Market Spotlight: Is SNB Deal Enough to Save Credit Suisse?

CS Shares Halted Amidst Volatility

It’s been a volatile week for Credit Suisse. Investors still holding onto shares have certainly been put through the wringer with CS stock cratering more than 30% from the week’s opening price, now down more than 50% on the year. Indeed, CS shares were suspended yesterday as volatility ratcheted higher, offering the bank some breathing room.

Saudi Backers Cut Support - SNB Steps In

Yesterday’s fall came as the bank’s main investor Saudi National Bank announced that it would not offer any further financial support. On the back of heavy capital outflows and spiralling liquidity concerns, many feared the end for the bank yesterday. However, Credit Suisse was able to land a last-minute rescue deal with the SNB which will give CS CHF50 billion and allow it to buy back debt.

Fending off accusations that it is headed the same way as SVB, CS notes that it doesn’t suffer from the same duration mismatches in its bond portfolios. Furthermore, the bank noted it is launching a tender to buy back around $3billion of debt.

Will SNB Backing Be Enough?

However, whether the moves will be enough to shore up confidence in the bank is yet to be seen. CS has been under heavy pressure since early 2021 and has a long way to go to claw back the value it once had. If banking sector volatility continues or worsens near-term, the bank might find itself running out of options.

Technical Views

Credit Suisse

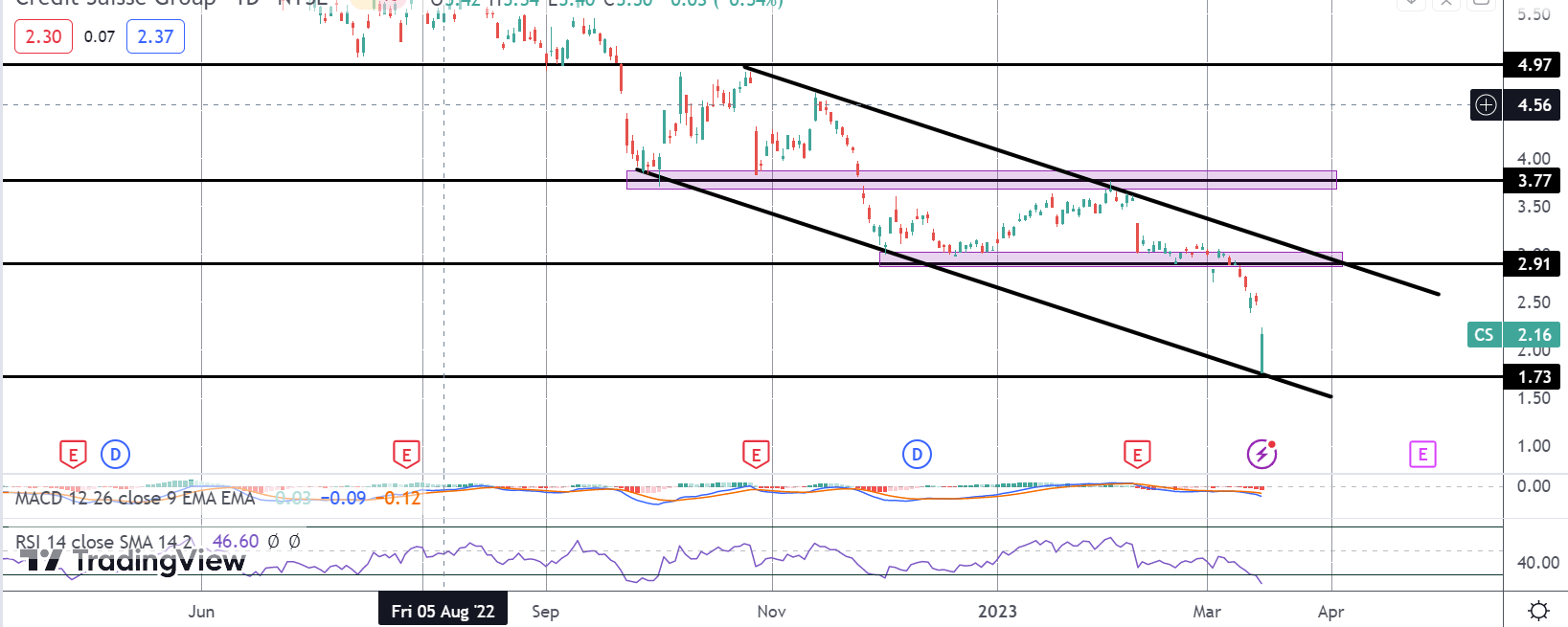

The breakdown below the 2.91 level has seen the market extending sharply lower within the bear channel which has framed the recent decline. Current lows of 1.73 mark the only support below market with bulls needing to see a break of 2.91 and the channel top to alleviate current bearishness.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.