Market Spotlight: Can Amazon Repeat Post-GFC Rally?

Amazon Under Pressure

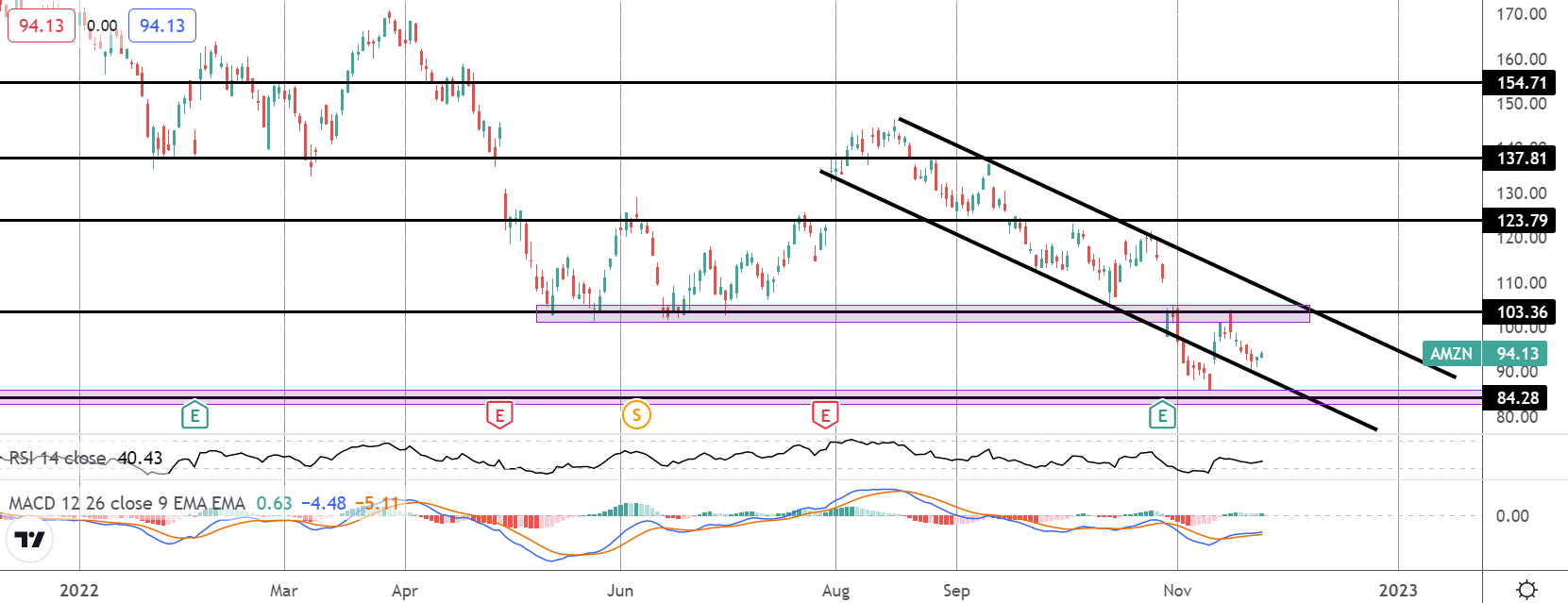

Shares in US tech giant Amazon have been back under pressure recently following a failed attempt at reclaiming the broken 103.36 level. The broader downturn in tech stocks has weighed heavily on the stock which reported lower revenues than expected over Q3. Looking ahead, the usually high demand holiday season over Q4 is not expected to be as fruitful this year as inflation bites at US and global consumers. Amazon shares are now down around 50% from the highs seen last November. The last time we saw such a move was in 2008 when the stock plunged almost 60% before enjoying an almost 300% rally.

Fed Focus

Looking ahead, a shift in Fed strategy could well pave the way for the stock to bounce back. With the Fed signalling that it will soon adopt a slower pace of rate hikes, tech stocks are likely to be among the key beneficiaries meaning that it might soon be time to start looking for upside opportunities in Amazon.

Technical Views

Amazon

Amazon shares are in an interesting position here. The initial rally off the YTD lows has been capped into a test of the 103.36 level. However, if the current low can hold, this might set up a higher low from which bulls can build and break back above that level and above the bear channel top. A break of this region will then open the way for a move back up towards 123.79. To the downside, while we hold below 103.36, a further test of 84.28 cannot be ruled out.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.