Institutional Insights: Credit Agricole FX Weekly 25/04/25

It’s the economy, stupid!

The intensity of the USD sell-off has diminished, and the currency might recover some ground soon due to several factors: (1) President Donald Trump’s administration appears to have reached the limit of its unorthodox policies, as economic concerns have prompted efforts to ease trade tensions; (2) Trump has softened his stance on Fed Chair Jerome Powell, alleviating fears over the Fed's independence; and (3) the USD is currently undervalued compared to fair value indicators, considering its rate advantage against other currencies.

The recent divergence between the USD and US interest rates/yields warrants closer examination. Notably, the simultaneous underperformance of the USD, US Treasuries, and US stocks has been attributed to capital outflows from US markets. We believe, however, that the USD sell-off has exacerbated the negative inflation impact of Trump’s tariffs, thereby delaying any Fed easing and supporting US rates.

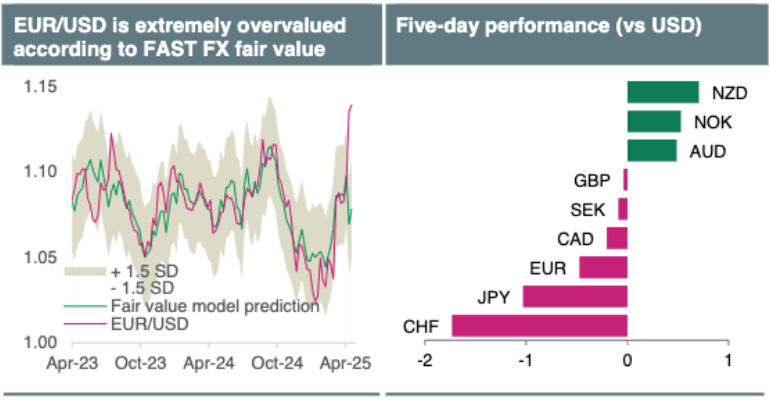

The USD sell-off contrasts with the EUR rally since the beginning of the year, which has increased downside risks to Eurozone growth and inflation, potentially leading to further ECB rate cuts. A recent EU study indicates that sustained EUR gains could reduce the Eurozone’s GDP by approximately 0.25% amid ongoing trade tensions. Therefore, we anticipate limits to how much the EUR/USD can deviate from the EUR-USD rate spread and maintain a bearish outlook on the pair.

Next week, attention will be on the Non-farm payrolls and manufacturing ISM for April, along with the Core PCE deflator for March. These releases may underscore how Trump’s policies have intensified the conflict with the Fed’s dual mandate, possibly delaying further policy easing. In contrast, Eurozone inflation might approach the ECB’s target in April, increasing rate cut expectations and impacting the EUR.

In Canada, polls ahead of the 28 April election strongly indicate that the Liberals could regain a majority under Mark Carney. However, this may not significantly strengthen the CAD, given uncertainty surrounding US tariffs. The BoJ is expected to maintain rates next week, and Governor Kazuo Ueda will likely aim to keep the JPY stable during the second round of US-Japan trade negotiations. Australian inflation data is expected to confirm another RBA rate cut in late May.

FX and Gold Outlook

The Euro (EUR) has been bolstered by market optimism that aggressive fiscal stimulus may enhance the Eurozone's economic prospects, attract capital repatriation, and potentially shorten the European Central Bank's (ECB) easing cycle. However, many positive factors are already reflected in the currency's current valuation, suggesting a more neutral short-term outlook. We see potential upside risks to our EUR/USD forecasts over the next 6 to 12 months, driven by an improving Eurozone economic outlook for 2026, especially if fiscal stimulus invigorates economic activity. Additionally, a resolution to the Ukraine conflict and easing sanctions on Russia could lead to a favorable commodity supply shock for the Eurozone.

Our below-consensus outlook on the US Dollar (USD) has been accurate thus far in 2025, as concerns about the US economic outlook prompted investors to unwind "Trump trade" positions, leading to a broad USD decline. The speed and intensity of the sell-off were unexpected, and a period of consolidation may occur soon. Nevertheless, we anticipate continued USD pressure over the next year as the Federal Reserve resumes its easing cycle and ends quantitative tightening. Concerns about fiscal dominance and a potential "Mar-a-Lago Accord" also loom. Looking further ahead, a renewed US economic recovery and rising Treasury yields could offer some relief to the USD in the second half of 2026.

Tariff uncertainties have increased demand for safe-haven currencies like the Swiss Franc (CHF), which has strengthened even against the recovering EUR. The EUR/CHF exchange rate could rise this year as Switzerland's return to zero interest rate policy (ZIRP) makes the CHF an attractive funding currency. However, lower inflation differentials should temper CHF real valuations, while stable growth should prevent significant nominal losses.

The narrowing of US-Japan rate spreads has put USD/JPY on a volatile downward trajectory. This contraction may have gone too far in the short term, potentially leading to a temporary rebound in the exchange rate. US tariffs impact both US and Japanese manufacturers, neutralizing effects on USD/JPY. Their influence on global equities is causing a reversal of JPY-funded carry trades, though this may have reached its limit.

While GBP/USD has benefited from recent USD selling, caution is still advised over the next 3 to 6 months due to ongoing concerns about the UK economic and fiscal outlook, significant geopolitical risks, and the threat of a US-led trade war. However, the GBP/USD rally could resume in 6 to 12 months, supported by persistent USD weakness and signs of improving UK growth. We remain bearish on EUR/GBP, believing the GBP will continue to outperform the EUR as a higher-yielding alternative in 2026.

USD/CAD has recently dropped below the 1.44 level due to widespread USD weakness. The Canadian Dollar (CAD) rebound has been resilient despite falling oil prices, but ongoing global uncertainties may hinder a sustained recovery, as the impact of persistent trade turmoil on domestic economic activity remains uncertain.

We expect a gradual increase in AUD/USD, supported by a limited Reserve Bank of Australia (RBA) rate-cutting cycle, general USD weakness, and improved investor sentiment towards China. US tariffs against Australia should have minimal impact relative to other G10 countries, even considering Australia's 10% GST. The larger effect of US tariffs will be through China, which will continue to weigh on our AUD forecast.

Similarly, we anticipate a slow rise in NZD/USD due to general USD weakness and potential positive surprises in New Zealand's economy as it emerges from recession. The New Zealand Dollar (NZD) could benefit from investors shifting from US to Asian assets. Like Australia, US tariffs on New Zealand should be minor, even considering its 15% GST. New Zealand is one of the few G10 countries with lower tariffs than the US. AUD/NZD is recommended as a sell on rallies.

Gold's recent strong performance may deter buyers in the short term, but its strength could increase later in 2025 due to central bank purchases and the Fed's easing cycle, which could lower US real rates and the USD. A renewed US economic recovery and higher US rates and Treasury yields would be needed to weaken gold's strength in 2026.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!