Institutional Insights: SocGen EURUSD August Seasonal Volatility

Brace for turbulence: FX volatility set to rise

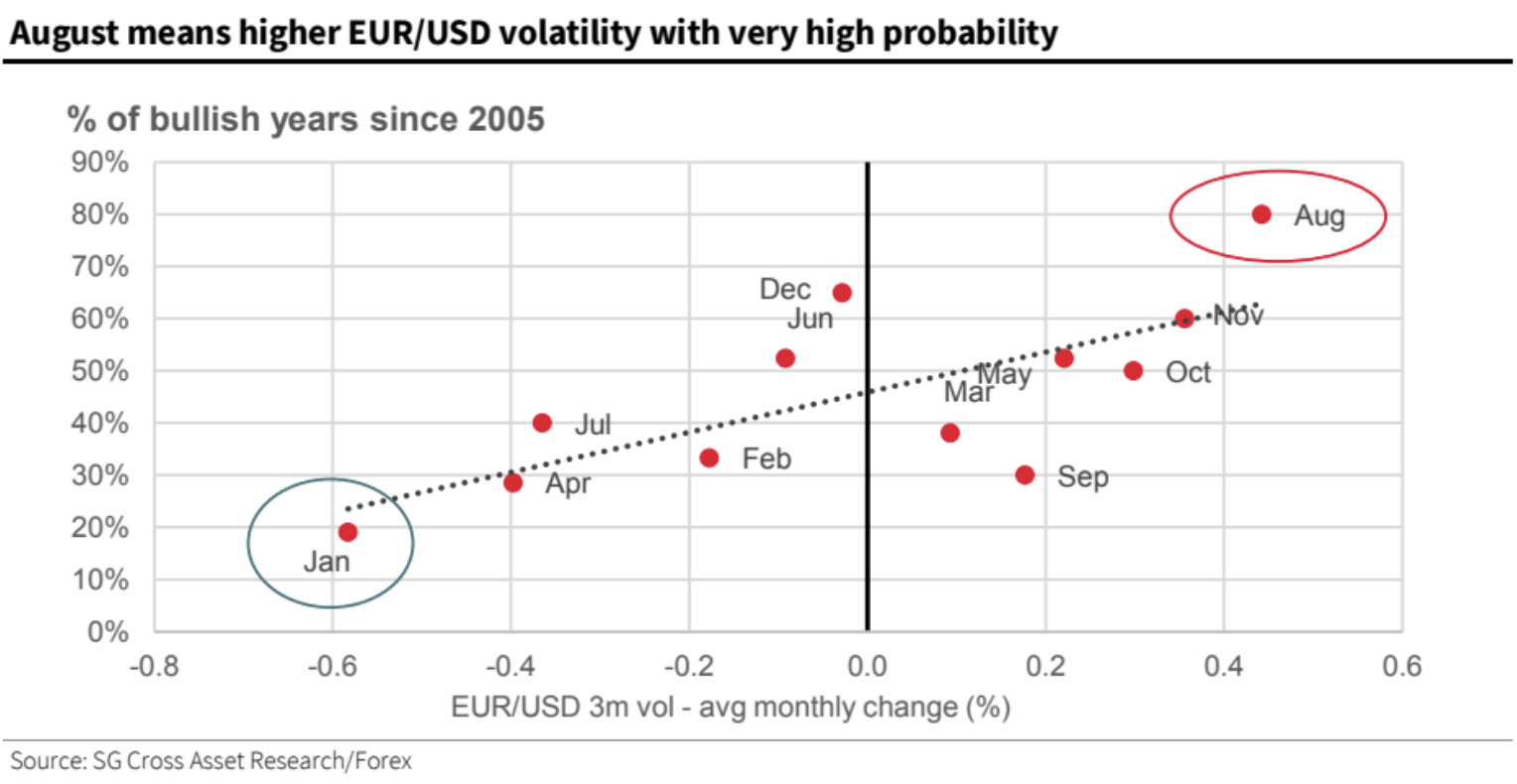

The US/EA trade agreement could alleviate some economic uncertainty, but we anticipate significant volatility in FX markets this summer. Contrary to a calm outlook, we expect a notable increase in volatility in the weeks ahead. The deal is viewed as somewhat uneven, adversely affecting sentiment towards the euro. The volatility market, previously quite complacent, now needs to reassess risk before two critical deadlines: the August 10 target for a US/China trade agreement and a newly enforced deadline for Russia to conclude its conflict in Ukraine. Both events may coincide. As positions in euro longs are unwound, the option market is also experiencing shifts. Much of the EUR/USD volatility in the first half of the year was influenced by a strengthening euro. However, if the dollar continues to strengthen, we may see a shift back towards dollar calls. In this scenario, FX options are becoming a favored tool for hedging in the second half of the year. FX risk is increasing, yet volatility remains historically inexpensive compared to swap points, which have risen unusually in tandem with the euro. Additionally, historical trends indicate a strong likelihood of heightened EUR/USD volatility in August, boasting an 80% historical success rate. The reduction of trade uncertainty is not likely to diminish FX volatility. The recent trade agreement between the US and the EU notably decreases economic uncertainty by making trade relationships and their economic effects more predictable. According to our economists, the deal is relatively favorable: the 15% tariff only slightly raises the expected impact on EU GDP (currently projected at 0.33%, up from 0.25% previously). Their analysis indicates that the EU is now facing an average tariff of 11%, given that a zero tariff has been established for certain products.

