Institutional Insights: Month End FX Rebalancing Models

.jpeg)

Institutional Insights: Month End FX Rebalancing Models

Banks are sharing their expectations for month-end rebalancing in February, indicating a consensus for demand for USD. According to Deutsche Bank's model, based on current equity performance, there is an anticipated moderate shift towards buying USD. The most significant relative outperformance is noted against European equities, suggesting a supply of EUR/USD. Coupled with the typical month-end corporate flows being more favorable for USD, selling of EUR/USD emerges as one of Deutsche Bank's stronger convictions for the upcoming week from a flow perspective. Additionally, the bank observes that for the first time in quite a while, U.S. equity underperformance is seen against all other indices they monitor, which reinforces a more bullish outlook for USD in the short term, particularly given the lack of other news for the forthcoming week. Deutsche also points out its seasonality charts, indicating a notable average selling of NZD/USD on the day prior to month-end, February 27, of 0.58% over the past decade. Similarly, AUD/USD reflects a tendency for average selling on both month-end day itself (February 28) and the day before.

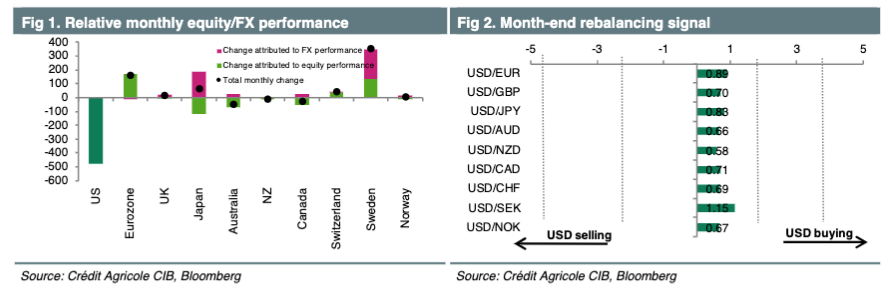

According to Credit Agricole's model, global equity markets experienced a general decline in February. In the foreign exchange sector, the USD also saw a significant drop for the month. When considering adjustments for market capitalization and FX performance this month, it appears that portfolio rebalancing flows at month-end are expected to be weak, particularly with regard to USD purchasing across G10 currencies, with the most pronounced indication evident in USD vs SEK. Nevertheless, the indicators from the month-end rebalancing model are insufficient to prompt a trading strategy. The bank's corporate flow model indicates potential EUR selling at the month's conclusion. However, due to the lack of a trading signal from the month-end rebalancing model, no trade recommendation is provided for February.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!