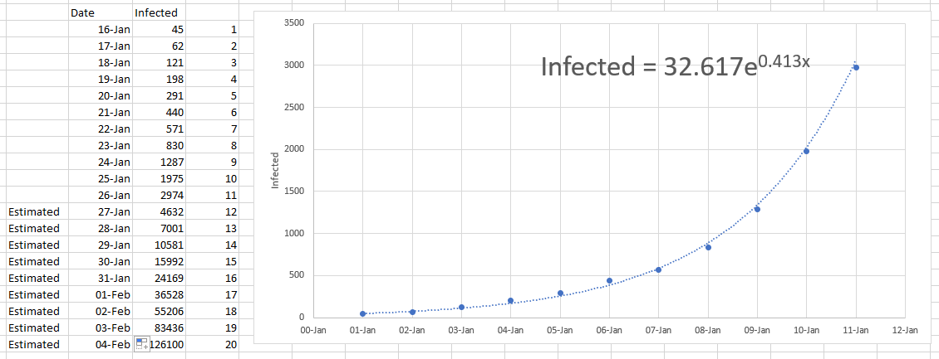

If we build a regression of confirmed cases by day from the start of data publication, we get the following model:

Source: reddit.

The R-squared of the model (how well the model "fits" into the data) is 0.9948 (max = 1). If a serious opposing factor does not intervene (for example, a shortage of tests, which will slow down the detection or gradual effectiveness of quarantine), the worst estimate is over 100K confirmed cases by 4 of February.

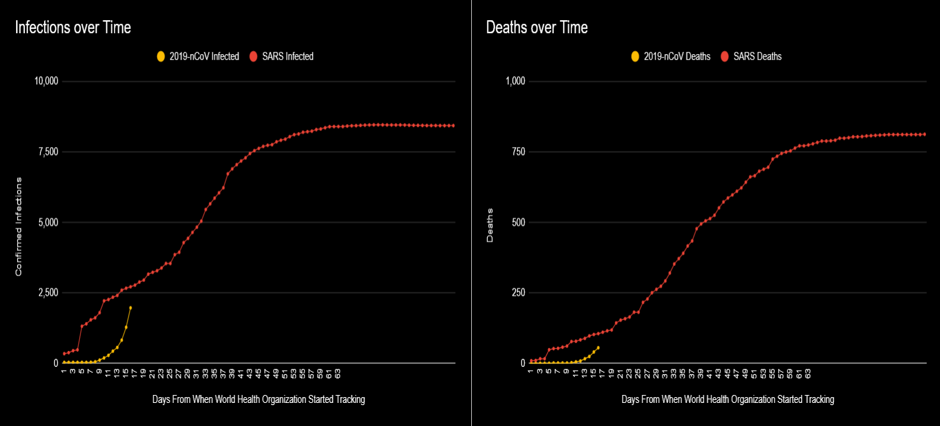

Let’s also compare the outbreak characteristics of the novel coronavirus with SARS:

From the graph on the left, it can be seen that transmission rate of the new coronavirus is higher than that of the SARS, which is explained by a longer and asymptomatic incubation period, when the patient can transmit the infection to other people (was not the case with SARS). The Chinese Disease Control and Prevention Authority said over the weekend that the risk of pandemic from the novel virus is higher than that of SARS. Nevertheless, the right graph allows us to say (for now) that the lethality of the new virus is lower.

It's also worth making an important point about potential news on vaccine. For the SARS virus, which genome is very similar to the novel coronavirus, after 17 years after the peak of the outbreak vaccine or effective treatment has not been developed yet.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.