The economic repercussions seem less severe than anticipated, yet the market's response could be more severe. The agreement steers clear of the direst outcomes and averts trade conflict escalation, but the immediate foreign exchange reaction indicates that the terms are perceived as uneven and unjust. In a departure from previous statements, the EU will not retaliate and is even projected to lower its own tariffs. Businesses are critiquing the deal, and the market interprets it as a signal of EU weakness, leading to a notably negative sentiment toward the euro. Overnight, the EUR/USD dropped below 1.16 after nearing 1.18. This decline disrupts the bullish trend that started below 1.08 in late March, right before 'Liberation Day.'

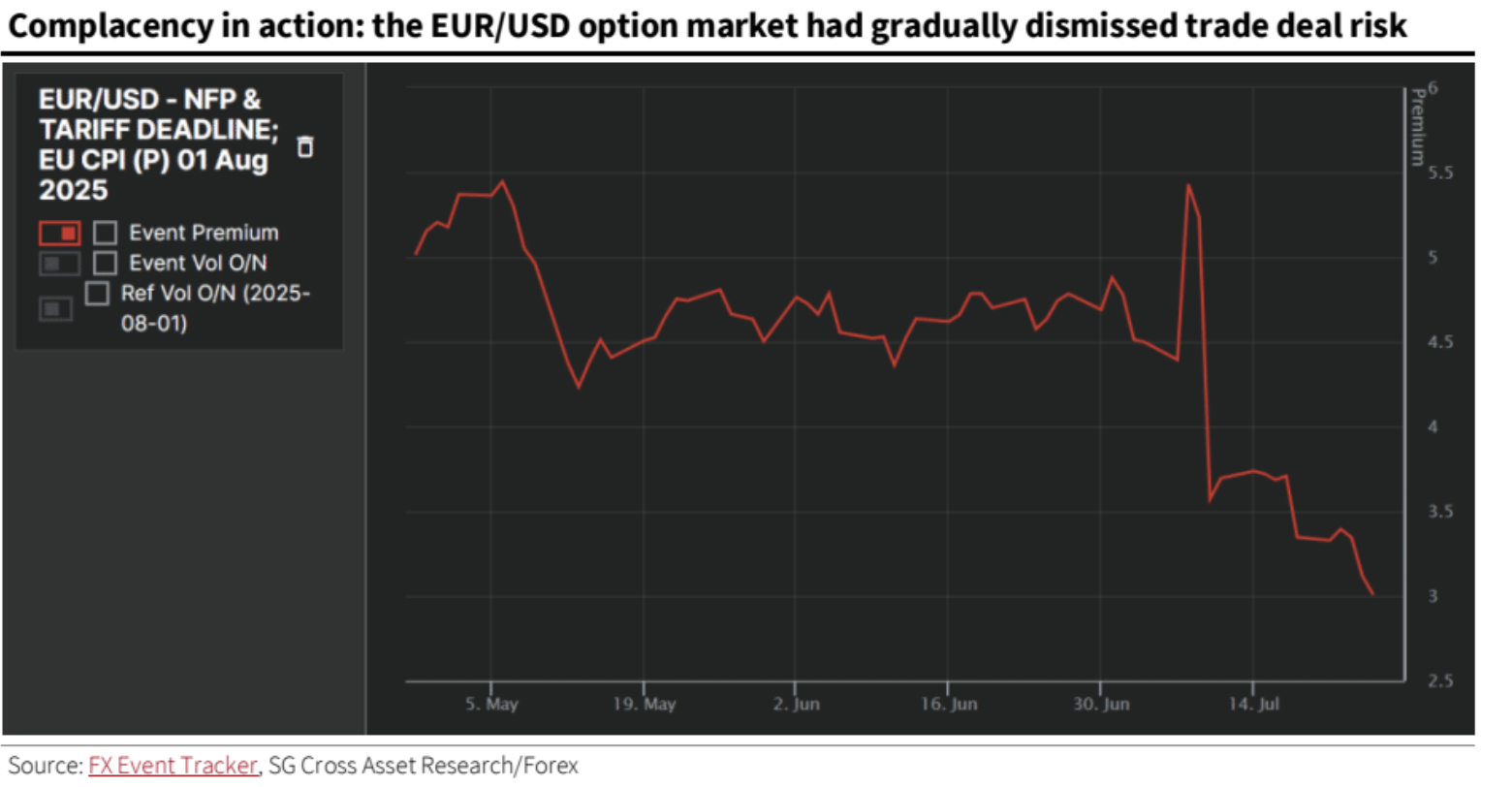

The volatility market needs to adapt from pre-agreement complacency and brace for upcoming deadlines. The options market had accounted for a moderate event premium regarding the 1 August tariff deadline, which according to our FX Event Tracker, notably diminished in the fortnight prior to the agreement. The sharp rebound of the dollar is instigating a spike in volatility, exposing that the market had become overly complacent. The market is likely to become apprehensive about the potential continuation of dollar gains—justifying a risk premium—while August also introduces two other significant deadlines. The market needs to reevaluate the risks associated with the 10 August tariff deadline concerning a deal with China, and just yesterday, President Trump shortened the deadline for Russia to resolve the Ukraine conflict to about ten days, suggesting a potential overlap of both deadlines. The options market is expected to hedge now, as realized volatility is poised to increase during the week of 11 August.

In the first half of the year, EUR/USD volatility was propelled by a stronger euro, but what now? If the US is perceived as the overall victor in trade talks, there is a risk of sentiment shifting towards a more enduring bullish dollar stance. Positions favoring euro longs had been accumulating, and the rebound of the dollar is at least partially fueled by unwinding those positions post-deal. Additionally, positioning in the options market is likely to change, as the rise in euro had previously driven most of the EUR/USD volatility in the year's initial half.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!