Dollar Volatility Risks: Tariffs & Jobs Data

US Labour Market Data

The US Dollar is having a muted week so far, ahead of the keenly awaited headline NFP release on Friday. Yesterday, a weaker-than-forecast JOLTS job openings number has raised the prospect of another soft reading this month, following on from last month’s weaker number. Ahead of Friday’s release, we have the ADP print today, expected at 118k, up from 77k prior. Given the bullish forecast, there is plenty of room for disappointment today which if seen, should keep USD pressured into Friday’s data where further weakness should see near-term Fed easing expectations rising accordingly.

Tariff Expectations

Away from US data, traders will also be keeping an eye on political developments today with Trump’s reciprocal tariffs due to take effect later today. There has been much speculation recently over whether Trump will opt for less aggressive measures, which would have a less destructive impact on risk markets or go all out, risking market chaos today.

Market Impact

For USD, the likely impact of today’s action is hard to nail down. A spike in risk-aversion and a fear that tariffs could lead to upward US inflationary pressure, should see USD rallying as high-beta currencies retreat. However, if the focus moves onto US growth fears as a result of tariffs, this could curtail USD and even see the Dollar falling as traders move into other safe-havens. Still, the base case scenario is for USD to spike today in response to tariffs, at least in the near-term.

Technical Views

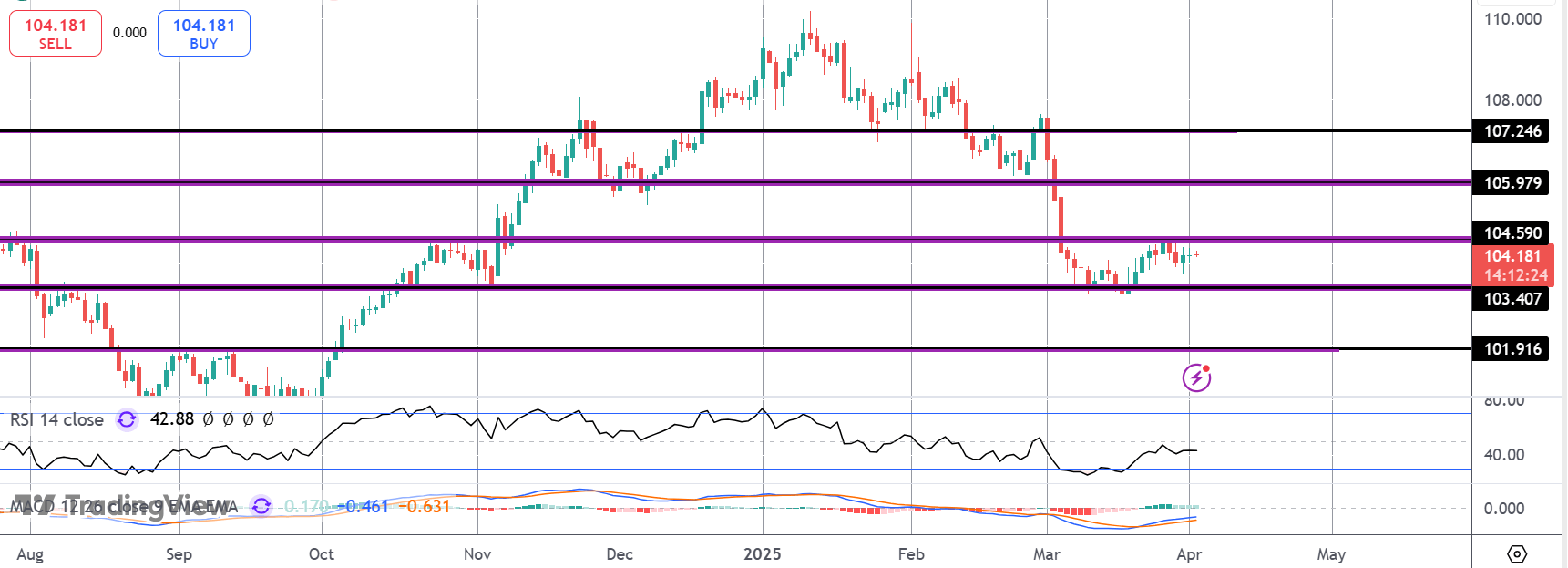

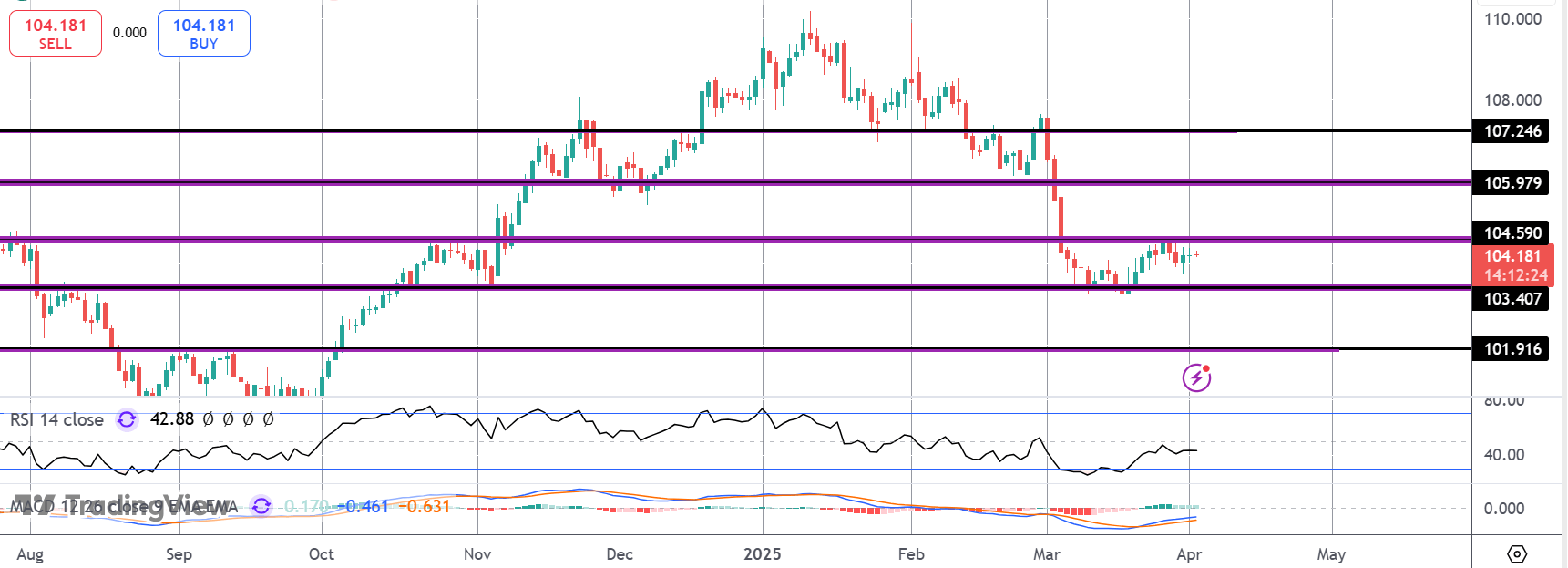

DXY

For now, USD is I caught between support at the 103.40 level and resistance at 104.59. Momentum studies are mildly bullish here, suggesting room for a move higher with 105.97 the next target if we do push up. To the downside, 101.91 is the next bear target.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.