Expert Claims or Mass Hysteria? – Choose Yours

The outbreak of coronavirus China has laid a solid foundation for the expectations of a softer interest rate path in the US. But to the surprise of many, it hasn’t altered the outlook of Rafael Bostic, an influential member of the Federal Reserve, who along with other 17 officials controls monetary policy in the US.

Bostic said that the Fed made three rate cuts last year and the economy is now feeling their effect. For the state of the economy at that time, three rate cuts an intentional overkill, which had to increase resilience of the economy to the negative events of similar magnitude.

The head of the Atlanta Federal Reserve Bank is a traditional "centrist", so his response hints that the majority of other Fed members who are also centrists, is also not very worried about the aftermath of the outbreak. The virus should “try” very hard to adjust the path of the US monetary policy. I think there are two options of how to interpret Bostic’s words - either mass hysteria is in place along with market overreaction or lying about the impact now is less “costly” than adding fuel to the fire. Choose yours.

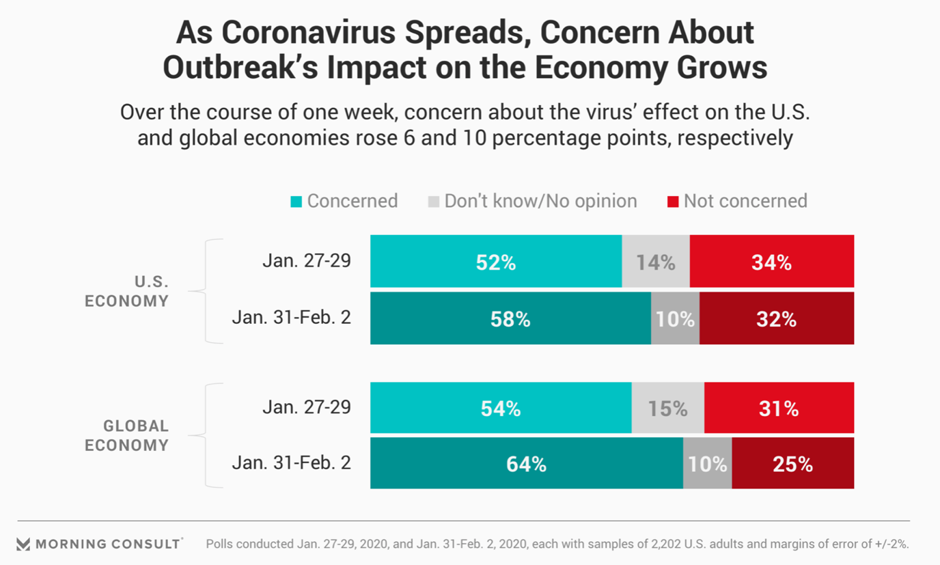

A Morning Consult survey conducted on January 27-29, and then at the start of February (sample size 2000 people), showed that among American consumers there is growing concern about the outbreak:

An increase in the level of concern should not be surprising, since this is a direct consequence of the efforts of the media, raising awareness, but at the same time sowing panic. It is much more important to assess how fears will change the consumption profile in the medium term. From the survey results it can be concluded that the transportation sector and the hotel industry will recover longer than others, while the consumption of other goods and services will change slightly. 44% of respondents said they were likely to postpone or cancel trips abroad over the next six months.

An interesting observation is that WHO chief continued to insist on low benefits of travel curbs since the risk of getting infected even when traveling to other provinces of China is very low. In a situation of mass hysteria, statements with such categoricalness, as it seems to me, are in fact putting personal career and the reputation of the organization on the line, so I would strongly recommend paying attention to this fact. But the public did not believe him, and the petition for the resignation of WHO head has already gained more than 200,000 votes.

Bostic also believes that the outbreak of the virus has not become a worldwide problem and recent past experience (which one ??) suggests that this will not happen. According to the official, now there is no need to think about adjusting rates in order to smooth out potential economic damage.

Jeremy Powell said at the last meeting that the Central Bank is closely monitoring the development of the epidemic. He acknowledged that the Chinese economy will suffer from the effects of the virus but refrained from mentioning whether the US economy will suffer. The slowdown in consumption growth to “moderate” was presented in the statement as an independent event.

Gold continued to pull back while oil rebounded from the level of $50 per barrel, probably in accordance with the ideas I delved into my yesterday article.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.