Market Spotlight: Computacenter Shares Jump on Profit Guidance

Better 2022 Results

Shares in UK listed Computacenter, Europe’s chief independent provider of IT infrastructure services, are up over 7% today. The move comes in response to updated from the company today with 2022 results now projected to be better than initially expected. Total revenues over last year were seen 30% above the company’s own forecasts for the period (gross invoices) with Computacenter citing the benefit of a stronger US Dollar as well as an acquisition made in H2 2022.

The company noted strong demand from all markets for its technology sourcing products. Additionally, the group noted decent services revenues also though did note that its services margins were impacted by the unwinding of covid-related benefits as well as the dampening effects of elevated inflation.

Reduced Covid Impact

Looking ahead, however, the group is confident in delivering further strong results this year, noting negative covid-related issues have now passed through. Shares are now up more than 14% on the year and look set for further gains should the BOE this week begin to steer away from aggressive monetary tightening.

Technical Views

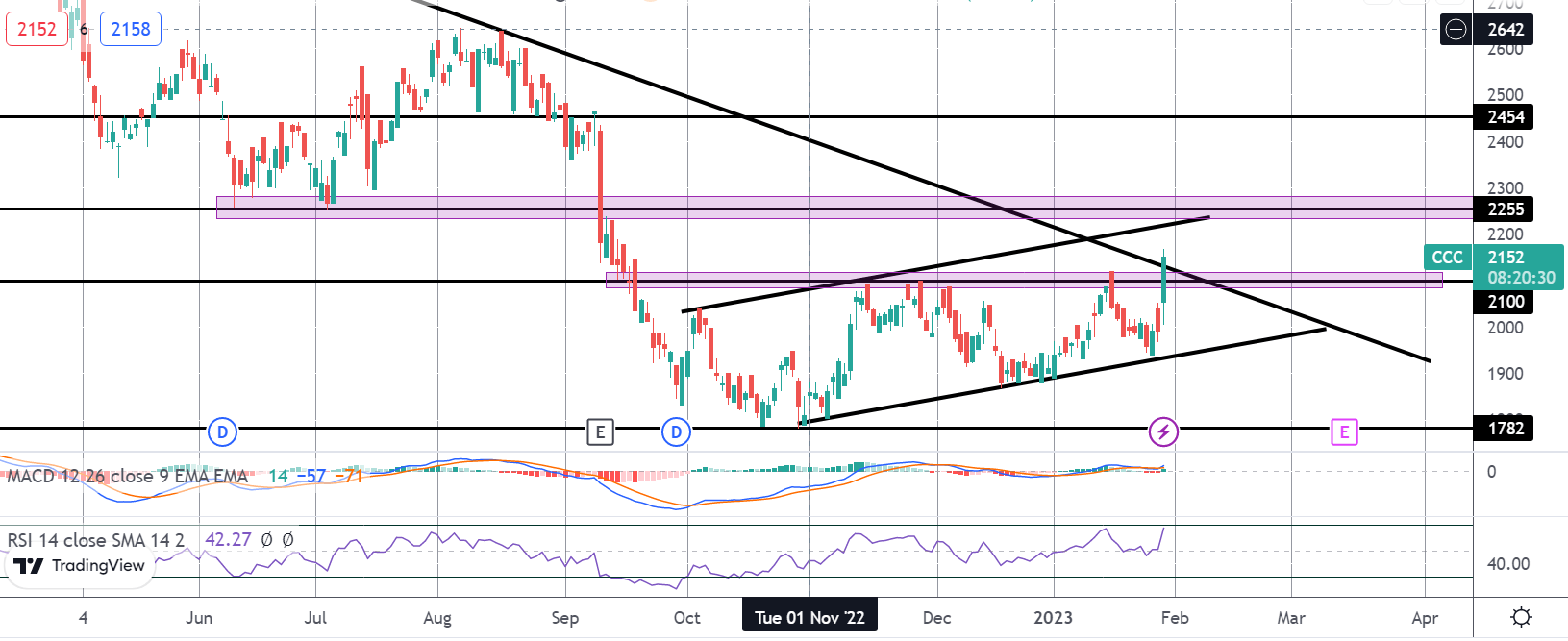

Computacenter

The rally has seen price breaking above the 2100 level and above the bearish trend line from last year’s highs. With momentum studies turning bullish, the focus is on a continuation higher while price holds above the 2100 level. Above here, the next area to watch is the bull channel top and 2255 level (prior broken lows). A move above here will be firmly bullish for the stock medium-term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.