EURUSD: Concerns About Risk-on Momentum Create Strong Case for a Pullback

JP Morgan analysts believe that the time is coming for a pullback in equities. According to their view, it can happen in the next two weeks. Markets won’t have enough psychological resilience to withstand the pressure of negative surprises from economic front.

In mid-July, I drew your attention to two key variables that characterize the US recovery in the post-lockdown period. Even then, there were some worrying signs of moderation. Given the rising shift in views of the heavyweights like JP Morgan, I think it makes sense to go back and see if there has been any development of those negative trends.

A major correction, according to the bank's analysts, is out of the question given that Congress is on the verge of approving new fiscal measures to smooth recovery after the Great Lockdown. In addition, pent-up demand, enhanced by 3 previous stimulus packages, is still far from exhaustion and retains some positive momentum.

The risk of pullback lies in potential of the July unemployment and retail sales reports to significantly tarnish news background and raise questions about how sustainable the recovery is. There are number of factors indicating possible miss in July reports such as consumer expectations and their behavior before the government "cuts" unemployment benefits in August, the end of moratorium on rent collection and sale of mortgages (a provision from the Cares Act), the negative impact of the new Covid outbreak -19 on job creation and revenue due to the return of restrictive measures.

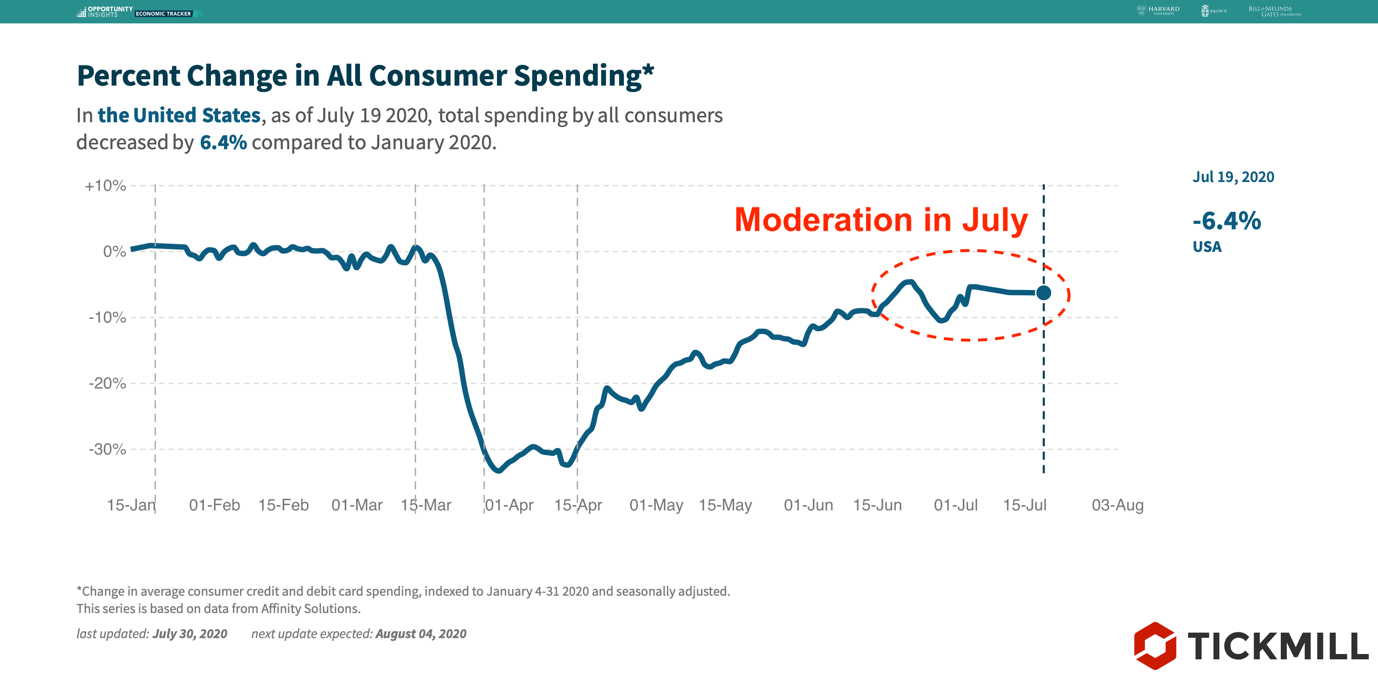

These factors led to a steady plateau in consumer spending in July:

