Gold Heads for a Test of $1900

For the first time in a while, a threat of covid restrictions becomes an overriding market theme again. Austria has announced a new lockdown, Germany could follow suit. The Swiss franc, dollar, yen led the growth in FX on Friday. At the same time, the yen, traditional safe-haven asset, rallies against USD which adds to the case that risk-off becomes again the key driver of market moves. Risk assets are under pressure, while still minor, European indices lost about half a percent. Oil prices are pulling back on rising energy consumption risks. Money markets are cutting rates on tightening the ECB's policy in 2022, which is not surprising, because the risks of new restrictions are now primarily concentrated in the Eurozone. Gold is at its highs since June and after the key trendline has been broken, it consolidates in the wedge pattern, likely indicating preparations for a new rally targeting next resistance at $1900- $1910:

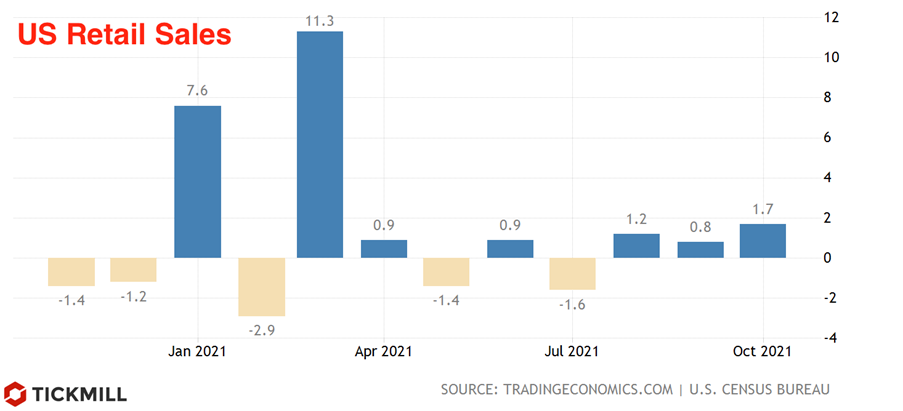

The strengthening of the dollar this week proved to be more or less stable, as data on the US economy continues to stand out. Of course, we are talking about the data on retail sales, which significantly exceeded the forecast. In particular, core retail sales jumped 1.7% MoM against the 1.0% forecast. The indicator shows positive growth rates for the third month in a row, pointing to an impulse in consumer spending, which forces investors to think about the growth of inflation risks in the American economy:

A $1.4 trillion fiscal spending package over the next 10 years, which may soon be passed by the US Congress, should have reflationary consequences for the economy, so the dollar is now following the news from Congress. If the spending package is approved, market participants may reconsider the pace of the Fed's QE curtailment and rate hikes, since the task of economic stimulus (at least part of the task) will be taken over by fiscal policy.

The UK retail sales data also exceeded expectations, but the GBP hardly got any relief from that. Nonetheless, the GBP is holding better than the EUR this week as the chances of a rate hike by the Bank of England increase in December. Excluding fuel, monthly sales growth was 1.6%, exceeding the forecast by as much as 1%.

Given that European countries have not been able to dodge the new wave of covid despite the high rates of vaccination, the main risk for this situation is an increase in covid hospitalization rates in the United States. If the country is swept by a new covid wave, a full-fledged risk-off will most likely begin in the markets and it will be possible to forget about policy tightening from major central banks next year.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.