Hawkish ECB Hints in Jackson Hole Help the EURUSD to Regain Ground Above Parity

The Eurozone money marketson Monday point to a sharp strengthening of expectations that the ECB willraise rates by 75 basis points in September, as the ECB officials signaled overthe weekend that they were ready to take a drastic step to quell inflation.

Among the ECBrepresentatives who spoke at the Jackson Hole symposium, Isabel Schnabel gavean important signal. She said that there is a growing risk that publicinflation expectations will de-anchor (which would dramatically reduce the effectivenessof the ECB monetary policy), while surveys show that high inflation isbeginning to undermine the credibility of the central bank policy.

Other officials noted that front-loadedrate hikes (rather than based on incoming economic data) are justified, andthat the neutral interest rate (at which the tightening cycle should end) maybe somewhere near 1.5% and should be reached by the end of this year or by theend of the first quarter of 2023.

Traders in the EU moneymarkets factor in a policy tightening of around 67 basis points in September.This means that there is no doubt that the ECB will raise rates by at least 50basis points in September, and the chances of a 75 bp increase are estimated at67%. On Friday, the chances of this outcome were only 24%.

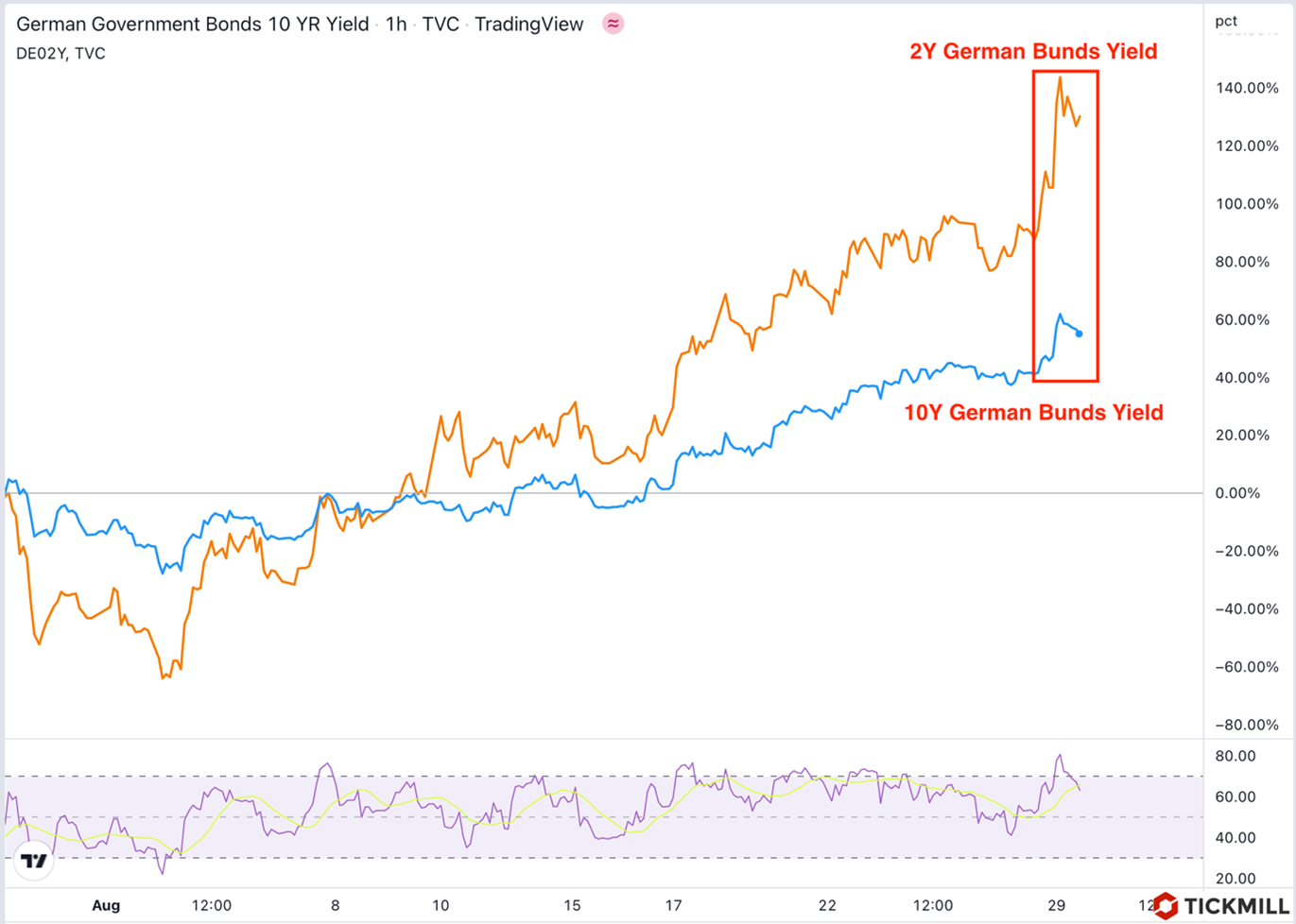

Along with the strengtheningof expectations that the ECB rate will increase rapidly, the yield of the EU'skey sovereign bonds - the German Bunds - also increased markedly. On Monday,two-year German bonds offered a yield of 1.16%, up 19 basis points from Friday,the highest since June 17. The far end of the yield curve also climbed, with10-year bonds offering a yield of 1.54%, the highest level in two months:

