Gold Rallying Over Trump Spending Bill Concerns

Gold Support Holding

Gold prices remain bid mid-week with the futures market up firmly of the 3,254.65 level. A weaker US Dollar and ongoing uncertainty around global geopolitical issues has seen demand for gold creeping up again. In the US, the passing of Trump’s so-called ‘mega-bill’ through the Senate means that the prospect of a heavy uptick in the US national debt has moved one step closer. Gold prices look set to gain further if the bill makes it through the House as a deteriorating US fiscal outlook should see deeper safe-haven demand for gold and a weaker US Dollar.

US Jobs Data On Watch

Looking ahead, traders will be watching incoming US jobs data with the ADP print due today and the NFP tomorrow. Yesterday, a stronger than expected JOLTS figure caused some giveback in gold as USD firmed a little. Near-term, rate cut chances are still very much alive after Powell’s Sintra comments yesterday. As such, any weakness in the headline data tomorrow should see gold prices rallying sharply as USD falls on an uptick in July rate cut pricing. The market is currently pricing just 20% likelihood of a cut this month. However, if that figure jumps following tomorrow’s data, this could be firmly bullish for gold. Alternatively, if we see an upside surprise tomorrow, gold is likely to cool into the weekend as USD rebounds on reduced July rate-cut expectations.

Technical Views

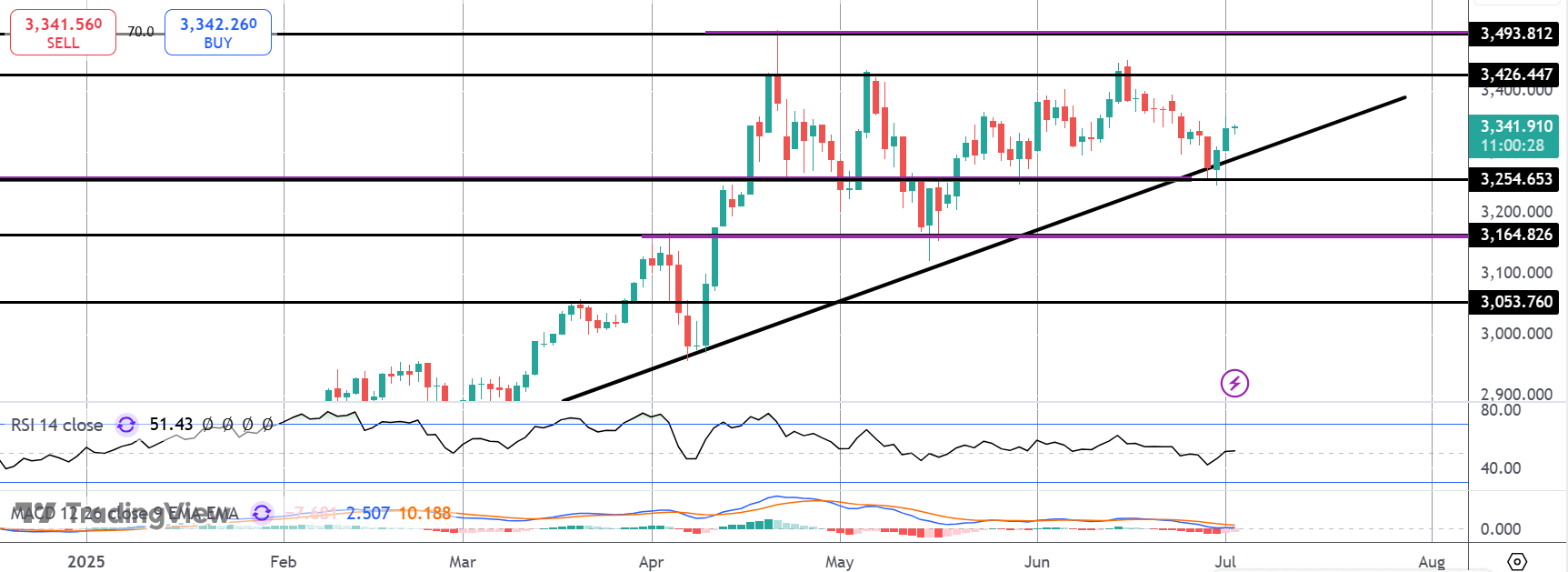

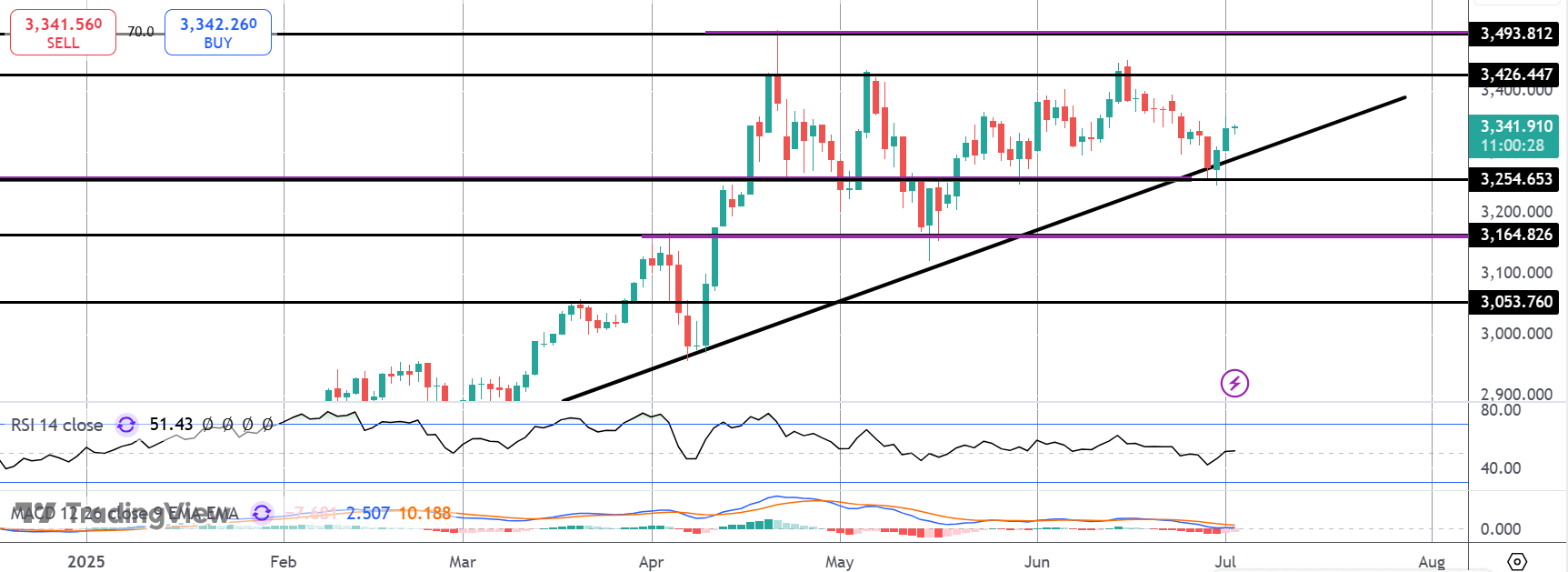

Gold

The sell off in gold has stalled for now into the 3,254.65-level support and bull trend line. While this area holds, focus is on a fresh push higher and a test of the current YTD highs around the 3,493.81 level. Below current support, however, focus turns to 3,164.82 as deeper support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.