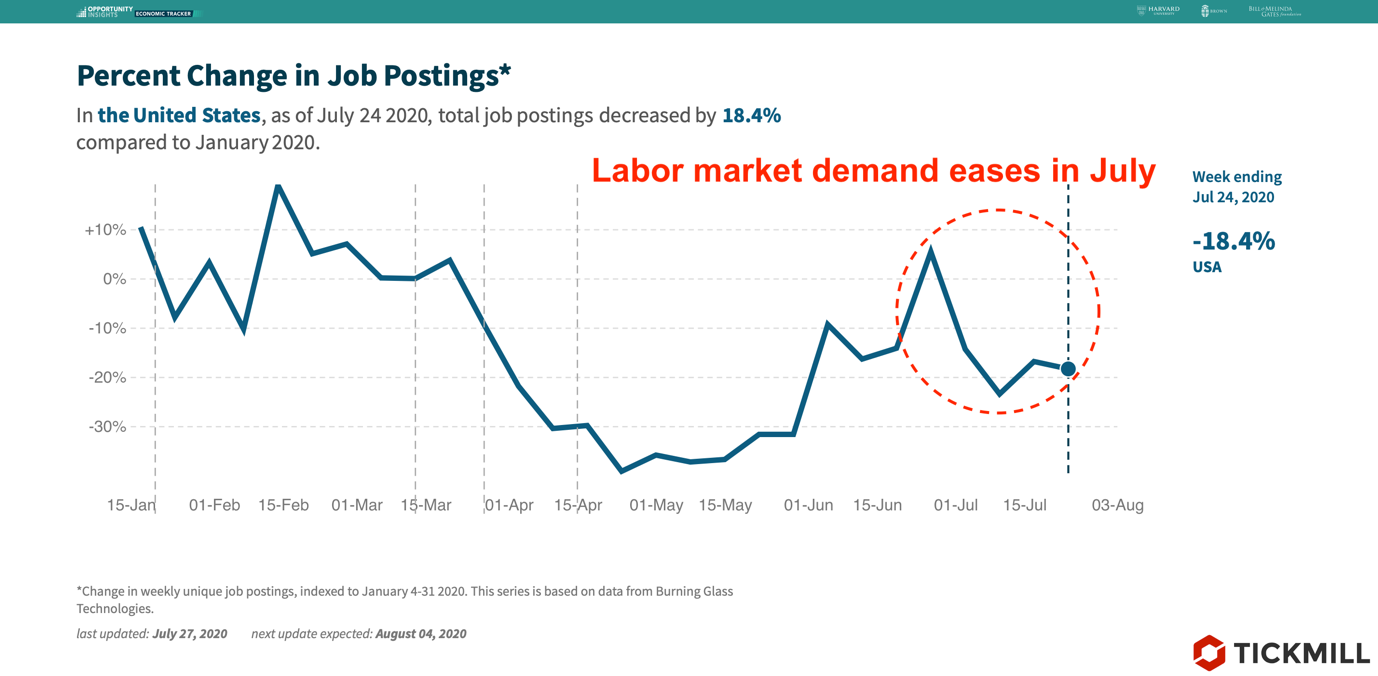

... and a persistent downward trend in job postings:

The rapid growth gave way to the stagnation and the downward trend. In early July, this was due to the fact that the states were actively restoring lockdown restrictions in response to the "second wave" of Covid-19, in the second half of July, concerns about sharp income fall in August came into effect, prompting austerity behavior of consumers.

As a result, there is a growing risk that market prices reflect higher expectations for retail consumption in July (the report is due August 14) and labor market strength (the release is due this Friday). The influence of this rising risk can now be felt in the market due to the assumption that slowdown impulse of the largest economy (the US) will be reflected in other economies, which will ultimately curb risk-on. As we remember, this risk-on was a negative factor for USD. The intensity of USD decline in July, in particular the extreme longs in EURUSD, will probably require a deeper pullback (to the level of 1.160 - 1.1630), before markets can begin discussion about further rally.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.