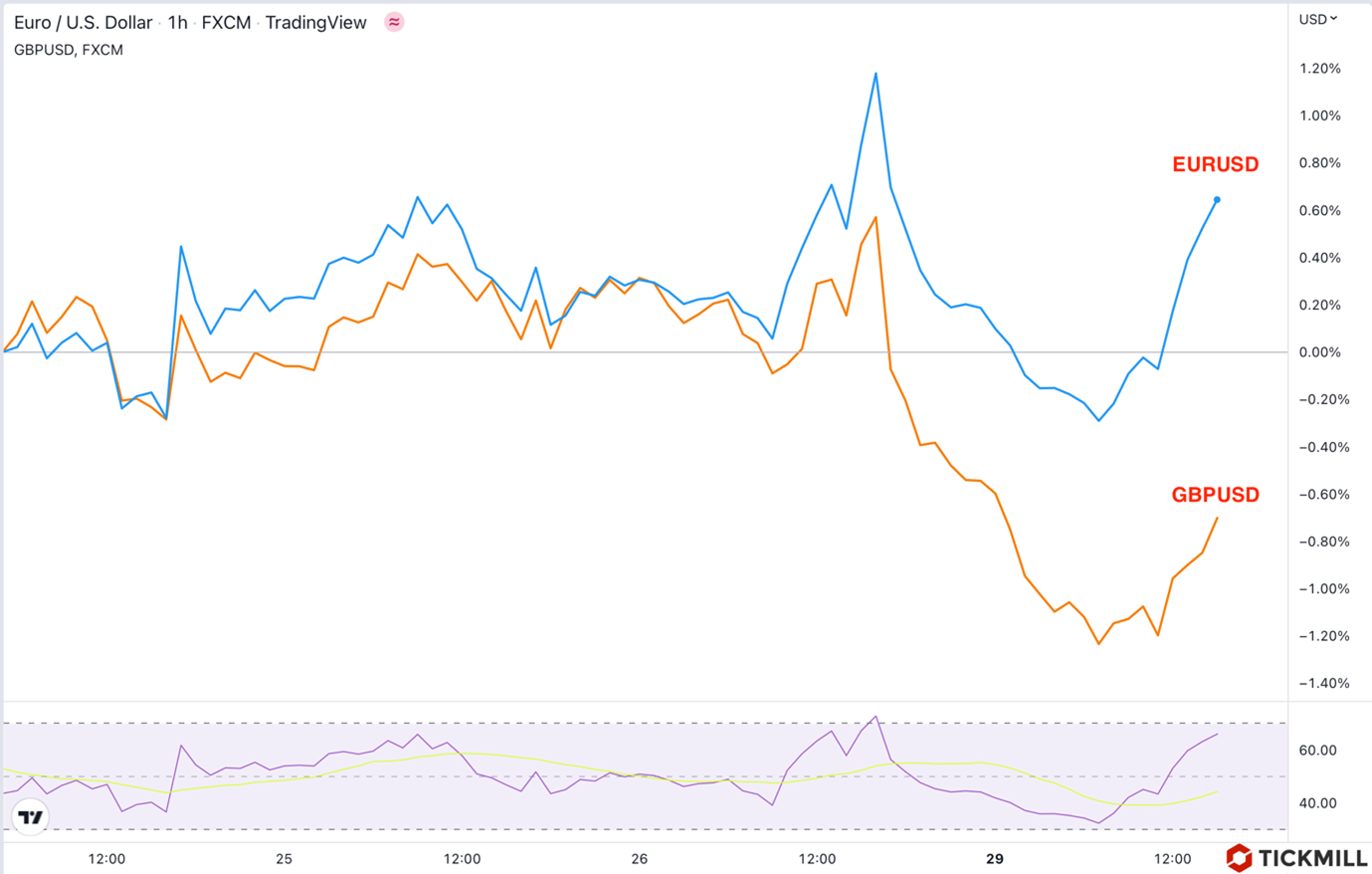

Market rumors that the ECBwill act decisively should offer solid support to the European currency untilSeptember, so a EURUSD move towards 0.95 will most likely hit roadblocks. Thedivergence in the expected pace of policy tightening is clear from the returnsof the EURUSD and GBPUSD in recent days: while the pound has dipped more than1% against the dollar since the middle of last week, recovering somewhat later,the European currency has gained 0.6% over the same period:

Thelikely tightening of the ECB's policy has also created additional strains inthe EU sovereign debt market. A key indicator of credit risk in the bondmarket, the spread between Italian and German bonds widened to 2.36%, thehighest in a month. In the event of an excessive increase in the spread, theECB will have to use the monetary policy Transmission Protection Mechanism(TPI), which consists in buying bonds of those countries of the block whereyields grow excessively due to the irrational reaction of investors. Thismeasure will reduce the cost of borrowing for the countries of the bloc'speriphery such as Italy, Greece, Spain, etc.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.