Institutional Insights: Goldman Sachs, China Flows & Positioning

.jpeg)

Institutional Insights: Goldman Sachs, China Flows & Positioning

GS Tactical Flow-of-Funds: China aka “TCT” aka The China Trade

Investors are calling this the most “bullish morning of the year” (China, AI, Crude, etc). This is not an S&P trade higher from here as exposure remains elevated. II. I really think this time is different for Chinese equities. It is time for a thread. a. Underweight Chinese equities is the largest consensus trade in all global equities. SHCOMP rallied 10% in 3 days - the largest rally since July 2020. b. The weekly rally in Chinese assets has been a pain trade for investors given current short, low positioning and benchmark tracking issues for global funds into quarter-end. c. Re-Emerging Markets have quickly become a favored post-US election trade for November and December. d. I have done more Zoom calls on China in the past 48 hours than all of 2024. e. What does the consensus think? “Fade” What does the consensus think about the consensus? “This may not be a fade this time.” As a result, buyers have lived higher. f. We have not seen any foreigner / international buying to date. g. We are starting to see “FOMO” today locally in China with “everything else at ATHs”

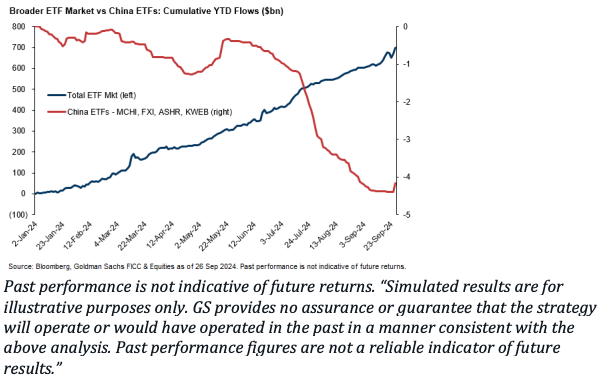

Positioning: 1. Record demand for Chinese equities - Sep 24th, Chinese equities on the Prime book collectively saw the largest 1-day $ net buying since Mar ’21 (second largest in the past 10 years, Z score = +5.6) - driven almost entirely by long buying 2. From a flow perspective, yesterday, Sep 25th, we saw continued demand for Chinese equities (ie long buying). 3. Chinese equities have been bought for 8 straight days at GS PB (macro managers, quant, and multi-managers - shorter term traders) - not traditional equity long/short or LO. That cohort may be forced in higher. 4. Mutual funds globally in aggregate have 5.1% allocation in Chinese equities as of end-August, which represents 1st percentile over the past decade. 5. On asset-weighted basis, active mutual fund mandates remain underweight Chinese equities by 310bps vs. benchmark. 6. At GS Prime, China Gross and Net allocations are still low and now in the 7th and 14th percentiles on a 5-year lookback, respectively. 7. Hedge funds allocated less than 7% in Chinese equities before the recently rally which is around 5-year low. This is the most important line from my note today on market structure: Chinese and EM assets do not benefit from passive inflows every day like the US market. 8. EM assets do not benefit from passive allocations. Out of the $695 billion of inflows for U.S.-listed exchange-traded funds in 2024: only $4.93 billion has gone into Emerging Markets ETFs. (71bps of passive assets have gone into EM). 9. This is changing: ASHR (China domestic A shares) saw the creation since June 9th, 2022 ($175M ~ 7.1m shares).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!