Gold Fighting USD For Safe-Haven Demand

Gold Fighting to Recover

Gold prices are bouncing back on Monday following a sharp move lower across early Asian trading overnight. The yellow metal has since recovered and is now close to turning positive on the day as safe-haven flows help stoke demand. Risk markets have come under heavy selling pressure across the board on Monday, a backdrop which should keep gold prices supported near-term. Tariff chaos and US recession risks have taken centre stage for now and with equities and commodities seeing severe declines, investors are turning back towards gold as a store of capital.

US Dollar Rallying

While gold is seeing better safe-haven demand this week, resilience in the US Dollar is attracting some attention away from the yellow metal. The Dollar looks to be attracting fresh safe-haven inflows, despite initially coming under pressure last week as tariffs were announced. Looking ahead this week, traders will be watching incoming US inflation data due on Thursday. CPI is expected to cool once again which, if seen, should turn some of the focus back towards near-term Fed easing expectations, potentially capping the rally in USD and helping gold prices push higher again.

Tariff News Risks

Incoming news flow around tariffs will of course be highly important very market moving this week. EU leaders are due to meet to discuss a response to the US tariffs, with the UK currently preparing its own response. China, which has already responded with counter measure sis also reported to be looking at further action. As such, risks of a deeper escalation of the trade war mean that gold prices are likely to push higher in coming weeks due to increased safe-haven demand.

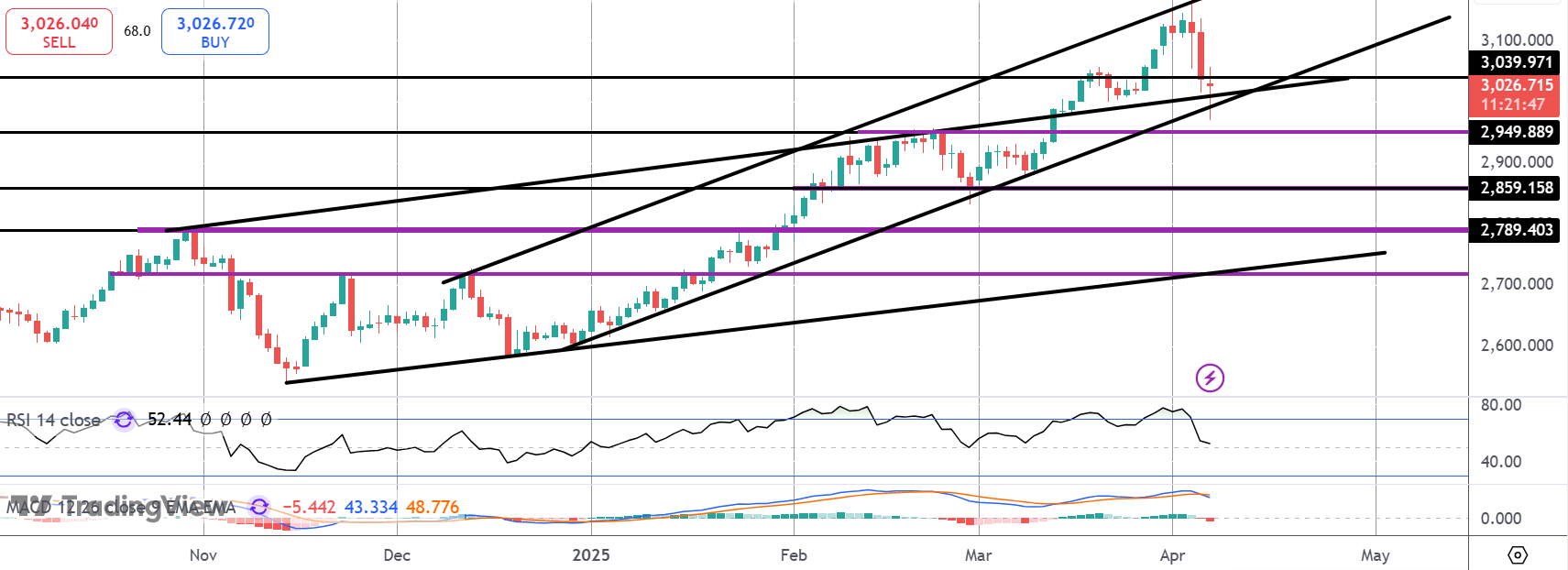

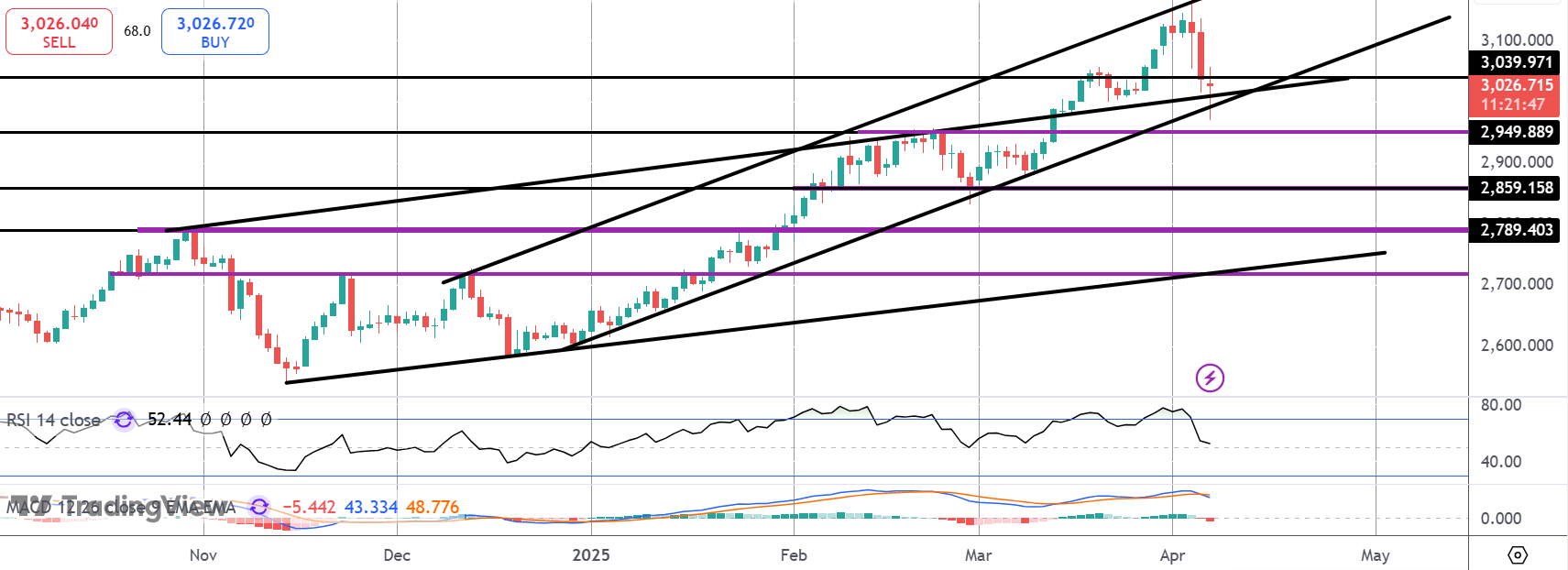

Technical Views

Gold

The correction lower in gold has seen the market retesting the broken bull channel highs and the current bull channel lows. With this region holding for now, focus is on a fresh push higher. However, weakening momentum studies suggest risks of a deeper push with 2,949.88 the key pivot to watch if we do push lower from here.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.