Markets Brace for Bullish CPI but Room for the Risk Rally is Limited

The dollar retreat eased pressure on oil prices as Brent price flirted with $95/bbl level on Monday. Despite the bounce and momentum that may drive prices higher, there are clear bearish risks for the market. The key among these is China's "Zero Covid" policy, which has been creating demand shocks, driving up price volatility.

The latest data on US strategic oil reserves showed that storage facilities were empty by 8.4 million barrels last week to 434.1 million barrels. This is the lowest stock level since 1984. The current plan to use reserves to smooth impact of energy price shocks will run until the end of October, then the question of extending the plan will arise, which the market will probably be watching closely. Gasoline and utility prices have already shown how they can accelerate headline inflation, thereby having a hand on shaping the Fed policy.

Europe, on the other hand, continues to develop a plan for interventions in the energy market and easing of imbalances. It will include energy rationing, a windfall tax on energy companies, utility bill offsets for individual consumers, and cheap lending facilities for vulnerable companies. The document is expected to be made public at the end of September and expectations that the EU will be able to demonstrate an effective reduction in dependence on energy imports from Russia may now act as a support factor for the Euro, as well as risk assets denominated in this currency.

The technical picture for oil indicates rising odds the price will retest the resistance at $100 per barrel on Brent. To do this, the price must rise and consolidate above the key trend line shown in the chart below:

The dollar continues to be under pressure ahead of the CPI release, while equities show a fairly confident growth. The S&P 500 posted its best four-day performance since June. The inflation report is expected to point to a slowdown in headline price growth and an acceleration in core inflation, which does not include prices for food, fuel and certain other commodities that fluctuate significantly from month to month. The market is also positively reassessing the risks of the energy crisis for the EU economy, which was triggered by the ECB's optimistic forecasts for this and next year, published at the last meeting. The regulator ruled out a recession next year, predicting a modest 0.9% economic growth, which came as a big surprise.

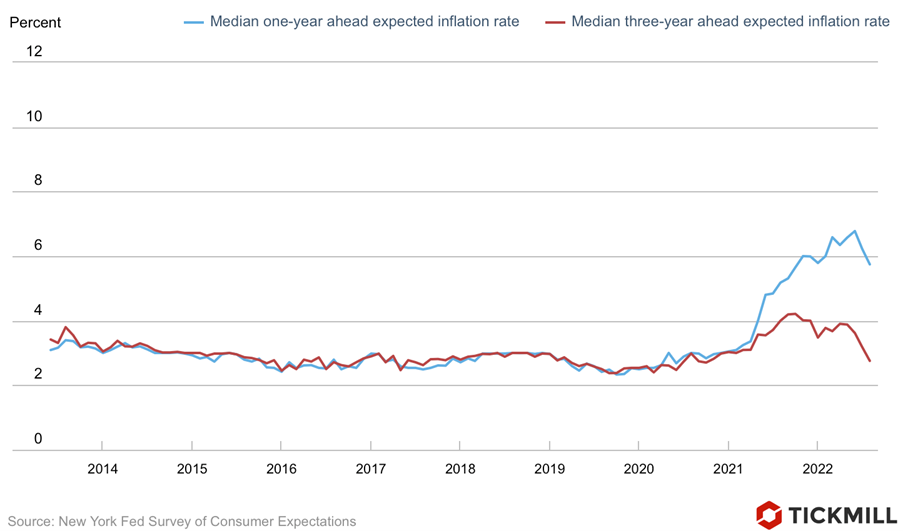

The highlight of the economic calendar next week will be the Fed meeting, and officials cannot comment on the week preceding it, so the markets will have to assess the impact of CPI on interest rate path and QT with officials’ clues. However, it is useful to remember, for example, Bullard's statement that a good CPI report will probably not affect the outcome of the September FOMC meeting. An equally important source of policy-influencing data for the Fed - household inflation expectations – made another step in the desired direction, according to the report on Monday. One-year inflation expectations slowed in August to 5.75% (6.2% in July), three-year inflation expectations fell to a two-year low of 2.8% from 3.2% in July:

The futures market estimates the probability of a rate hike of 75 bp in 93%, the probability of a smaller increase (50 bp) is only 7%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.